Arbitrage, in its simplest form, is the act of buying and selling the same asset across different markets to profit from price discrepancies. This strategy can be applied across various financial markets, including cryptocurrencies, stocks, commodities, and fiat currencies. In the crypto world, arbitrage involves capitalizing on price differences of digital assets between various exchanges.

Imagine a shopkeeper buying bread at a lower price from a nearby store and selling it at a higher price in their own shop. This is essentially arbitrage – profiting from the price difference of bread across two different markets.

The profitability of arbitrage depends heavily on the trading volume. While negligible at small scales, the potential gains can be substantial with large-scale operations. Therefore, arbitrage is often considered a low-risk, high-reward trading strategy for investors who can identify and execute it effectively.

Arbitrage opportunities arise due to fragmented liquidity and data discrepancies. Currently, addressing these discrepancies remains a significant challenge for market makers. This challenge, however, translates into greater profit potential for arbitrage traders, especially with the advent of decentralized finance (DeFi).

How Does Crypto Arbitrage Work?

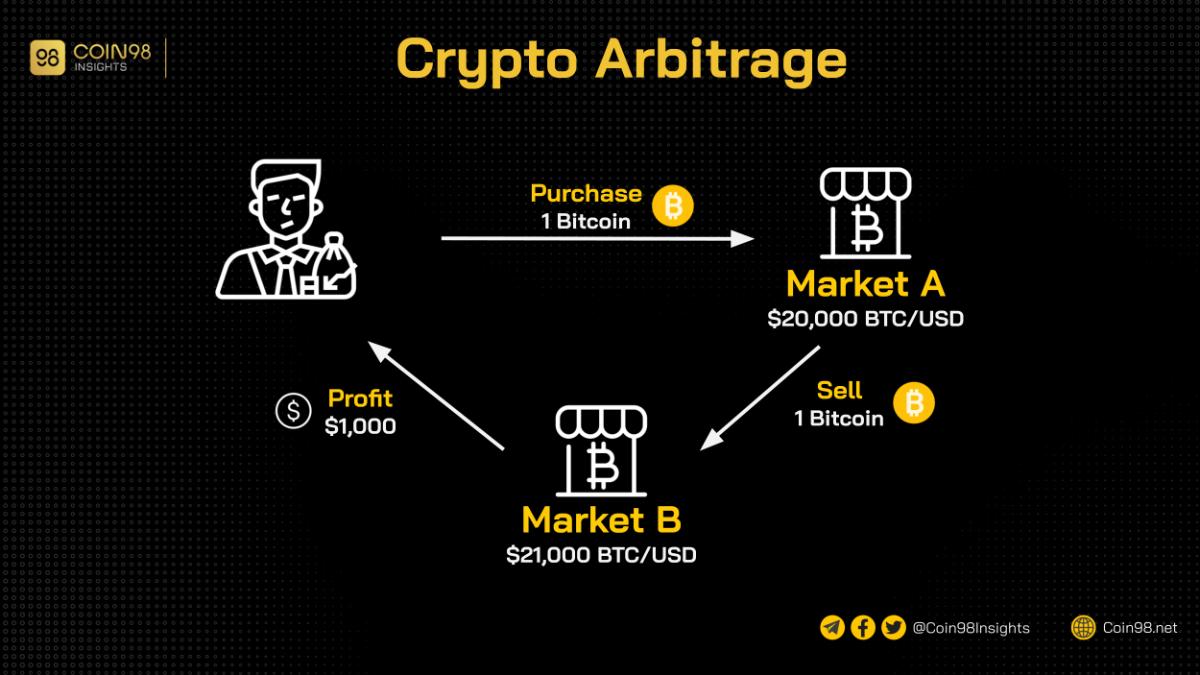

The goal of arbitrage trading is straightforward: buy an asset at a lower price and sell it at a higher price. Here’s a simplified example illustrating how profitable arbitrage works:

- A trader identifies a price difference for Bitcoin across two crypto exchanges.

- The trader buys 1 Bitcoin for $20,000 on Exchange X.

- They transfer the Bitcoin to Exchange Y, where it’s priced at $21,000.

- By leveraging the $1,000 price difference, the trader profits $1,000 (minus trading fees) by selling the Bitcoin for $21,000 on Exchange Y.

In reality, arbitrage traders often exploit fragmented liquidity across decentralized exchanges (DEXs) on different blockchains. This process can involve more complex asset swaps and carries the risk of losses if calculations are inaccurate.

