In the ever-evolving landscape of the cryptocurrency market, opportunities often materialize when they are least expected. Many investors tend to gravitate towards familiar and established sectors, believing this strategy minimizes their risk. However, by focusing solely on widely recognized assets, they often inadvertently miss out on emerging prospects that could yield significant returns. In this article, Unilever.edu.vn explores the recent shifts in crypto trends, highlighting the success stories and indicators that signal forthcoming opportunities.

The Unnoticed Opportunities

As行情变化迅速, many investors overlook the potential in less-discussed projects. The case of Solana (SOL) illustrates this beautifully. Following the collapse of the FTX exchange at the end of 2022, SOL’s price dipped to an unfortunate $10, prompting a mass exodus of users from its ecosystem. Many leading projects abandoned Solana in favor of more promising prospects like Polygon and Ethereum.

Turning Point for Solana

Turning Point for Solana

Image depicting the challenges faced by Solana in late 2022.

Despite the daunting circumstances, Solana’s infrastructure underwent continuous improvements. By Q1 2023, a strong resurgence was noted, with SOL witnessing a rapid increase in value. This revival not only attracted returning users but also ushered in a wave of new projects, rewarding those who remained loyal through the hard times with substantial returns and token airdrops.

The Signs of Market Reversal

Just like Solana’s rebound, various movements within the crypto market signal possible reversals. Here are some noteworthy signs:

