PancakeSwap has rapidly risen to become the dominant decentralized exchange (DEX) on the Binance Smart Chain (BSC). But what exactly makes this platform tick? This in-depth analysis delves into PancakeSwap’s inner workings, exploring its various products, the role of the CAKE token, and the potential opportunities it presents for investors.

An Overview of PancakeSwap

Launched shortly after the Binance Smart Chain mainnet went live, PancakeSwap is an automated market maker (AMM) forked from Uniswap V2. Leveraging BSC’s advantages of high transaction speeds and low fees, PancakeSwap quickly gained traction, attracting a large number of retail investors, particularly those with limited capital.

Over time, PancakeSwap has expanded beyond its initial AMM offering to include a diverse suite of products like Syrup Pools, Initial Farm Offerings (IFOs), Lottery, Prediction, and Team Battles. These additions have contributed significantly to its growth and popularity, solidifying its position as a leading DEX in terms of Total Value Locked (TVL) and trading volume. This article will unpack each of these elements, revealing how PancakeSwap captures value and sustains its ecosystem.

Dissecting the PancakeSwap Ecosystem

PancakeSwap’s ecosystem comprises seven core products:

- PancakeSwap AMM

- Farms

- Syrup Pools

- Initial Farming Offering (IFO)

- Lottery

- Prediction

- Team Battle

We’ll analyze each product, focusing on its functionality, mechanics, and how it contributes to the value of the CAKE token.

PancakeSwap AMM: The Foundation of the Exchange

What is PancakeSwap AMM?

At the heart of the PancakeSwap ecosystem lies its AMM, facilitating the exchange of BEP20 tokens. Mirroring Uniswap V2, it employs the x*y=k constant product market maker formula. However, PancakeSwap introduces several key improvements.

Here’s a breakdown of how the PancakeSwap AMM works:

- Liquidity Pools: Each pool contains two assets (e.g., A and B) provided by liquidity providers (LPs) at a 1:1 ratio. In return, LPs receive LP tokens representing their share of the pool.

- Trading: Traders swap asset A for asset B (or vice versa) by interacting with the pool.

- Fee Distribution: PancakeSwap charges a 0.25% fee on each trade. This fee is allocated as follows:

- 0.17% (68%) to LPs

- 0.03% (12%) to the PancakeSwap Treasury

- 0.05% (20%) for CAKE token buyback and burn

- Yield Farming: LPs can further enhance their returns by staking their LP tokens in Farms to earn CAKE rewards, incentivizing liquidity provision.

How PancakeSwap AMM Captures Value for CAKE

The AMM is PancakeSwap’s primary revenue generator. Its high TVL and trading volume translate into substantial fees, a portion of which is directly used to buy back and burn CAKE tokens every Monday. This mechanism creates consistent buy pressure and reduces circulating supply, benefiting CAKE holders.

Key Features of PancakeSwap AMM

- Binance Smart Chain Integration: Leveraging BSC’s speed and low fees differentiates PancakeSwap from other AMMs.

- Low Trading Fees: The 0.2% trading fee attracts users but also results in slightly lower returns for LPs compared to some competitors.

- Buyback and Burn Mechanism: This crucial feature directly impacts CAKE tokenomics and the overall project’s functionality.

Farms: The Yield Farming Engine

What are Farms?

Farms are a key incentive mechanism within the PancakeSwap ecosystem, designed to bootstrap TVL and encourage users to provide liquidity. CAKE rewards are distributed to LPs in selected pools, with the allocation determined through community voting.

