GDP, or Gross Domestic Product, is a cornerstone of economic analysis, providing a snapshot of a nation’s economic health and performance. It represents the total monetary value of all finished goods and services produced within a country’s borders during a specific period, typically a year or a quarter. Understanding GDP is crucial for investors, policymakers, and anyone interested in grasping the dynamics of a country’s economy. This comprehensive guide delves into the intricacies of GDP, exploring its various facets, calculation methods, and influencing factors.

GDP is short for Gross Domestic Product.

GDP is short for Gross Domestic Product.

Why is GDP Important?

GDP provides valuable insights into several key aspects of an economy:

- Economic Growth Rate: GDP tracks the pace of economic expansion or contraction, revealing whether an economy is thriving or experiencing a downturn.

- Business Cycles: Changes in GDP help identify the different phases of a business cycle, including periods of growth, peak, recession, and recovery.

- National Development Potential: GDP serves as an indicator of a country’s economic potential and its capacity for future growth.

- Fluctuations in Value: It reflects changes in the overall value of goods and services produced, signaling shifts in market dynamics and consumer behavior.

GDP vs. GNP: Key Differences

While both GDP and GNP (Gross National Product) measure a nation’s economic output, they differ in scope. GDP focuses on production within a country’s borders, regardless of who owns the factors of production. GNP, on the other hand, measures the output of a country’s citizens and businesses, regardless of where they are located.

Here’s an example illustrating the difference:

A South Korean investor establishes a garment factory in Vietnam to cater to the domestic market. In this scenario:

- Vietnam’s GDP: Includes the revenue generated from selling the garments produced within Vietnam.

- South Korea’s GNP: Includes the profits earned by the South Korean-owned factory in Vietnam after deducting taxes, welfare funds, and salaries of South Korean employees working at the factory.

Types of GDP: Nominal, Real, and Per Capita

There are three primary types of GDP:

GDP Per Capita

GDP per capita measures the average economic output per person within a country. It’s calculated by dividing the total GDP by the country’s population. While it provides insights into average income and living standards, it’s important to remember that a high GDP per capita doesn’t necessarily equate to a high standard of living for everyone, as it’s an average figure.

Nominal GDP

Nominal GDP is calculated using current market prices. This means that the value of goods produced in a specific period is calculated using the prices prevalent during that period. Nominal GDP reflects changes in both output and price levels, making it susceptible to inflationary distortions.

Real GDP

Real GDP adjusts for inflation, providing a more accurate measure of economic growth over time. By using a base year’s prices, real GDP isolates changes in output from changes in prices, offering a clearer picture of actual economic performance. Real GDP is generally preferred over nominal GDP for analyzing long-term economic trends.

