The Walt Disney Company is a name synonymous with entertainment, creativity, and innovation. Founded nearly a century ago, this illustrious company has not only entertained millions worldwide but also shaped the very fabric of modern popular culture. But what makes Disney such an enduring powerhouse in the entertainment industry? In this detailed analysis, we delve into the SWOT analysis of Disney, highlighting its strengths, weaknesses, opportunities, and threats, along with a brief overview of the BCG matrix to shed light on its strategic positioning.

An Overview of Disney

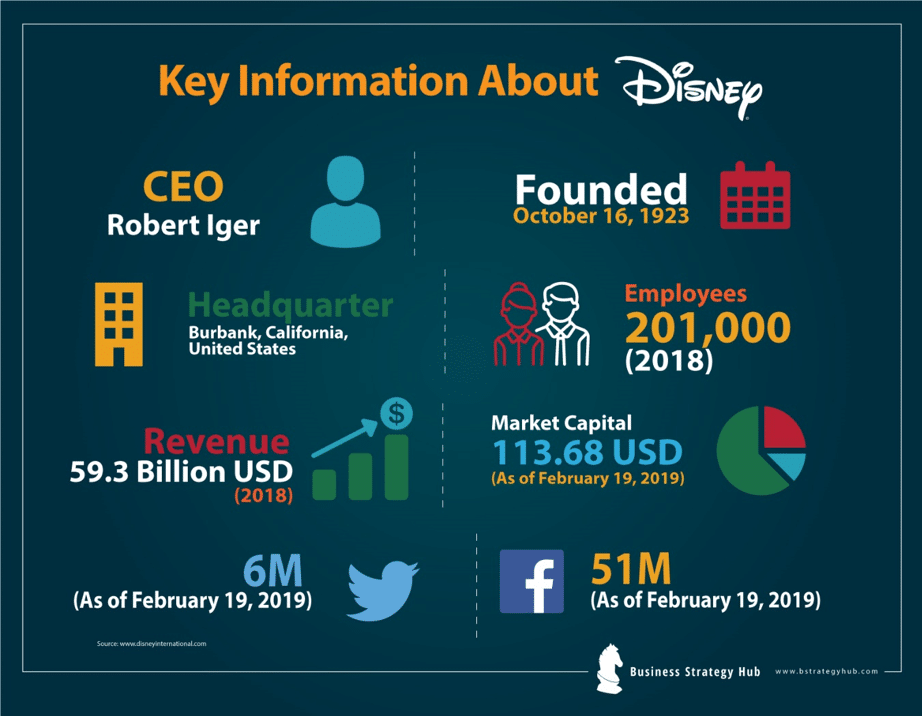

Disney’s journey began in 1923, founded by Walt and Roy O. Disney in a modest garage. Fast forward to today, and Disney has transformed into a global entertainment juggernaut with an extensive portfolio that spans television programs, motion pictures, theme parks, and even consumer products. With a market cap of over $204 billion, the company’s financial stature is as impressive as its creative output.

Disney’s reputation as a leader in family entertainment is well-deserved. From the magical realms of Disneyland to the animated charm of classics like The Lion King and Alice in Wonderland, Disney has successfully captured the hearts of audiences across generations.

The Walt Disney SWOT Analysis

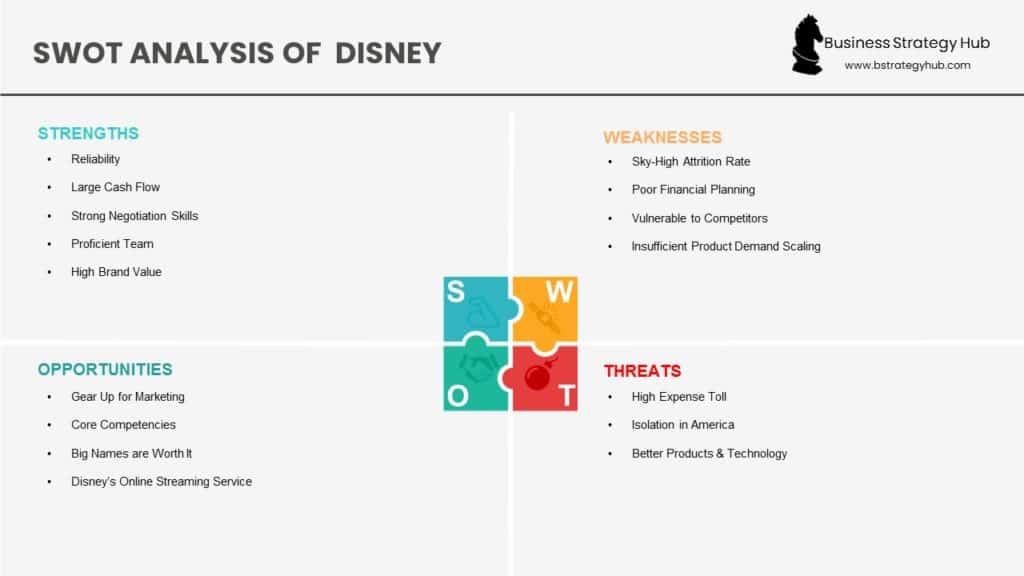

Strengths

Reliability

Disney has established strong relationships with suppliers, ensuring a high-quality production line. This reliability guarantees that Disney products maintain their high standard which is synonymous with the brand.Large Cash Flow