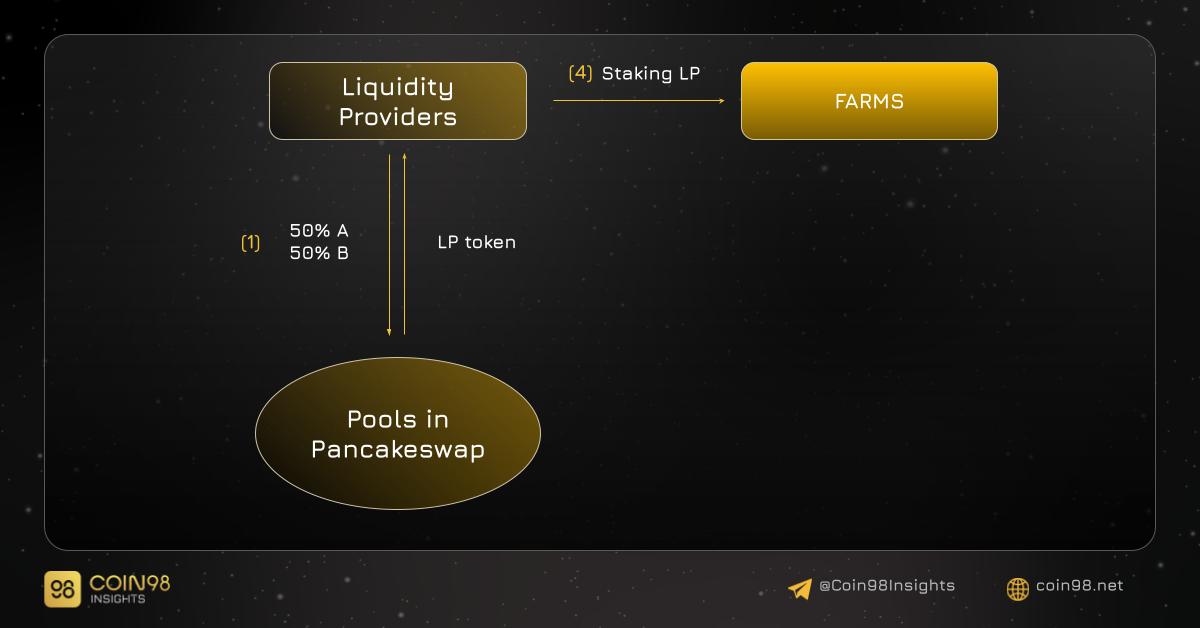

How Yield Farming Works on PancakeSwap

cơ chế yield farming pancakeswap

cơ chế yield farming pancakeswap

The process is straightforward:

- Provide liquidity to a PancakeSwap pool and receive LP tokens.

- Stake LP tokens in a Farm to earn CAKE rewards over time.

How Yield Farming Captures Value for CAKE

Yield Farming indirectly benefits CAKE by boosting TVL. Increased TVL attracts more traders, generating higher trading fees, which in turn contribute to the CAKE buyback and burn program.

Syrup Pools: Simple Staking for Sweet Rewards

What are Syrup Pools?

Syrup Pools offer a simple staking mechanism where users can stake CAKE to earn rewards, either in CAKE or other tokens. There are two types of Syrup Pools: CAKE-CAKE and CAKE-Other Token.

How Syrup Pools Work

The process involves four steps:

- Projects apply and are vetted by PancakeSwap to be featured in Syrup Pools.

- Users stake CAKE in their preferred pool.

- Users earn rewards over time.

- CAKE rewards can be re-staked with an optional 2% auto-compounding fee.

How Syrup Pools Capture Value for CAKE

Syrup Pools offer several benefits:

- Rewards for CAKE holders

- Increased CAKE demand due to staking

- Partnerships with new projects

- Increased trading volume on PancakeSwap

These factors contribute both directly and indirectly to the value of CAKE.

Initial Farm Offerings (IFOs): A Novel Token Launchpad

What are IFOs?

IFOs are a unique fundraising mechanism similar to IDOs, but using LP tokens from the CAKE-BNB pool as the participation asset. This removes the need for holding platform-specific governance tokens to participate.

How IFOs Work

The IFO process is as follows:

- Projects apply to PancakeSwap for IFO listing.

- Users provide liquidity to the CAKE-BNB pool and stake the LP tokens in the IFO.

- Token allocation is based on an overflow mechanism, with excess LP tokens returned.

- Raised CAKE is burned, and BNB is distributed to the project.

How IFOs Capture Value for CAKE

IFOs benefit CAKE by:

- Increasing CAKE demand

- Decreasing CAKE supply through burning

- Incentivizing liquidity provision

- Fostering new partnerships

- Driving trading volume on PancakeSwap

Lottery: A Chance at Big Wins

What is the PancakeSwap Lottery?