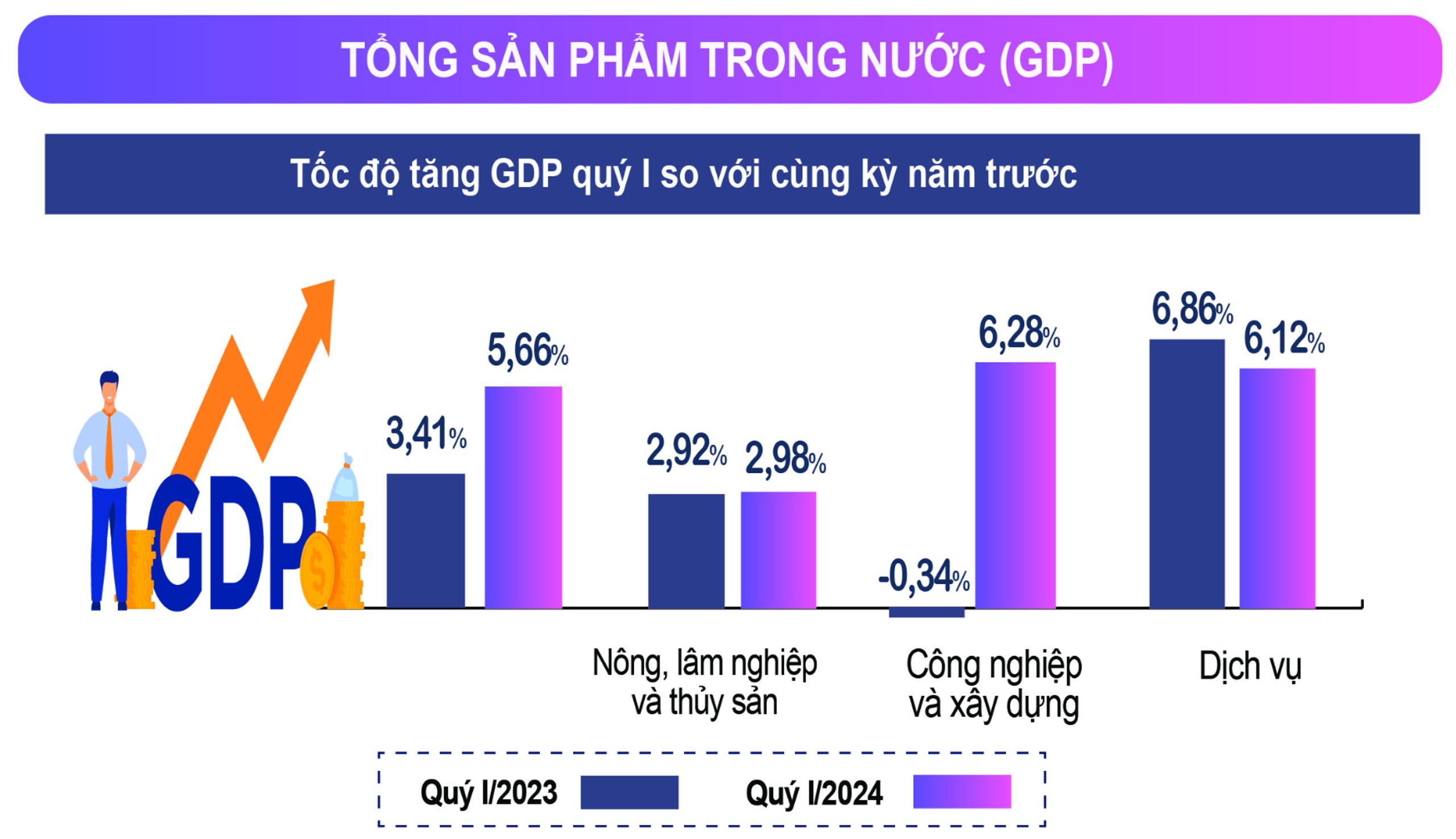

tổng gdp việt nam quý 1 2024Vietnam’s GDP growth rate in the first quarter compared to the same period last year. Source: General Statistics Office of Vietnam

tổng gdp việt nam quý 1 2024Vietnam’s GDP growth rate in the first quarter compared to the same period last year. Source: General Statistics Office of Vietnam

Calculating GDP: Three Approaches

There are three main methods for calculating GDP, each offering a different perspective on how economic output is generated:

The Expenditure Approach

This approach calculates GDP by summing up the total spending on goods and services within an economy. The formula is:

GDP = C + I + G + NX

- C: Consumption – Household spending on goods and services.

- I: Investment – Business spending on capital goods like machinery and equipment.

- G: Government Spending – Government expenditure on public services and infrastructure.

- NX: Net Exports – The difference between the value of exports and imports (Exports – Imports).

The Production (Value-Added) Approach

This method calculates GDP by adding up the value added at each stage of production. The formula is:

GDP = Value Added + Import Taxes

Alternatively:

GDP = Total Output – Intermediate Consumption + Import Taxes

- Total Output: The value of all goods and services produced in the economy.

- Intermediate Consumption: The cost of materials and services used in production, excluding fixed assets.

The Income Approach

This approach calculates GDP by summing up all the incomes earned in the production process, including wages, rent, interest, profits, indirect taxes, and depreciation. The formula is:

GDP = W + R + I + Pr + Ti + De

- W: Wages – Compensation to employees.

- R: Rent – Income from property ownership.

- I: Interest – Earnings from lending capital.

- Pr: Profits – Earnings of businesses after taxes.

- Ti: Indirect Taxes – Taxes on goods and services.

- De: Depreciation – The decrease in the value of fixed assets over time.

Ideally, the three approaches should yield similar GDP figures, as they measure the same economic activity from different angles.

Factors Influencing GDP

Several key factors can significantly influence a country’s GDP:

- Population: Population size affects both the supply of labor and the demand for goods and services. Changes in population dynamics can influence production capacity and consumption patterns.

- Foreign Direct Investment (FDI): FDI brings in capital, technology, and expertise, boosting economic growth and increasing production, employment, and incomes, ultimately contributing to higher GDP.

- Inflation: Sustained increases in the general price level erode purchasing power, create uncertainty, and discourage investment, potentially hindering economic growth and impacting GDP negatively. Governments implement policies to manage inflation and maintain economic stability.

Understanding GDP for Informed Decision-Making

GDP is a crucial indicator for understanding a nation’s economic performance. By analyzing GDP data, investors can make informed decisions about investment strategies, assess potential risks and opportunities, and gain a deeper understanding of market trends. Policymakers use GDP to evaluate the effectiveness of economic policies and formulate strategies for sustainable economic development. For individuals, understanding GDP provides valuable context for interpreting economic news and understanding the broader economic landscape.

Conclusion: GDP as a Tool for Economic Analysis

GDP, while not a perfect measure, provides a valuable framework for assessing a country’s economic health and performance. By understanding its various components, calculation methods, and influencing factors, we can gain valuable insights into the complex dynamics of national economies. This knowledge empowers us to make informed decisions, whether as investors, policymakers, or simply as engaged citizens seeking to understand the world around us.

FAQ: Frequently Asked Questions about GDP

Here are some common questions about GDP:

Q: Does a high GDP guarantee a high standard of living?

A: Not necessarily. While GDP per capita provides an indication of average income, it doesn’t reflect income distribution or other factors contributing to well-being, such as access to healthcare and education.

Q: What are the limitations of GDP as an economic indicator?

A: GDP doesn’t capture non-market activities, such as household production and volunteer work. It also doesn’t account for environmental costs or the distribution of income.

Q: How often is GDP data released?

A: GDP data is typically released quarterly and annually by national statistical agencies.

Q: What is the difference between real and nominal GDP growth rates?

A: Real GDP growth adjusts for inflation, providing a more accurate measure of economic growth. Nominal GDP growth includes the effects of both output and price changes.

We encourage you to share this article and contribute to the discussion by leaving your questions and comments below. Your engagement helps us build a more informed community.