Ethereum, a cornerstone of the decentralized web, is undergoing a strategic shift towards a rollup-centric approach. Instead of processing all transactions directly on the mainnet, Ethereum is focusing on solidifying its core strengths – security and decentralization – while empowering Layer 2 solutions (L2s) to handle scalability. This move leverages Ethereum’s robust network effect, particularly among developers, and capitalizes on its significant market share. Currently, ETH represents nearly 15% of the total crypto market capitalization, and excluding Bitcoin, this figure surpasses 46%. Given this advantageous position and a clear developmental roadmap, Ethereum’s L2s are poised to attract significant investment and become a focal point within the crypto market. This article delves into the current state and future trends of the Ethereum L2 ecosystem, analyzing key metrics and highlighting emerging opportunities.

The Current Landscape of Ethereum and its Layer 2 Solutions

This section assesses the activity and value capture within the Ethereum network and its L2s using two primary categories of indicators: network and ecosystem metrics.

Network Metrics:

- Daily Active Addresses

- Daily Transactions

- Fee Generation

Ecosystem Metrics:

- Stablecoin Market Cap

- Total Value Locked (TVL)

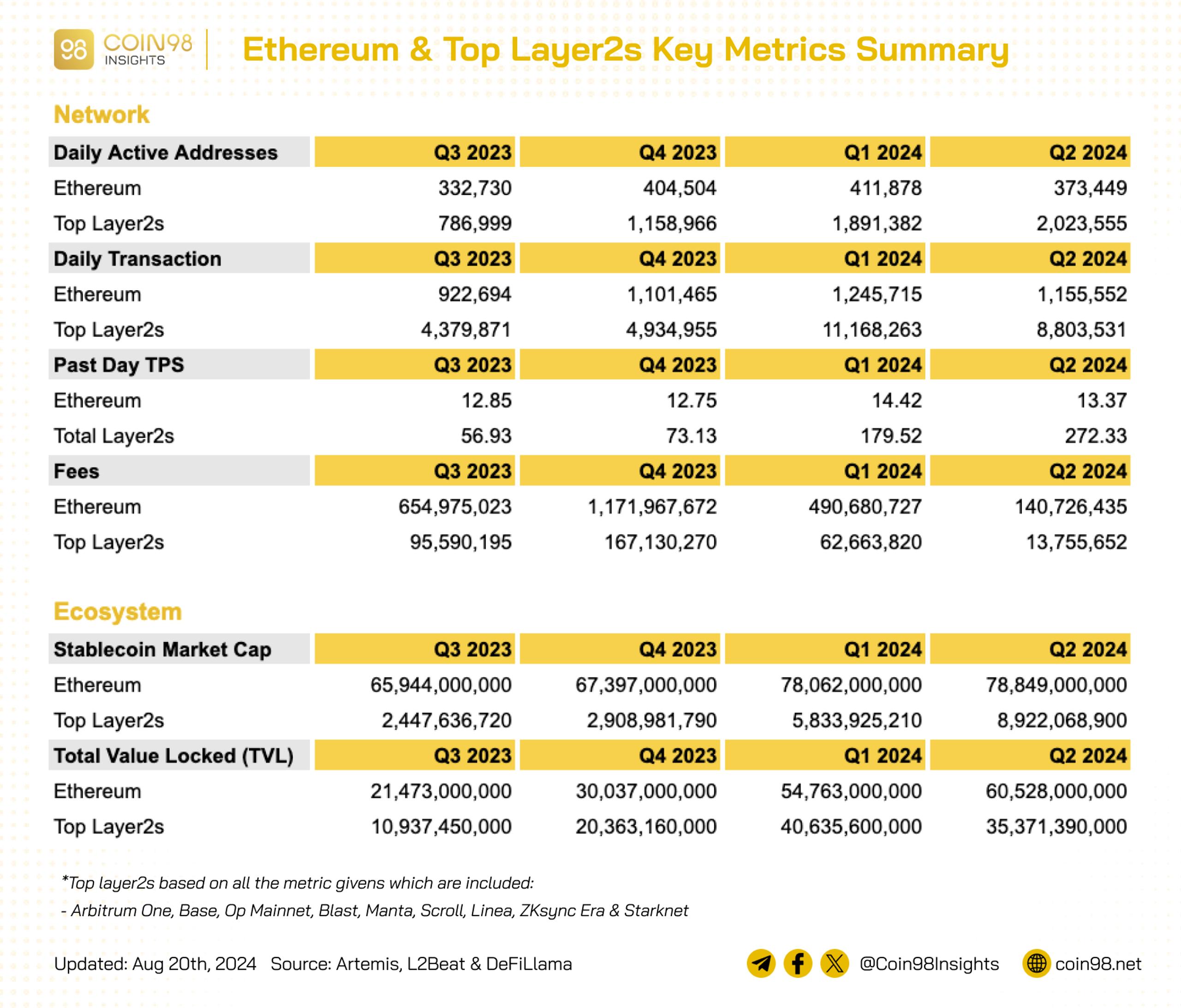

According to L2Beat, as of late August 2024, there are 72 active L2s and 81 upcoming L2 projects. While the sheer number of projects is impressive, performance across the aforementioned metrics varies significantly. For a focused analysis, this article will examine nine representative L2 projects: Arbitrum One, Base, Optimism Mainnet, Blast, Manta, Scroll, Linea, zkSync Era, and Starknet.

Bảng tổng hợp Etherem và layer 2

Bảng tổng hợp Etherem và layer 2

Network Analysis

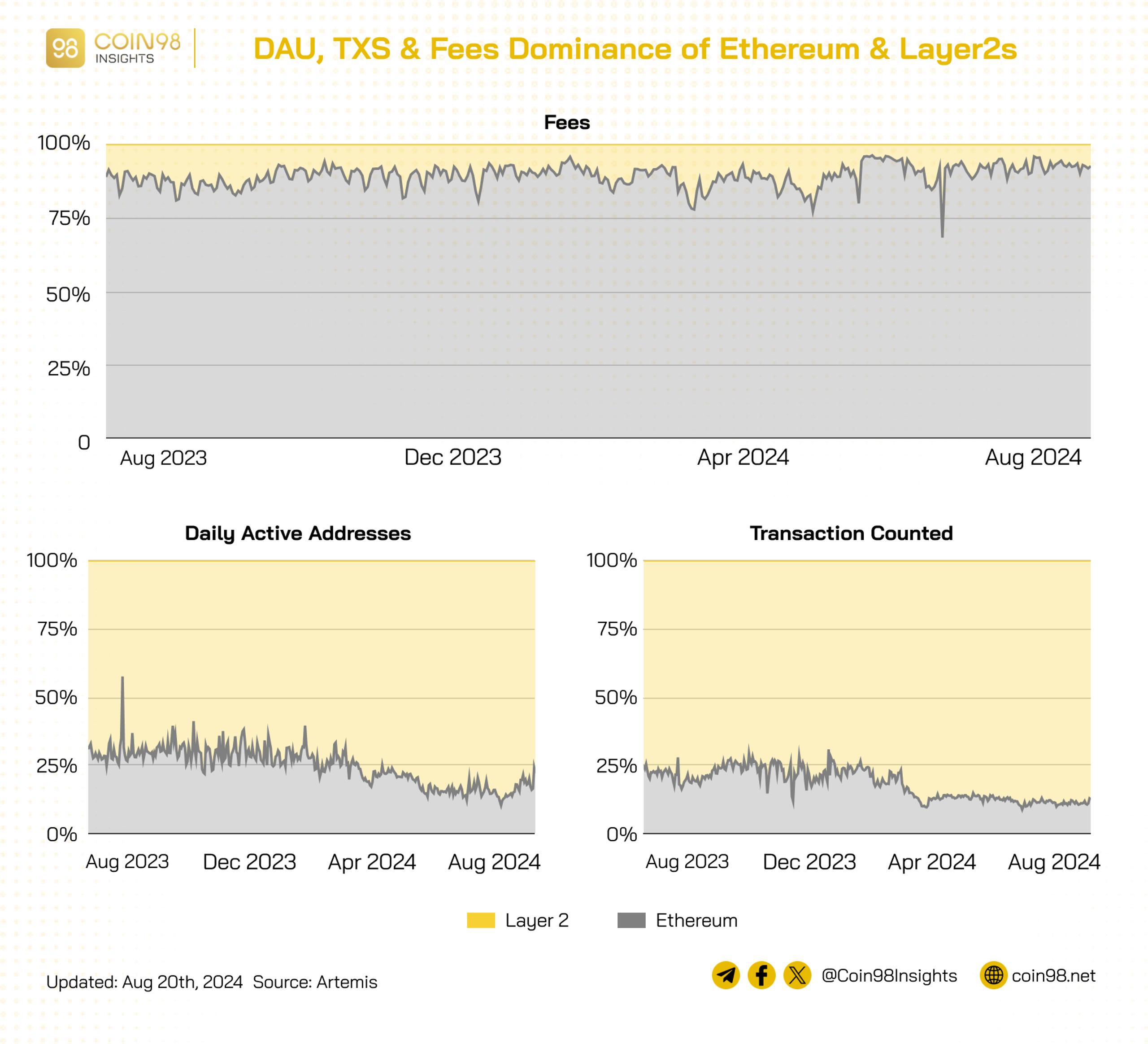

Daily Active Addresses and Transactions:

