The cryptocurrency market is a dynamic landscape, with projects constantly vying for dominance. In recent years, Solana has emerged as a strong contender, surpassing Binance Smart Chain (BSC) in several key metrics. This isn’t the first time SOL has overtaken BNB in market capitalization, but the underlying reasons for this recent surge are worth exploring. This article delves into Solana’s performance in the first half of 2024, examining the factors that propelled its growth and comparing its trajectory to BSC’s.

Solana vs. BSC: A Tale of Two Ecosystems

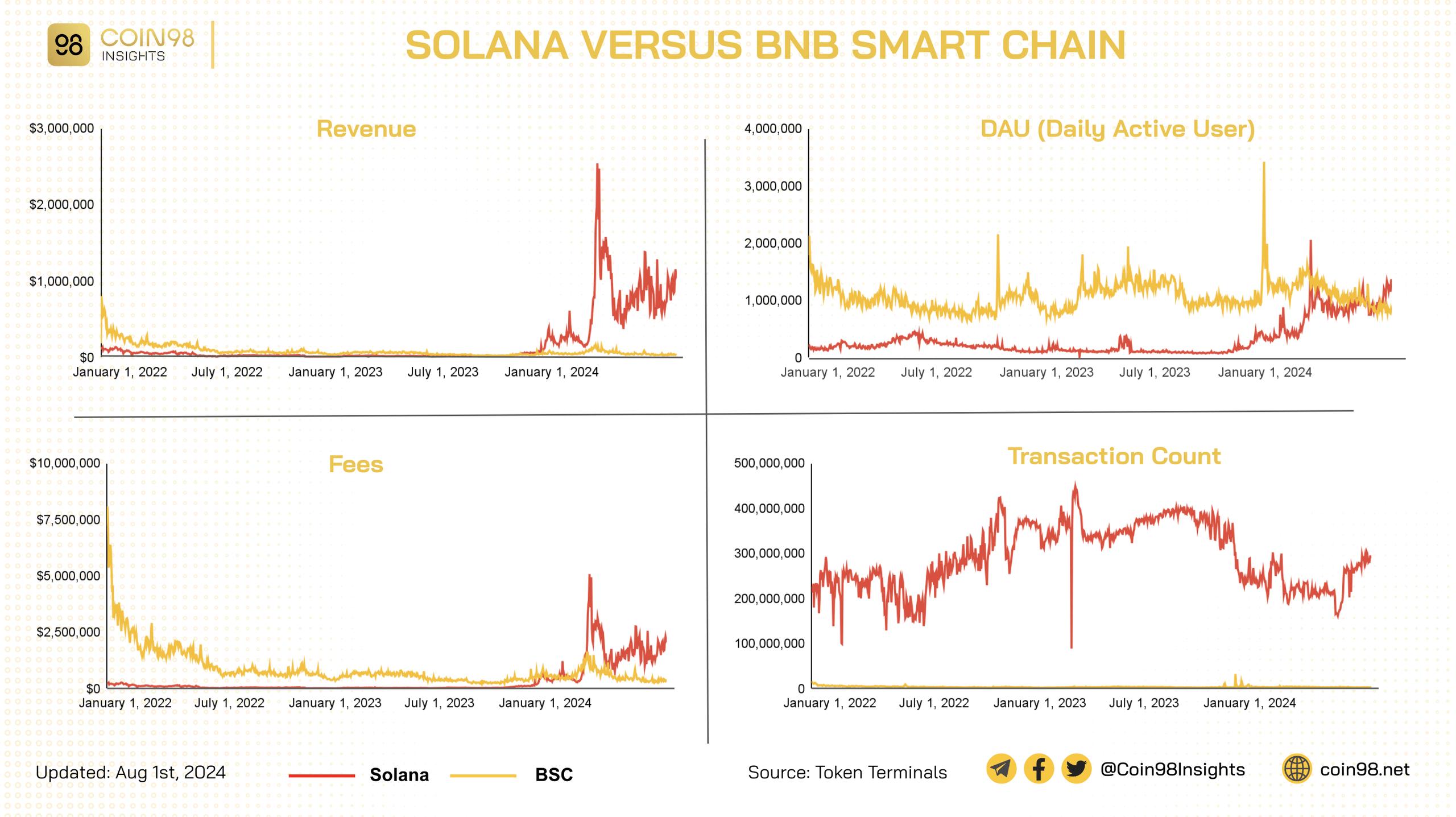

Throughout the first half of 2024, Solana consistently outperformed BSC across various metrics, including revenue, transaction fees, and on-chain transaction volume. Even daily active users, a metric where BSC once held a significant lead, have shown a shift towards Solana.