With an operating cash flow of $6.02 billion in 2022, Disney’s financial health permits it to invest in various ventures and maintain performance even in challenging times.Strong Negotiation Skills

The company’s ability to negotiate effective deals has allowed it to secure valuable distribution channels and partnerships, bolstering its market presence.Proficient Team

Disney employs a creative and innovative workforce, comprising skilled artists, writers, and graphic designers, allowing for the continuous production of captivating entertainment.High Brand Value

Recognized globally, Disney’s brand is estimated at $61 billion according to Forbes, ranking it among the top brands in the world. The easily identifiable “D” logo symbolizes quality and trusted entertainment.Diversified Offerings

Unlike competitors that focus on niche segments, Disney caters to all ages through a wide array of products and services—from streaming platforms like Disney+ to its theme parks and merchandise.Impressive Portfolio

Disney boasts immensely popular brands such as Marvel, Pixar, Lucasfilm, and more, which not only enhances its product offerings but also broadens revenue streams.

Weaknesses

Sky-High Attrition Rate

Despite significant investment in employee training, Disney faces challenges with high attrition rates, leading to ongoing recruitment and training costs.Poor Financial Planning

The failed investments, including the acquisition of 21st Century Fox, have strained Disney’s financials and hindered its competitive edge in the evolving digital landscape.Vulnerable to Competitors

Disney’s limited advertising efforts restrict its market penetration beyond core releases, leaving it susceptible to competitors who employ aggressive marketing strategies.Insufficient Product Demand Scaling

The inability to anticipate market trends has resulted in missed opportunities that competitors have capitalized on.Burdening Acquisitions

The financial strain from acquisitions like Fox has raised concerns over long-term profitability, impacting investor confidence and company resources.Negative Publicity

Recent scandals, including allegations of racism among top executives and backlash from performers over workplace conditions, have tarnished the company’s reputation.

Opportunities

Enhanced Marketing Strategies

By investing in strategic marketing, Disney can tap into new consumer segments and revive lesser-known products and services.Core Competencies

Leveraging its expertise in the mass media industry, Disney can innovate and adapt to emerging technologies, ensuring relevance in an ever-changing landscape.Expansion of Streaming Services

With the launch of Disney+, the company is well-positioned to compete with heavyweights like Netflix by offering exclusive content at competitive prices.Global Expansion

Beyond the U.S., opportunities for new theme parks in emerging markets can cater to the growing middle class and their increasing disposable income.Strategic Acquisitions

Identifying and acquiring complementary businesses can further diversify Disney’s portfolio and strengthen its market dominance.

Threats

High Expense Toll

Rising salaries and training costs pose a risk to Disney’s profit margins, challenging the sustainability of its business model.Economic Uncertainty

Recent global events, particularly the pandemic, have drastically impacted Disney’s earnings, necessitating cautious financial management.Piracy and Content Protection

The increase in digital piracy undermines Disney’s revenue, especially for streaming services, making it critical to enhance security measures.Tighter Regulations

Changes in governmental regulations may challenge Disney’s operational privileges, particularly in their film distribution strategies.Increased Competition

The escalating competition in the streaming sector from services like Amazon Prime and HBO Max requires Disney to continuously innovate to maintain its market share.Hacking Threats

The rising incidence of cyber attacks on streaming platforms poses risks to user data and company reputation.

BCG Matrix of Disney

In conjunction with the SWOT analysis, one can leverage the BCG matrix to assess Disney’s various business units. The matrix categorizes a company’s business lines based on market growth and relative market share.

- Stars: Disney+ is positioned as a star due to its high growth potential amidst increasing demand for streaming services.

- Cash Cows: Established franchises such as Marvel and Pixar remain cash cows, generating substantial revenue with lower investment.

- Question Marks: Some new ventures, such as the launch of Disney+ internationally, could be viewed as question marks—ripe with potential but requiring significant investment.

- Dogs: Certain underperforming films or TV shows may fall under the dogs category, representing low share in a stagnant market.

Conclusion

The Walt Disney Company has proven its resilience and adaptability since its founding in 1923. Through a rich history of captivating stories and innovative ventures, Disney maintains a significant presence in the global entertainment landscape. Despite facing challenges related to competition, financial planning, and external threats, the company’s robust strengths and opportunities indicate a bright future.

The insights derived from the SWOT and BCG analyses reveal not just the current standing of Disney but also highlight potential strategies for sustained growth and relevance. As Disney continues to expand its horizons, it’s clear that the magic is far from over.

We would love to hear your thoughts! Did you find this article insightful? Share your experiences and opinions in the comments section below!