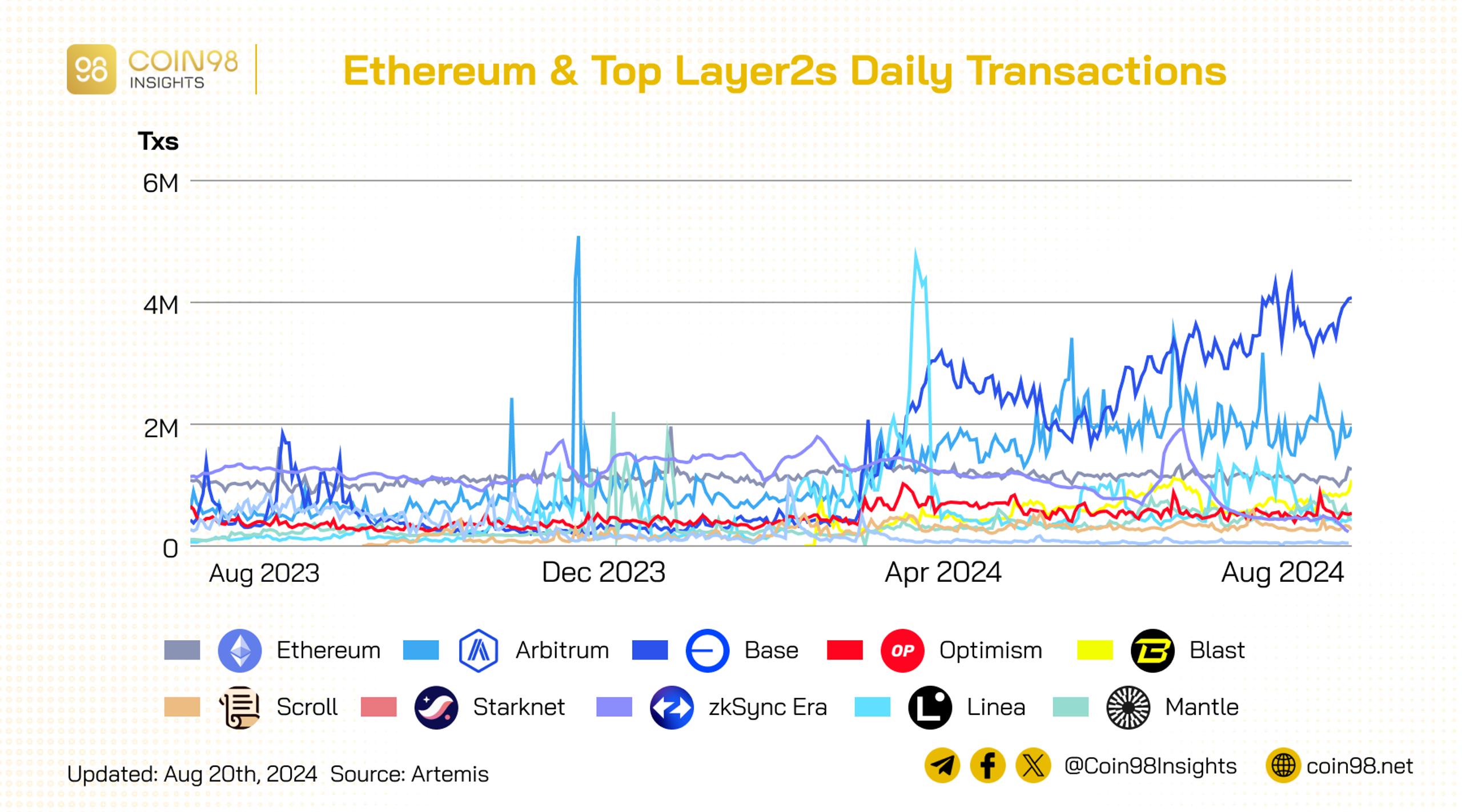

Ethereum’s daily active addresses remain stable between 300,000 and 400,000. Remarkably, Base, Arbitrum One, and Linea have surpassed Ethereum in daily active addresses.