The Lottery is a simple game where users purchase tickets with CAKE, matching numbers to win a share of the prize pool.

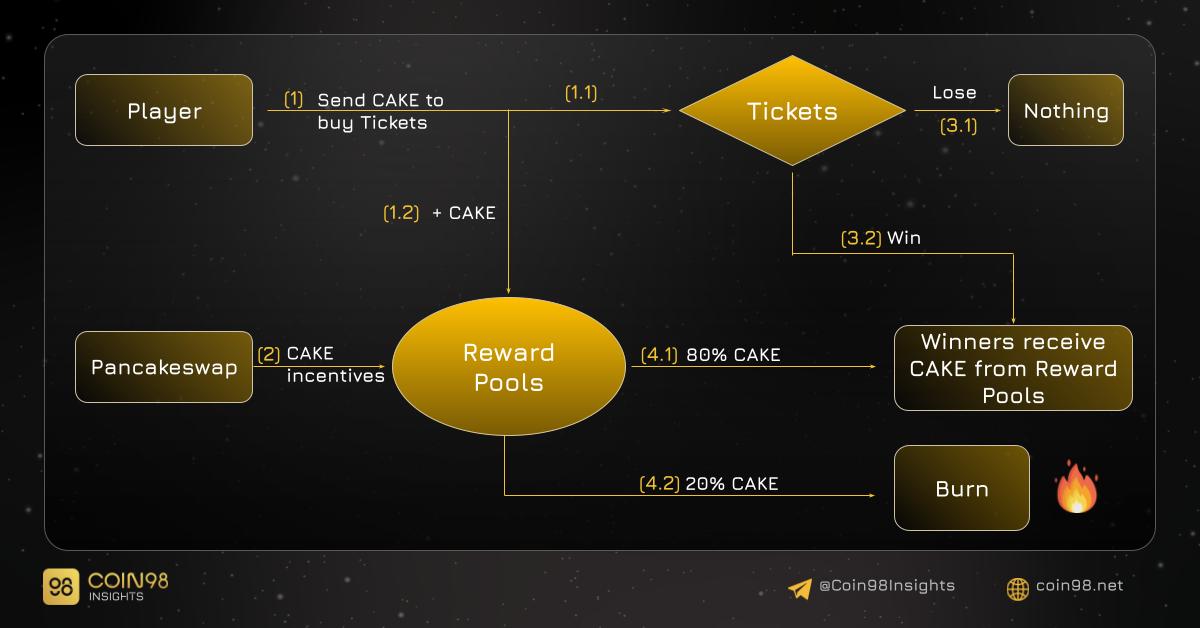

How the Lottery Works

- Users purchase tickets with CAKE.

- PancakeSwap contributes to the prize pool.

- Winning numbers are drawn.

- 80% of the pool is distributed to winners, and 20% is burned.

How the Lottery Captures Value for CAKE

The Lottery drives CAKE demand and reduces supply through burning, directly benefiting CAKE holders.

Prediction: Betting on BNB Price Movements

What is Prediction?

Prediction is a market where users predict the price movement of BNB within a specific timeframe.

How Prediction Works

- Users bet on BNB price going up or down.

- 3% of each pool is allocated to the PancakeSwap Treasury for CAKE buyback and burn.

- Winners are determined based on the actual price movement.

How Prediction Captures Value for CAKE

Prediction contributes to CAKE value through the 3% fee allocated to buyback and burn.

Team Battle: Competitive Trading for CAKE Rewards

What is Team Battle?

Team Battle is a game where teams compete to generate the highest trading volume on PancakeSwap, earning a share of a CAKE prize pool.

