The crypto world is buzzing, and not in a good way. Su Zhu and Kyle Davies, the disgraced founders of the now-defunct hedge fund Three Arrows Capital (3AC), are back. This time, they’re aiming to launch a new cryptocurrency exchange called GTX, alongside the founders of CoinFLEX. While pitched as a platform to help creditors of bankrupt crypto firms like FTX, Celsius, and BlockFi, GTX has been met with widespread ridicule and skepticism. This article delves into the controversy surrounding GTX, examining the founders’ tarnished reputations, the platform’s proposed functionality, and the overwhelmingly negative community response.

The Genesis of GTX: From Bankruptcy to a New Venture

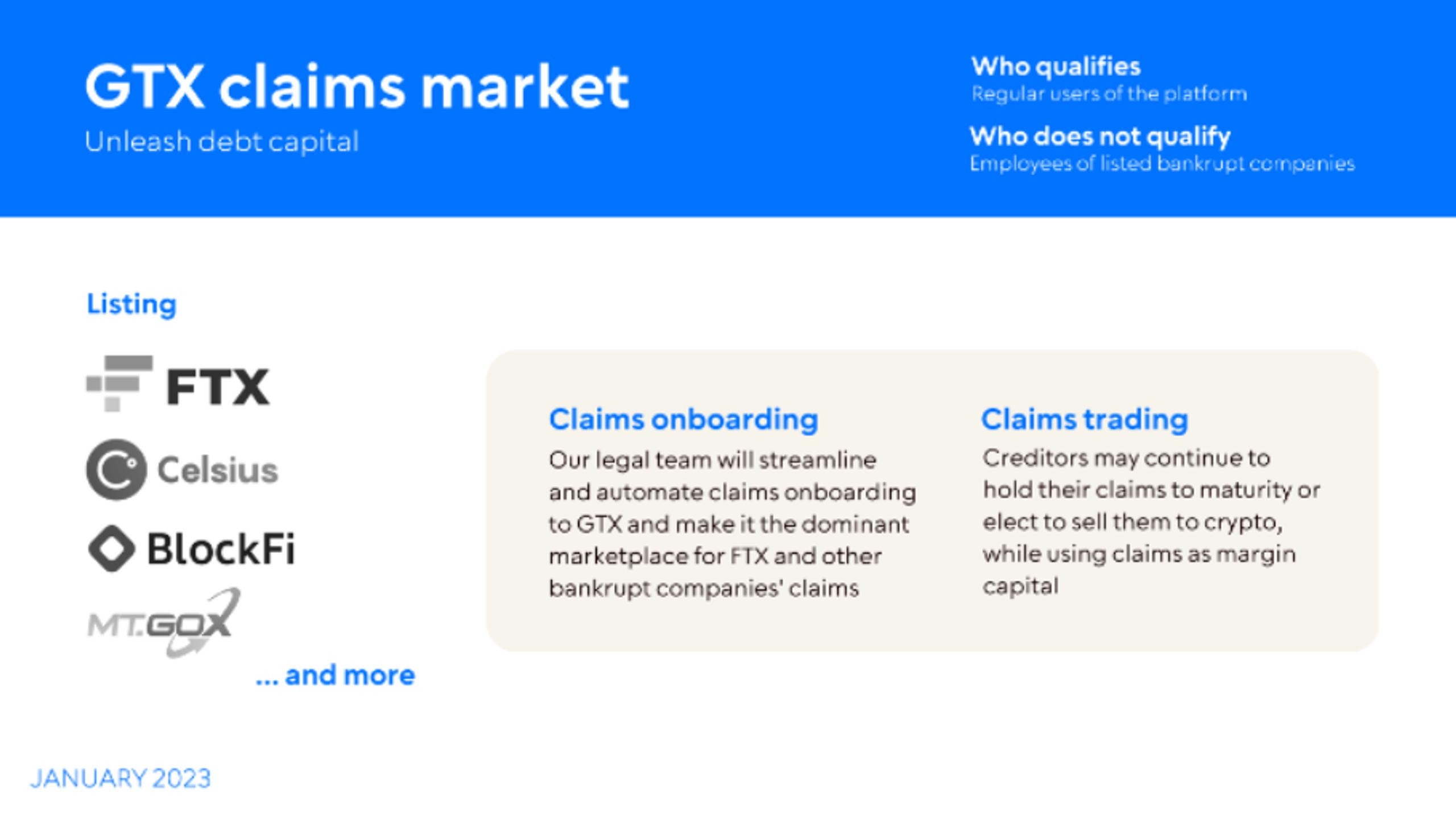

GTX’s purported mission is to provide a platform for creditors of failed crypto companies to recoup some of their losses. Instead of waiting indefinitely for potential payouts, creditors would have two options on GTX: sell their claims for USDG, a credit-based stablecoin, or use their claims as collateral for leveraged trading. This concept, while seemingly innovative, is overshadowed by the baggage the founders bring to the table.