Ethereum currently processes approximately 1 million transactions daily. While transaction volumes on L2s fluctuate, most have shown improvement in recent months. Base exhibits particularly strong growth, processing over 3 million transactions daily with a continued upward trend. Arbitrum One maintains a steady 2 million daily transactions. Other top L2s currently handle several hundred thousand transactions per day.

Beyond Base and Arbitrum One, several L2s experience short bursts of high transaction volume, often driven by campaigns, airdrops, or transient trends. zkSync, for example, sees significant spikes exceeding 1.5 million daily transactions whenever token-related announcements are made.

This increased activity on L2s demonstrates a clear demand for these scaling solutions, relieving congestion on the Ethereum mainnet and offering users lower fees and faster transaction speeds.

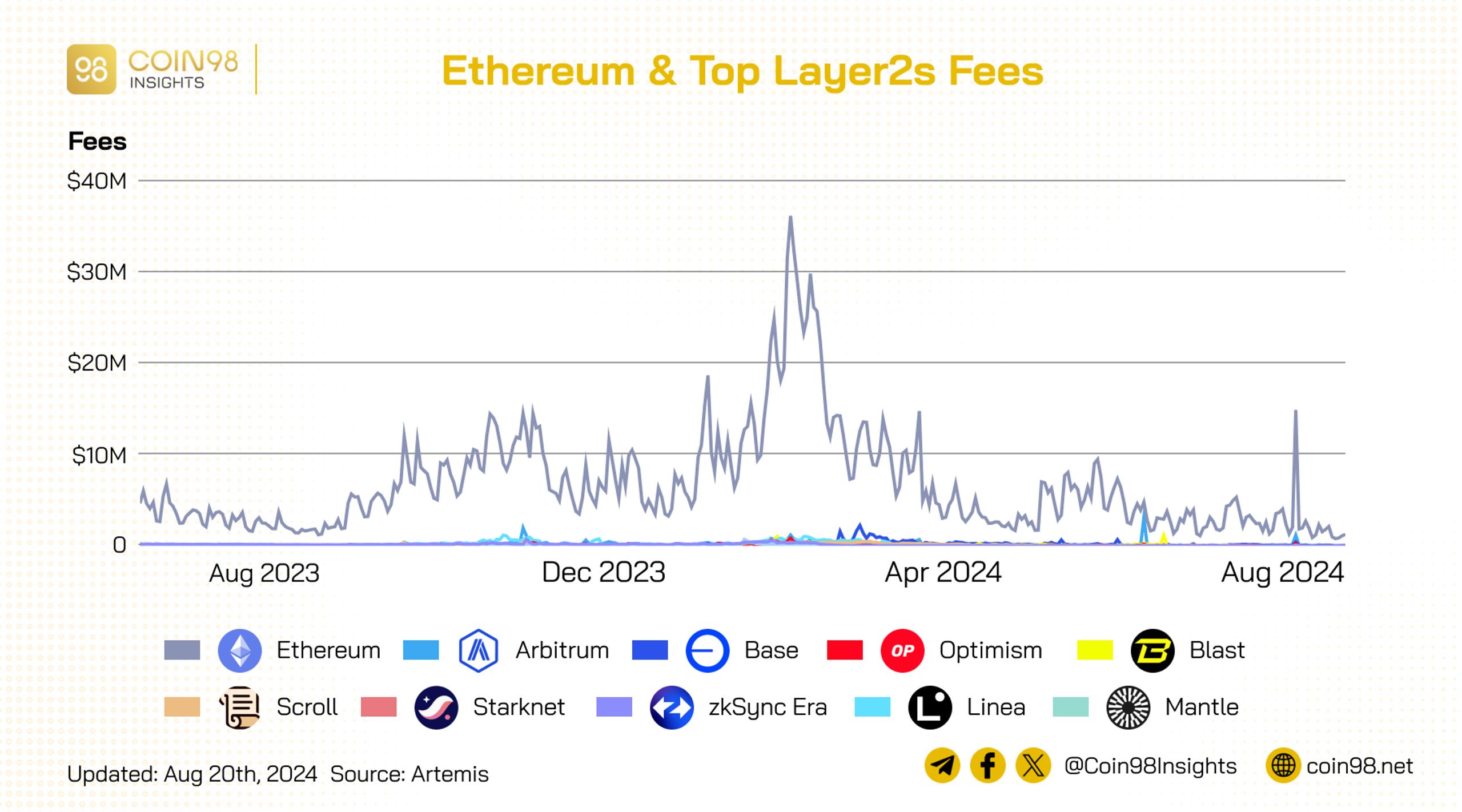

Fee Generation:

Despite the higher transaction volumes on some L2s, the fees generated are significantly lower than on Ethereum. This is inherent in the L2 design, prioritizing low-cost transactions, and fees continue to decline over time.