Comparison of Solana and BSC ecosystemsComparison of Solana and BSC ecosystems. Source: Token Terminal

Comparison of Solana and BSC ecosystemsComparison of Solana and BSC ecosystems. Source: Token Terminal

Furthermore, Solana’s Total Value Locked (TVL) surpasses BSC by approximately $600 million, reaching $5.4 billion. Solana’s Fully Diluted Valuation (FDV) and Stablecoin Marketcap are also closely trailing BSC, indicating the potential for further growth and market dominance in the near future.

Solana’s revenue growth has been particularly impressive, even surpassing Ethereum’s at the end of July 2024 – a historic first for the platform. This achievement underscores Solana’s growing influence and potential to disrupt the established order.

Solana’s blockchain revenue surpasses Ethereum’s. Source: Solanians

Solana’s blockchain revenue surpasses Ethereum’s. Source: Solanians

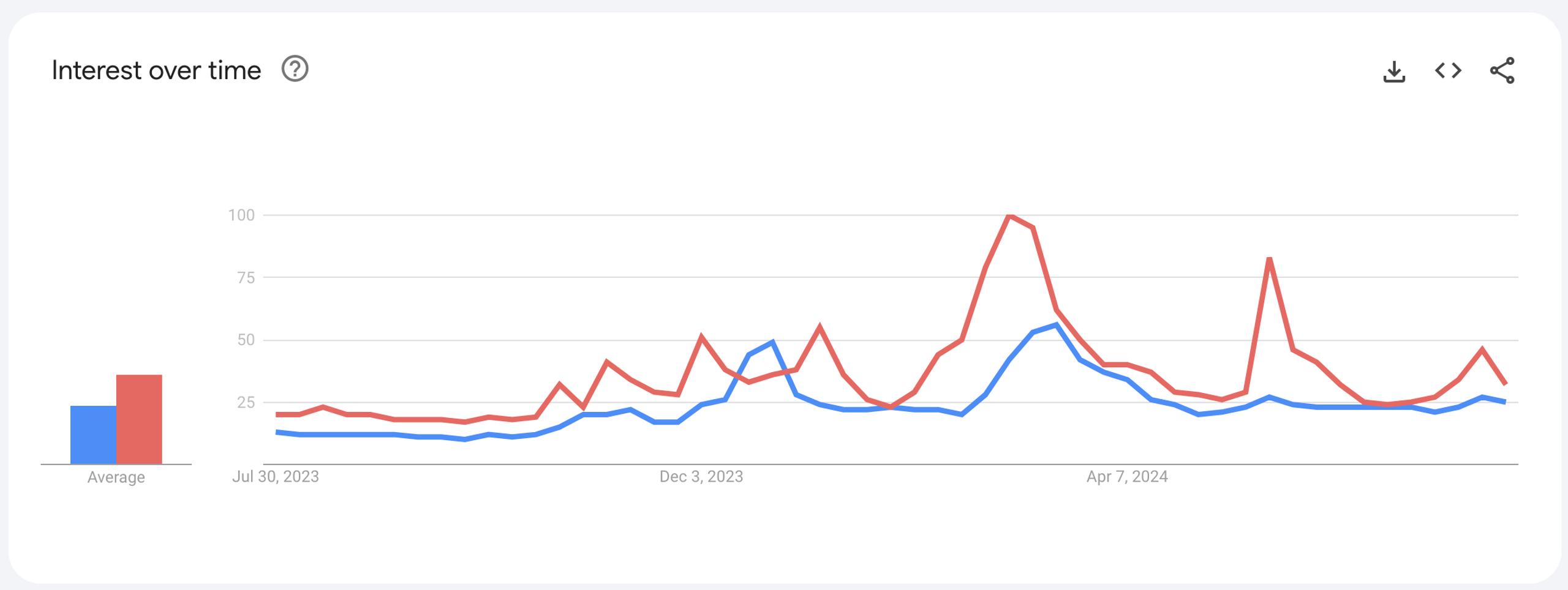

Adding to this momentum, Solana has consistently garnered more Google searches than Ethereum in the US for an extended period, with search volume for Solana doubling that of Ethereum.

Solana and Ethereum Google TrendsGoogle search trends for Solana (red) and Ethereum (blue). Source: Google Trend

Solana and Ethereum Google TrendsGoogle search trends for Solana (red) and Ethereum (blue). Source: Google Trend

These compelling statistics beg the question: what factors have fueled Solana’s remarkable ascent?

Drivers of Solana’s 2025 Success

Several key factors contributed to Solana’s success in the first half of 2024, including its thriving DeFi ecosystem, strategic integration of Real-World Assets (RWAs), impactful airdrop campaigns, and the rise of memecoins. Institutional interest in SOL, including accumulating token holdings and filing for SOL Exchange Traded Funds (ETFs), has further bolstered its market position.

DeFi and RWA Integration: A Powerful Combination

Solana’s DeFi protocols, like Kamino Finance, have played a pivotal role in its growth, attracting users with compelling yields. Integrations with major financial platforms like Stripe and Shopify have also opened up new avenues for developers and projects within the ecosystem.