The 3AC Legacy: A History of Controversy

Su Zhu and Kyle Davies aren’t strangers to controversy. The collapse of 3AC in 2022 sent shockwaves through the crypto market, leaving creditors with billions of dollars in losses. The founders faced accusations of mismanagement and reckless speculation, further fueled by their subsequent disappearance and evasion of legal proceedings. Their reappearance with GTX has, understandably, been met with distrust.

CoinFLEX’s Troubles: Adding Fuel to the Fire

The involvement of CoinFLEX’s founders doesn’t help GTX’s case. CoinFLEX itself faced financial difficulties and filed for restructuring in August 2022, further eroding confidence in the team’s ability to manage a successful exchange.

GTX and FTX: An Unfortunate Resemblance

The name GTX itself has drawn criticism, with many pointing out its similarity to the disgraced FTX exchange. While the GTX team claims the name is not final, the association has already left a negative impression. The attempt to position GTX as a solution to the problems created by FTX while using a similar name has been viewed as tone-deaf and opportunistic.

Community Backlash: A Chorus of Criticism

The reaction to GTX from the crypto community has been overwhelmingly negative. Influential investors, traders, and media outlets have voiced their concerns and ridiculed the project. Criticisms range from the founders’ tarnished reputations to the perceived inadequacy of the GTX proposal and the ill-conceived name.

Several high-profile figures in the crypto space have publicly denounced GTX. Foobar, a prominent investor with a substantial following on Twitter, sarcastically commented on the founders’ lack of experience in “scamming,” while Tyler, a well-known trader, accused them of launching a “scam” disguised as a helpful service. CHADLY, another investor, mocked the project’s funding round, suggesting the investors involved were “interns.”

A Deeper Dive into the Criticisms

Garlam, another prominent voice in the crypto community, took a deeper dive into the GTX pitch deck, dissecting its flaws and highlighting the absurdity of the proposed model. He compared it to “hitting someone in the face with a stick and then selling them a cosmetic surgery package.” Satvik Sethi questioned the project’s valuation and funding stage, pointing out that GTX hadn’t even launched a product or established a market presence yet. He argued that the project should be in the pre-seed stage, not the seed round as claimed.

The skepticism extends beyond individual investors. Whalechart.org, a popular Twitter account with a large following, expressed a complete lack of trust in Su Zhu and Kyle Davies, stating they would never invest in their ventures. Another user labeled GTX as “Grand Theft Exchange,” urging people to stick with established platforms like Binance, Bitget, and Bitmex.

Even institutional players have weighed in. The CEO of Wintermute, a leading crypto market maker, issued a stern warning, stating that any association with GTX could jeopardize future business dealings with Wintermute. This statement underscores the severity of the reputational damage surrounding the project.

The GTX Pitch Deck: A Source of Further Ridicule

The GTX pitch deck itself has become a source of mockery. The deck features a graphic reminiscent of the James Bond opening sequence, with expanding concentric circles, showcasing Su Zhu’s estimated $20 billion market cap target. The Financial Times compared FTX to a “giant carcass” providing “feeding opportunities” for projects like GTX, highlighting the opportunistic nature of the venture.

A Glimpse of Honesty?

One intriguing detail in the pitch deck is Su Zhu’s admission that 3AC achieved 40x returns in traditional markets and 80x returns in crypto before its collapse. While this might be an attempt at transparency, it’s unclear whether such a statement can salvage his reputation or generate any goodwill.

GTX 2025: An Uncertain Future

The future of GTX remains uncertain. The overwhelming negativity surrounding the project raises serious doubts about its viability. The founders’ damaged reputations, the questionable business model, and the intense community backlash create significant hurdles. Whether GTX can overcome these challenges and launch successfully remains to be seen. However, as of 2025, the project faces an uphill battle, with the crypto community largely united in its disapproval.

FAQ: Addressing Common Questions about GTX

What is GTX? GTX is a proposed cryptocurrency exchange founded by the disgraced founders of 3AC and CoinFLEX. It aims to offer a platform for creditors of bankrupt crypto firms to sell or trade their claims.

Why is GTX controversial? The founders’ involvement is the primary source of controversy. 3AC’s collapse and the subsequent actions of its founders have left a deep scar on the crypto community. The involvement of CoinFLEX, a platform that also faced financial difficulties, further fuels the skepticism.

Will GTX be successful? The overwhelming negative sentiment suggests a difficult path ahead for GTX. The project faces significant reputational and operational challenges.

What are the alternatives for creditors of bankrupt crypto firms? Creditors can pursue legal avenues to recover their funds, but this can be a lengthy and complex process. Some may choose to wait for potential payouts from bankruptcy proceedings, while others might explore alternative platforms or investment opportunities.

We encourage our readers to share their thoughts and questions about GTX in the comments section below. Your insights and perspectives are valuable to our community.