The year is 2015. PayPal, once a seemingly stagnant subsidiary of eBay, spins off and embarks on a remarkable journey of growth. But to understand this resurgence, we need to delve into PayPal’s history, tracing its roots back to the dawn of e-commerce and uncovering the eight key product growth lessons that propelled it to become a global payments giant.

From Humble Beginnings to Dot-Com Darling: The Early Days of PayPal

In 1998, Max Levchin and Peter Thiel, two Silicon Valley visionaries, joined forces to create Confinity, a company focused on digital wallets. Their initial product, FieldLink, a payment system for PDAs, failed to gain traction due to a limited market and lack of product-market fit. This leads us to the first crucial lesson:

Lesson 1: Prioritize Product-Market Fit Before Aggressive Growth

Confinity quickly pivoted, recognizing the need for a product that addressed a genuine user need in a larger market. They shifted their focus to web-based checkout and email payments, a solution perfectly aligned with the growing demand for secure online transactions. This pivot marked the beginning of PayPal’s product growth journey.

Lesson 2: Harness the Power of Referrals

In 1999, PayPal launched its innovative “give $20, get $20” referral program, a groundbreaking strategy that capitalized on the social nature of payments. This program fueled exponential growth, demonstrating the potential of well-executed referral programs to acquire users at scale.

Lesson 3: Strategic Partnerships and Integrations Drive Growth

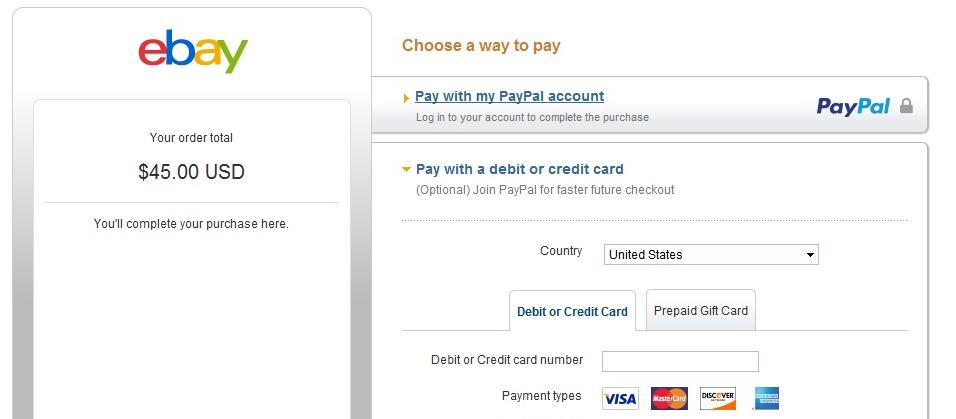

PayPal’s integration with eBay, the dominant e-commerce platform at the time, proved to be a game-changer. The seamless integration of PayPal’s checkout button on eBay’s platform drove significant transaction volume, establishing merchant integrations as a powerful product growth lever.

Early PayPal integration with eBay checkoutEarly integration with eBay played a pivotal role in PayPal’s initial growth.

Early PayPal integration with eBay checkoutEarly integration with eBay played a pivotal role in PayPal’s initial growth.

Navigating the Dot-Com Bubble and the eBay Era

The year 2000 brought both challenges and opportunities. A merger with Elon Musk’s X.com led to internal restructuring and a renewed focus on innovation. Despite the dot-com bubble burst and the aftermath of 9/11, PayPal persevered, successfully IPOing in 2002. Shortly after, eBay acquired PayPal for $1.5 billion.

The eBay years, while financially stable, saw a period of relative stagnation in product growth. The focus shifted towards enhancing eBay’s checkout experience, leading to linear growth but hindering PayPal’s potential as an independent payments platform. However, strategic acquisitions like Fraud Sciences, Bill Me Later, and Braintree (including Venmo) laid the groundwork for future growth.

The “PayPal Mafia” emerged from this era, demonstrating the company’s impact on the tech landscape.

The “PayPal Mafia” emerged from this era, demonstrating the company’s impact on the tech landscape.

The Spin-Off and the Resurgence of PayPal: A Product Growth Masterclass

The appointment of Dan Schulman as CEO in 2014 marked a turning point. Schulman, a seasoned executive with a proven track record of scaling businesses, spearheaded PayPal’s spin-off from eBay in 2015, setting the stage for a remarkable resurgence.

Lesson 4: Prioritizing User Experience Fuels Long-Term Growth

In 2016, PayPal adopted a user-centric approach, prioritizing customer choice in payment methods over short-term revenue gains. This strategy fostered user loyalty and increased transaction volume, demonstrating the power of prioritizing user experience for long-term success.

Lesson 5: Leveraging Social Connections with Venmo

PayPal unlocked the potential of social payments with Venmo. By integrating social features and creating a social feed within the app, Venmo transformed peer-to-peer payments into a social experience, driving impressive growth in transaction volume.

Venmo’s social integration fueled explosive growth in transaction volume.

Venmo’s social integration fueled explosive growth in transaction volume.

Lesson 6: Building Two-Sided Network Effects Creates a Powerful Moat

PayPal doubled down on building two-sided network effects, strengthening its position in the market. Acquisitions like Simility, iZettle, and Hyperwallet enhanced its offerings for both consumers and merchants, creating a virtuous cycle of growth and reinforcing its competitive advantage.

Strategic acquisitions bolstered PayPal’s two-sided network, creating a formidable moat.

Strategic acquisitions bolstered PayPal’s two-sided network, creating a formidable moat.

Lesson 7: Expanding into Adjacent Markets with New Products

PayPal broadened its product portfolio beyond core payments, offering services like crypto trading, buy now, pay later options, and savings accounts. This expansion catered to a wider range of user needs, increasing engagement and platform stickiness.

PayPal’s expanded product ecosystem caters to a diverse range of financial needs.

PayPal’s expanded product ecosystem caters to a diverse range of financial needs.

Lesson 8: Continuous Iteration is Key to Sustainable Growth

PayPal consistently iterates on its growth strategies. The ongoing refinement of its referral program exemplifies its commitment to continuous improvement and adaptation to the evolving market landscape.

PayPal continuously iterates on its referral program to optimize its effectiveness.

PayPal continuously iterates on its referral program to optimize its effectiveness.

Conclusion: PayPal’s Enduring Legacy in Product Growth

PayPal’s journey, marked by both successes and setbacks, provides invaluable lessons for product growth professionals. Its ability to adapt, innovate, and prioritize user needs has cemented its position as a leader in the payments industry. By embracing a holistic approach to product growth, PayPal continues to shape the future of finance.

FAQ:

Q: What was the key turning point in PayPal’s growth trajectory?

A: The appointment of Dan Schulman as CEO and the subsequent spin-off from eBay in 2015 marked a significant turning point, ushering in a new era of focused product growth.

Q: How did Venmo contribute to PayPal’s success?

A: Venmo’s integration of social features transformed peer-to-peer payments into a social experience, driving substantial user engagement and transaction volume growth.

Q: What is the significance of two-sided network effects for PayPal?

A: Building two-sided network effects, by serving both consumers and merchants, created a powerful moat for PayPal, strengthening its competitive advantage and driving sustainable growth.

Do you have any other questions about PayPal’s product growth journey? Share them in the comments below! And don’t forget to share this article with fellow music and fintech enthusiasts!