The growing dominance of L2s in daily active addresses and transactions, coupled with their significantly lower fees, highlights the value proposition of these scaling solutions. This trend contributes to a less congested Ethereum mainnet while meeting user demands for affordability and speed.

So sánh thị phần số lượng địa chỉ ví hoạt động và giao dịch xử lý của Ethereum và các top layer 2

So sánh thị phần số lượng địa chỉ ví hoạt động và giao dịch xử lý của Ethereum và các top layer 2

Ecosystem Analysis

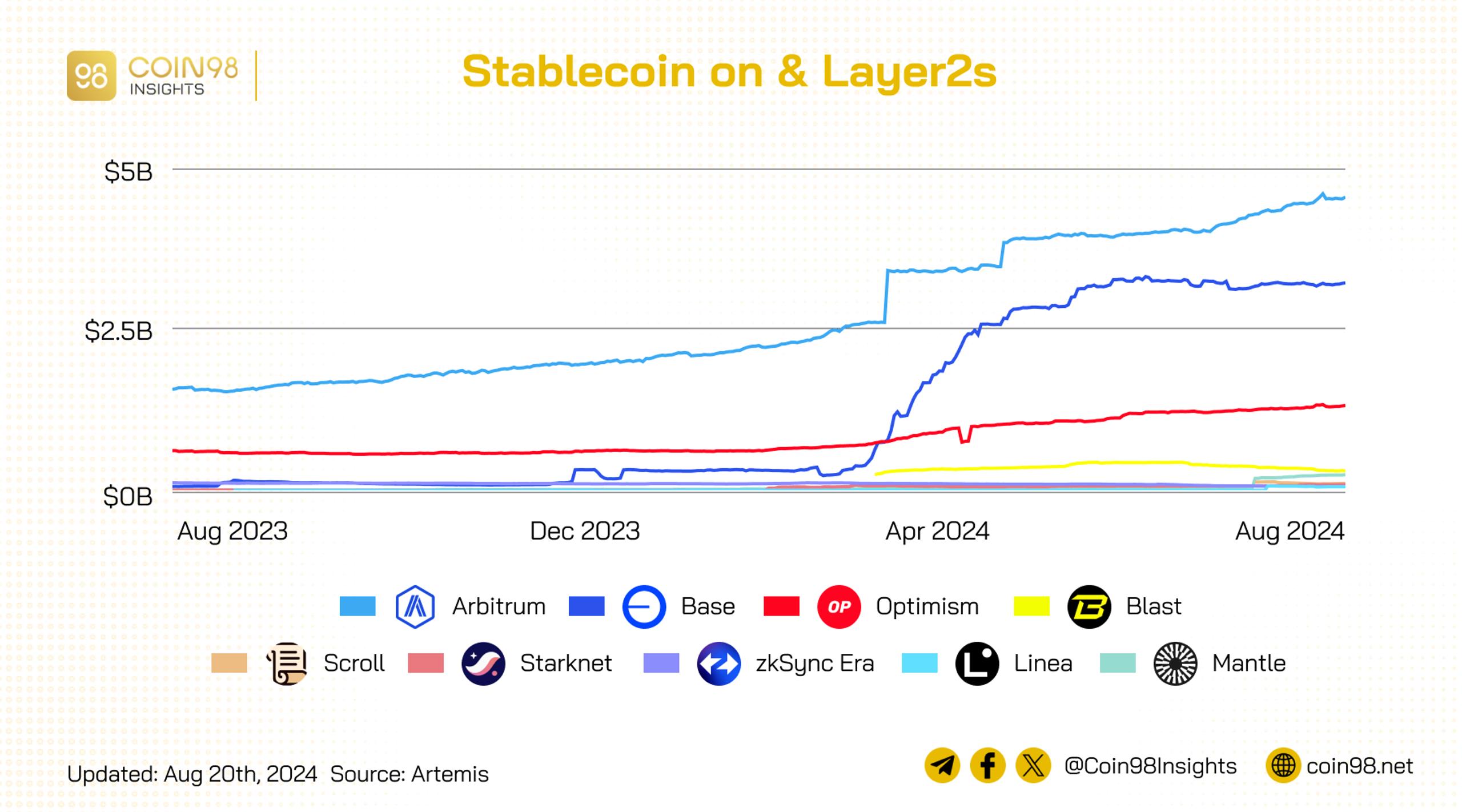