Beyond generating profits for traders, arbitrage also plays a crucial role in enhancing market liquidity and stabilizing asset prices across different markets.

Types of Crypto Arbitrage Trading

Exchange Arbitrage

This is the most basic form of crypto arbitrage. Traders buy an asset on one exchange (often a centralized exchange or CEX) and sell it on another where the price is higher. The greater the price difference, the higher the profit.

DeFi has expanded arbitrage opportunities by enabling trading across DEXs. This eliminates the custodial risks associated with CEXs and presents more arbitrage opportunities due to fragmented liquidity.

DeFi also offers tools like bridges, flash loans, and mempool transaction analysis for more sophisticated arbitrage strategies. However, these require significant experience and technical expertise.

DEX-based arbitrage has its downsides. Transaction speeds are limited by blockchain speeds (e.g., Ethereum’s block time of around 15 seconds), impacting price sensitivity and profits. The Miner Extractable Value (MEV) mechanism can also lead to front-running, while slippage on low-liquidity DEXs can result in losses.

Spatial Arbitrage

Crypto exchanges are often located in different countries, with user access restricted based on nationality and regulations (e.g., Coinbase adhering to US regulations). Spatial arbitrage exploits these geographical limitations and regulatory disparities.

Sam Bankman-Fried (SBF), the founder of FTX, famously capitalized on the “Kimchi Premium” – the price difference between Bitcoin on Korean and US exchanges. He also exploited similar price gaps in Japan, reportedly generating millions in profit from these arbitrage opportunities.

Spatial arbitrage arises from varying crypto regulations and market dynamics across countries. While localized exchanges perpetuate this, decentralized exchanges (DEXs) offer a potential solution. Ironically, DEXs also create further arbitrage opportunities for savvy traders.

Funding Rate Arbitrage

Funding rates bridge the gap between perpetual contract prices and the underlying asset’s spot price. Perpetual traders pay each other fees based on their long or short positions. A positive funding rate means long position holders pay short position holders, and vice versa.

Traders can simultaneously open equal-sized long and short positions on different platforms to capitalize on funding rate discrepancies.

For example, a trader could short $10,000 worth of a perpetual contract and simultaneously buy $10,000 worth of the underlying asset on a spot exchange. This neutralizes price fluctuation risk while earning profit from a positive funding rate. The profitability of this strategy depends on the funding rate and the position size.

Risks of Arbitrage Trading

Transaction Fees

Arbitrage involves various fees, including trading fees, deposit/withdrawal fees, and gas fees (for DeFi transactions). These costs can accumulate and potentially outweigh profits, especially for smaller trades.

Traders can mitigate this by choosing low-fee platforms and optimizing for larger trade volumes.

Timing Discrepancies

Precise timing is crucial in arbitrage. Buying and selling must happen quickly to capitalize on price differences. High market activity, including other arbitrage traders, can introduce significant price slippage, diminishing potential profits.

Bot Risks

Professional arbitrage traders often use bots for high-frequency, precise trading. However, bots can malfunction, leading to potential losses. Developing and maintaining effective arbitrage bots also requires technical expertise.

Traders without bots face significant disadvantages compared to those using automated systems.

Security Risks

Arbitrage often involves distributing capital across multiple platforms and markets, increasing security risks. Hacks and rug pulls remain prevalent in the crypto space. Using reputable exchanges and well-established DEXs is essential for minimizing these risks.

Frequently Asked Questions about Crypto Arbitrage

Is Arbitrage Good for the Crypto Market?

Arbitrage contributes to market efficiency and price stability across different exchanges. Arbitrage traders play a vital role in maintaining a healthy and functional crypto ecosystem.

Should I Use an Arbitrage Bot?

Bots offer significant advantages for high-frequency, precise arbitrage trading. However, they aren’t foolproof and require technical expertise. Traders should carefully weigh the costs and benefits of developing or purchasing a bot.

How Profitable Can Arbitrage Trading Be?

Arbitrage is generally considered a low-risk strategy, but individual profits per trade are often small due to typically low price discrepancies. While 10% differences are rare, consistent small gains across multiple trades can accumulate significant profits over time.

While crypto arbitrage offers the potential for substantial returns, it’s not easy to execute manually and requires specialized knowledge, making it unsuitable for most casual traders. Furthermore, increasing competition from sophisticated bots makes profitable arbitrage increasingly challenging.