The Resurgence of Ethereum

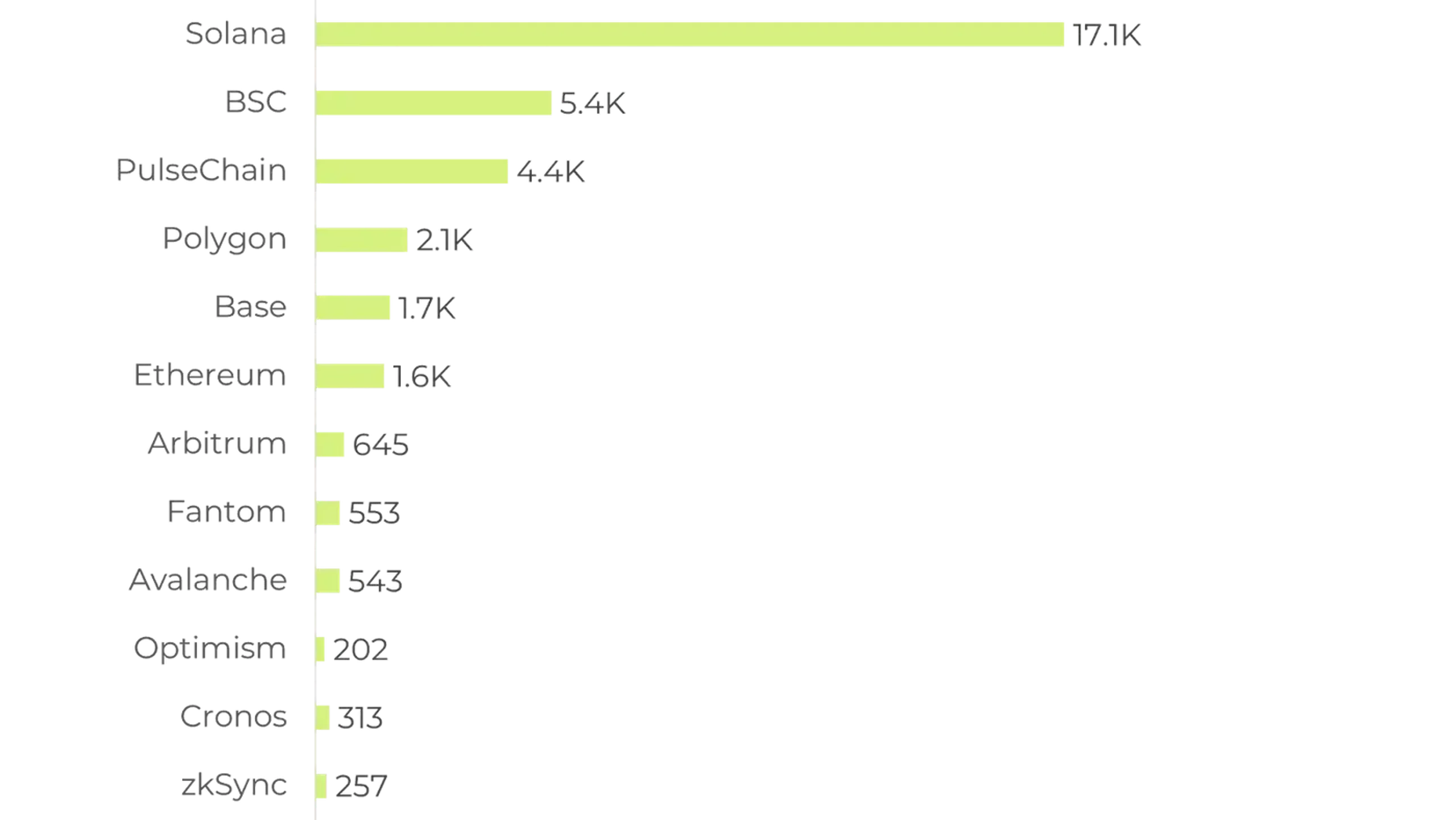

The current state of Ethereum isn’t as vibrant as one might hope. Network activity has slowed, with gas fees occasionally dipping below 1 gwei. Furthermore, both the price of ETH and the Total Value Locked (TVL) have seen declines, causing many investors to turn their attention to altcoins, particularly Solana.

According to Coingecko, Ethereum has lost its position as the go-to investment, with many top-performing tokens emerging from meme coins and the Solana ecosystem. This trend raises the question: will Ethereum be able to reclaim its former glory?