RWAs represent another significant growth area for Solana. Users can mint NFTs linked to real-world assets through Metaplex NFTs. Partnerships like the one between Drift and Ondo Finance (backed by BlackRock and Coinbase) further integrate RWAs as collateral within Solana’s DeFi ecosystem. Other notable RWA projects on Solana include DigiCask, Credix, HomeBase, Baxus, AlloyX, and CollectorCrypt.

Solana’s stablecoin supply has also witnessed rapid expansion, with a market cap reaching $3.25 billion. USDC accounts for 70% of this stablecoin market, with its trading volume on Solana exceeding USDT by a factor of 19. This dominance is attributed to numerous Solana-based funds holding USDC and Circle’s Cross Chain Transfer Protocol, which enhances USDC’s usability and liquidity on the platform.

Stablecoins on Solana. Source: Artemis

Stablecoins on Solana. Source: Artemis

These initiatives collectively position USDC as the leading stablecoin on Solana, benefiting from its regulatory compliance and widespread adoption by traditional financial institutions.

Strategic Airdrop Campaigns: Fueling Community Growth

The first half of 2024 saw numerous Solana projects conduct impactful airdrop campaigns, distributing tokens worth thousands, and sometimes tens of thousands, of dollars. Projects like Jito, Pyth Network, Jupiter, Wormhole, and Drift leveraged airdrops to attract new users and generate excitement within the ecosystem.

Solana projects frequently conduct airdrops.

Solana projects frequently conduct airdrops.

Memecoin Mania: Riding the Hype Wave

Solana also benefited from the surge in popularity of memecoins like Dogwifhat, Book of meme, and MAGA, driving significant capital inflows and attracting a broader audience.

Solana’s memecoin landscape extends beyond animal-themed tokens to encompass those inspired by celebrities and political figures. Platforms like pump.fun further contributed to the memecoin frenzy and helped solidify Solana’s position as a vibrant hub for this emerging trend.

Institutional Backing: Solidifying Solana’s Legitimacy

Solana has attracted substantial interest from traditional financial institutions. Over the past year, $69 million has flowed into Solana from institutional investors, ranking it among the top crypto assets alongside Bitcoin and Ethereum.

Major financial institutions like VanEck and 21Shares have filed applications for SOL ETFs. Approval of these ETFs would further simplify access for traditional investors, potentially driving greater demand for SOL.

Crypto inflows from traditional finance. Source: Bloomberg & CoinShares

Crypto inflows from traditional finance. Source: Bloomberg & CoinShares

BSC’s Challenges: Struggling to Attract Value

While Solana flourished, BSC faced challenges in maintaining its momentum. Many BSC projects experienced limited growth, with most seeing only single-digit percentage increases in value over the past month. The majority of projects on BSC have a TVL below $60 million, with only one project exceeding $1 billion. This lackluster performance has dampened demand for BNB.

In contrast, Solana projects have experienced robust growth, with several boasting TVLs above $100 million and five exceeding $1 billion.

Comparison of Solana and BSCComparison of Solana and BSC ecosystems. Source: Coin98 Insights, DeFiLlama

Comparison of Solana and BSCComparison of Solana and BSC ecosystems. Source: Coin98 Insights, DeFiLlama

Binance, a significant contributor to BNB demand, also struggled to generate significant buzz during this period. Initiatives like launchpool, megadrop, and memecoin offerings failed to deliver substantial growth, with some even leading to losses for investors.

Conclusion: Solana’s 2025 Outlook and Beyond

Solana’s success stems from a combination of factors, including a vibrant ecosystem, innovative DeFi protocols, strategic airdrop campaigns, embracing the memecoin trend, and growing institutional interest. Its ability to adapt to evolving market dynamics and cater to a diverse range of user needs positions it for continued growth in 2025 and beyond. While BSC faces challenges in attracting and retaining value, Solana’s multi-faceted approach has solidified its position as a leading contender in the cryptocurrency space.

FAQs: Addressing Common Questions about Solana’s Rise

Q: What are the key reasons for Solana’s recent outperformance of BSC?

A: Solana’s success can be attributed to its robust DeFi ecosystem, strategic integration of Real-World Assets, impactful airdrop campaigns, and the rise of memecoins. Furthermore, institutional interest in SOL, including accumulating token holdings and filing for SOL ETFs, has further bolstered its market position.

Q: How has Solana’s DeFi ecosystem contributed to its growth?

A: Solana’s DeFi protocols offer attractive yields and integrations with major financial platforms, driving user engagement and attracting capital inflows.

Q: What role have airdrops played in Solana’s success?

A: Airdrops have been instrumental in attracting new users to the Solana ecosystem and generating excitement around its projects.

Have more questions? Feel free to share them in the comments below! We encourage community discussion and welcome further insights on Solana and the wider crypto market.