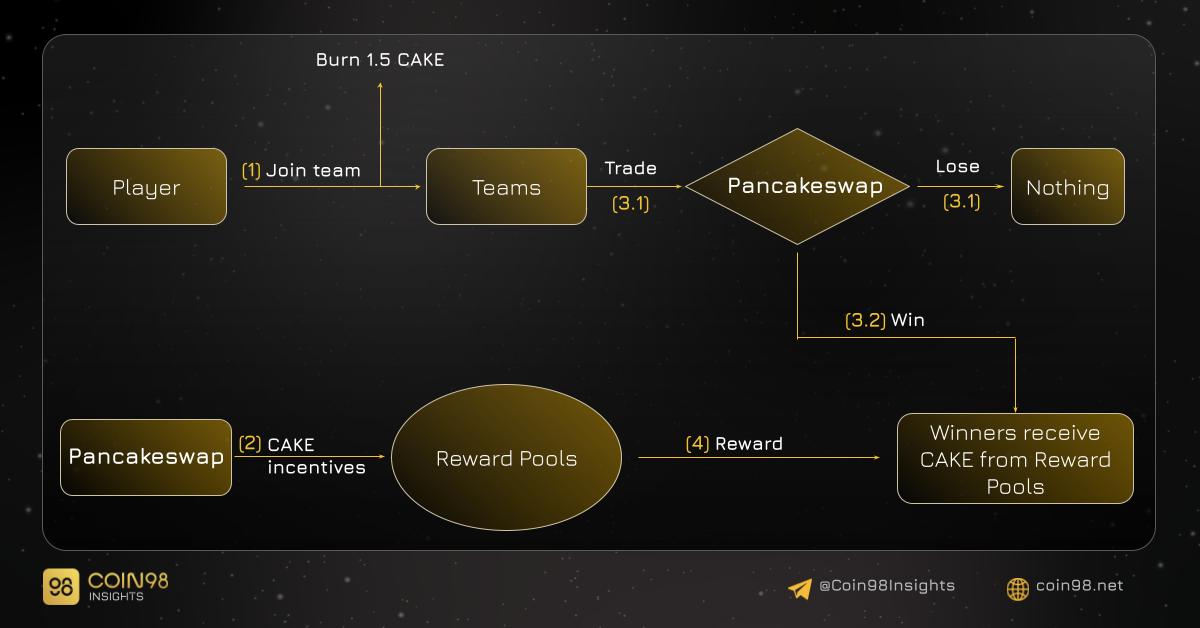

How Team Battle Works

cơ chế team battle pancakeswap

cơ chế team battle pancakeswap

- Users create profiles and join teams.

- Teams compete to generate trading volume.

- Winning teams share the prize pool.

How Team Battle Captures Value for CAKE

Team Battle increases CAKE demand through profile creation fees and indirectly boosts CAKE value by driving trading volume.

The PancakeSwap Flywheel: A Self-Sustaining Ecosystem

PancakeSwap operates on a flywheel model, with CAKE at its center. The platform mints CAKE to incentivize participation in its various products, which in turn generate revenue used to buy back and burn CAKE, controlling inflation and supporting the token’s value. This creates a self-sustaining ecosystem where growth in one area fuels growth in others.

CAKE Tokenomics: Balancing Supply and Demand

CAKE has an unlimited supply, making supply management crucial. PancakeSwap utilizes various mechanisms to balance minting and burning, aiming for a state where the two are roughly equal. This involves carefully allocating CAKE rewards across different products and generating revenue through fees and other activities.

Investment Opportunities in PancakeSwap

The growth of PancakeSwap presents two key investment opportunities:

- CAKE Token: Increased demand driven by platform activity can lead to price appreciation.

- PancakeSwap Products: Participating in IFOs, Syrup Pools, and other products can generate attractive returns.

The Future of PancakeSwap

PancakeSwap’s modular ecosystem allows for easy integration of new products and features. Potential future developments include gamification, lending and borrowing, margin trading, and referral programs, further expanding the platform’s reach and functionality.

Conclusion

PancakeSwap’s innovative approach to building a DeFi ecosystem around the CAKE token has propelled it to the forefront of the BSC landscape. Its diverse product offerings, coupled with a focus on community engagement and continuous development, position it for continued growth and success in the evolving world of decentralized finance. While challenges remain, particularly in managing CAKE token inflation, PancakeSwap’s dynamic model and forward-thinking strategy offer promising opportunities for both users and investors.