Ethereum ETFs and Layer 2 Technology

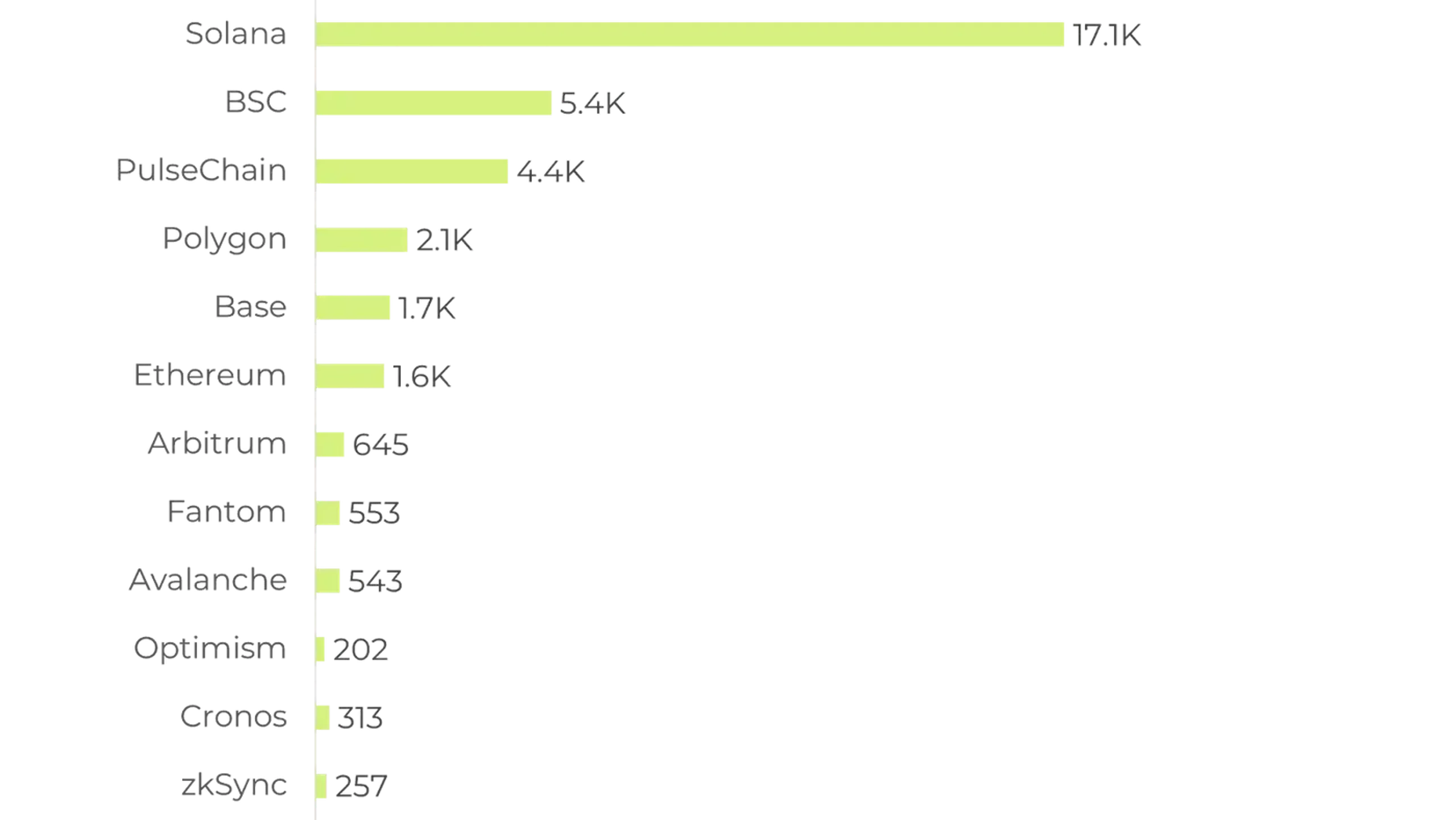

- Ethereum ETF Launch: Recently, Ethereum ETFs have begun trading, albeit with a higher number of sell orders than buy orders in the initial weeks. This mirrors the early landscape of Bitcoin ETFs. As Ethereum ETFs provide easier access for traditional investors, there’s potential for significant capital inflow into the crypto space.

Turning Point for Solana

Turning Point for Solana

Comparison of trading volumes between Ethereum and Bitcoin ETFs.

- Layer 2 Solutions: Ethereum’s transition towards a Rollup-focused strategy reveals promising potential. Although the TVL on these Layer 2 solutions has also decreased, transaction volumes remain stable. New Layer 2 solutions, particularly Optimistic Rollups, are gaining traction. This stability amidst market volatility could suggest hidden strengths in Ethereum’s infrastructure.

Emerging Narratives That Attract Value

With demand for ETH surpassing its inflation rate, the stage is set for the development of complex systems. Notably, Eigen Layer, a pioneering project in restaking, has amassed a TVL of nearly $13 billion and plans an airdrop for the community. This model could invigorate activity on Ethereum, similar to Solana’s path in recent times.

The growing meme coin culture further impacts this dynamic. Popular tokens like Doge and Pepe are based on the Ethereum network, drawing significant attention despite competition from emerging platforms like Solana.

Other Indicators of Shift

The cryptocurrency market is notorious for its fluctuations. However, several trends point to possible shifts:

1. Break-Even Points

Investors often feel increasingly at ease when assets approach their initial break-even point. The psychological comfort of recovering from investments may lead to less selling pressure on these tokens. Investors gravitating towards projects with solid technological foundations are more likely to hold onto their assets when reaching these pivotal break-even points.

2. The Birth of New Products

The crypto sphere witnesses many innovative projects regularly. Fresh ideas can disrupt the norm and open up new avenues for profit, even if short-term volatility continues. While meme coins may dominate the attention for now, quality projects can greatly benefit from this shifting spotlight.

Conclusion: The Essence of Recognizing Trends in Crypto

Drawing from the recent history of the crypto market and observations within, we can reach a greater understanding of market dynamics:

- General Market Conditions: In a rising market, projects generally attract more attention and capital.

- Industry Trends: Projects aligned with current industry trends typically enjoy greater advantages.

- Product Innovations: Projects with committed support bases and innovative offerings often prevail over others.

By paying attention to these indicators, investors can strategically position themselves to harness new opportunities while mitigating risks. Ultimately, informed decision-making is key to thriving in the ever-changing cryptocurrency landscape.

As we conclude, it is clear that the potential for gain is often mirrored by an equal chance for risk. Thus, thorough research and prudent capital allocation remain paramount for success in this volatile market.