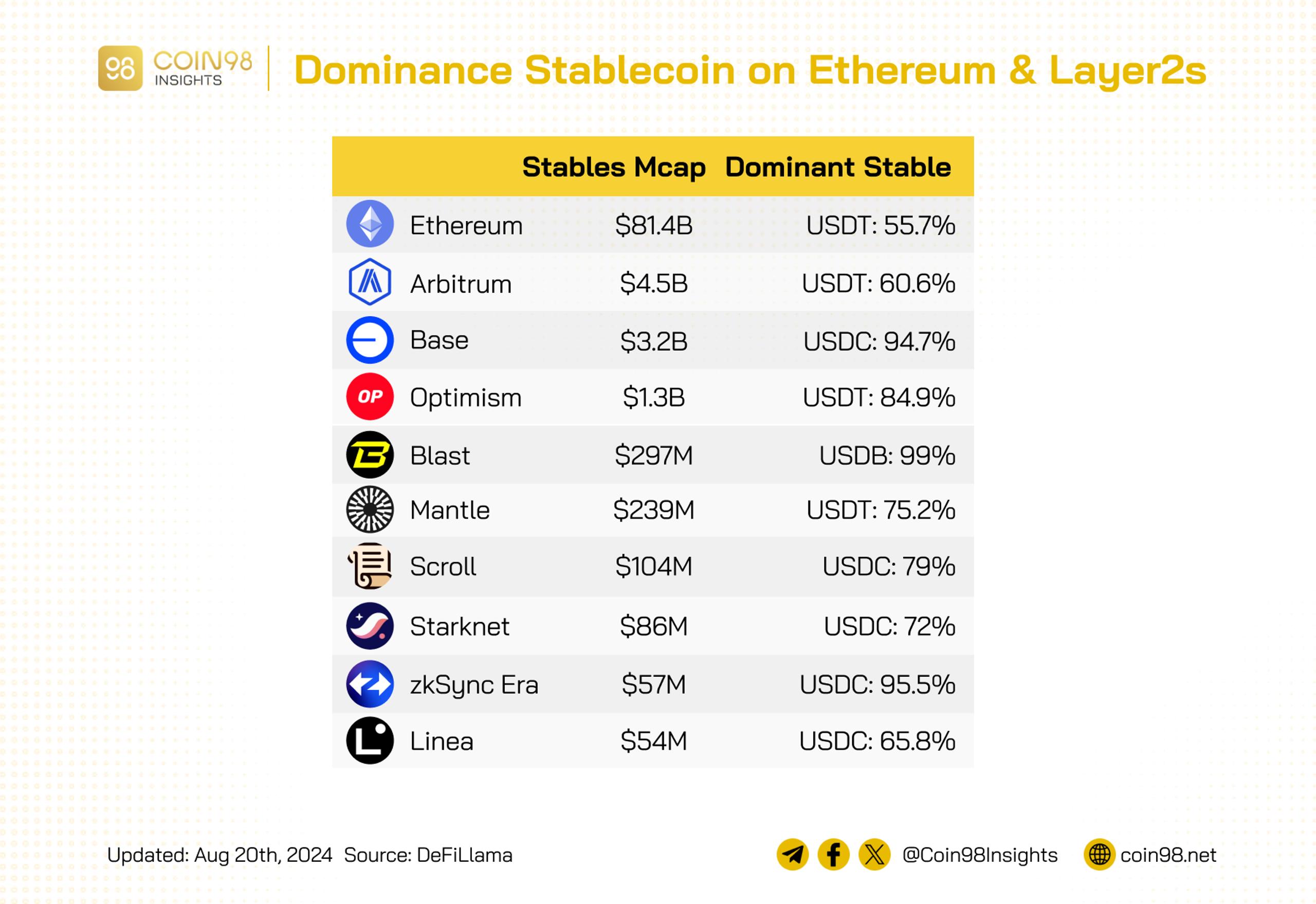

Stablecoin Market Capitalization:

Stablecoin market capitalization on both Ethereum and its L2s has steadily increased despite market conditions. According to DeFiLlama, over the past year, stablecoin market cap on Ethereum grew from $66.4 billion to $81.4 billion, while on leading L2s, it rose from $2.3 billion to $9.9 billion. Arbitrum, Base, and Optimism stand out, each exceeding $1 billion in stablecoin market cap. Arbitrum and Optimism maintain a growth trajectory, while Base has stabilized after a period of rapid expansion.

USDT and USDC compete for market share across L2s. While USDT dominates larger ecosystems, USDC holds a stronger presence on many smaller L2s.

Stablecoin có tỷ trọng cao nhất trên Ethereum và các layer 2

Stablecoin có tỷ trọng cao nhất trên Ethereum và các layer 2

Total Value Locked (TVL):

The TVL of L2s generally follows a similar trend to Ethereum. Currently, the combined TVL of L2s stands at $35.7 billion, with Arbitrum One, Base, and Optimism Mainnet leading the pack.

Base’s rapid growth, driven by support from Coinbase, is noteworthy. Within a year of launch, it achieved leading positions in daily active addresses, transactions, stablecoin market cap, and TVL. Its open approach, embracing new product models like Farcaster and catering to the Ethereum community seeking cheaper and faster transactions, has been a key factor in its success. While Arbitrum One and Optimism focus on project support and SDK development, Base’s strategy of fostering a vibrant ecosystem, even with a significant presence of meme coins, has proven remarkably effective.

Future Trends for Ethereum and its Layer 2 Solutions

The Interplay Between Ethereum and L2s

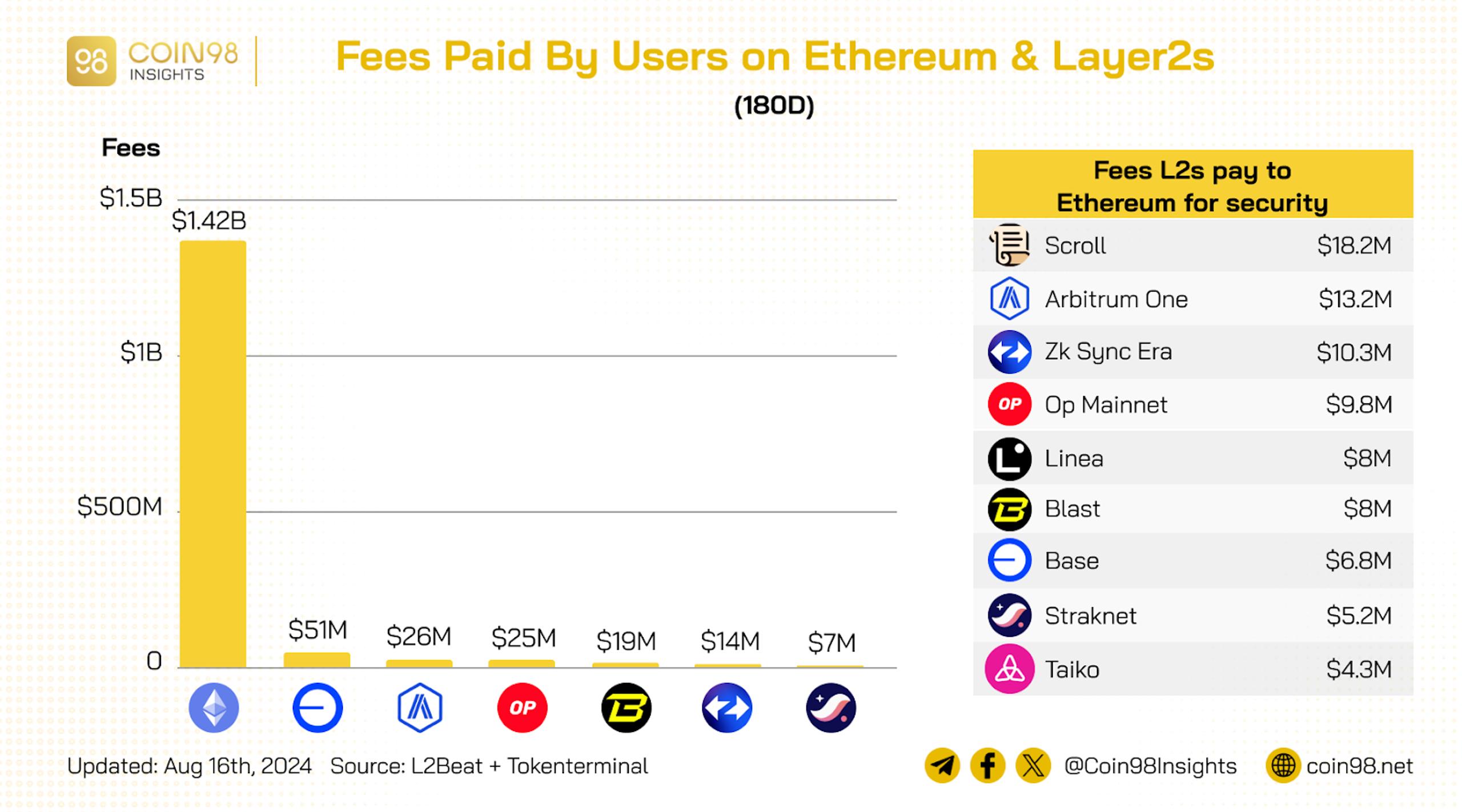

L2s inherit Ethereum’s security by posting transaction data to the mainnet, for which they pay fees. This symbiotic relationship means the growth of L2s directly benefits Ethereum. While the revenue generated for Ethereum through L2 activity is currently modest, it is expected to increase significantly as the number and quality of L2s improve.

phí tạo ra từ ethereum và các layer 2

phí tạo ra từ ethereum và các layer 2

The use of ETH as the primary asset for gas fees and DeFi participation further strengthens its presence across various ecosystems. Some argue that Ethereum’s revenue could decrease as more users transact on L2s, particularly those utilizing their own tokens for gas. However, the trend towards minimizing or eliminating transaction fees, mirroring traditional markets, is inevitable. Ethereum’s strong network effect positions it for continued growth as it addresses scalability. L2s that stray too far from Ethereum risk losing access to its vast user base. The lower fees on L2s can drive user adoption and enable innovative revenue models to compensate for reduced transaction costs.

The emergence of numerous new L2s has helped maintain a high overall Transactions Per Second (TPS). This steady TPS growth indicates increasing activity on L2s. Alongside Optimistic Rollups, which currently attract the majority of value, ZK Rollups, despite their greater technical complexity, are gaining traction. Specialized L2s targeting specific use cases like AI, gaming, and DeFi are also emerging, catering to diverse user needs.

The Challenges Facing Layer 2 Solutions

While L2 development is crucial for Ethereum’s scaling strategy, building a successful L2 is challenging. Many new L2s lack differentiation, and value is likely to consolidate around a few key players with strong network effects and unique offerings. Examples include Arbitrum, Optimism, and Base, with their strong communities and stable capital flow, and Starknet, pioneering ZK solutions and fostering innovative models like fully on-chain gaming.

Short-Term Volatility and Long-Term Correlation

In the long term, Ethereum and its L2s will likely exhibit correlated performance, with L2 growth driving mainnet growth and vice-versa. However, short-term fluctuations favoring either side are possible. While L2s are central to Ethereum’s roadmap, other narratives like restaking, meme coins, and Ethereum ETFs can influence Ethereum’s value. Similarly, L2s can experience short-term trends, as seen with Optimism and Arbitrum’s successful airdrop campaigns, Base’s embrace of meme coin trends, and the rise of SocialFi.

Conclusion

Layer 2 solutions are integral to Ethereum’s future. Their growth is poised to propel the entire ecosystem forward. However, building a successful L2 remains a significant challenge. While long-term correlation between Ethereum and its L2s is expected, short-term volatility remains a factor. The ability to adapt and innovate will be key for L2s to thrive in this dynamic landscape.

FAQs

- What is the primary benefit of using Layer 2 solutions on Ethereum? L2s enhance scalability, allowing for faster and cheaper transactions while leveraging the security of the Ethereum mainnet.

- Are all Layer 2 solutions the same? No, L2s utilize different technologies, such as Optimistic Rollups and ZK Rollups, and cater to different needs.

- How do Layer 2 fees compare to Ethereum mainnet fees? L2 fees are significantly lower than Ethereum mainnet fees.

- What is the future of Layer 2 solutions? L2s are expected to play a crucial role in Ethereum’s continued growth, with further innovation and specialization anticipated.

- How can I learn more about specific Layer 2 projects? Research individual projects, explore their communities, and analyze their performance metrics. Engage with the community and ask questions. We encourage you to share your thoughts and queries in the comments below.