📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Equity value, often referred to as market capitalization, represents the total value of a company available to equity investors. It’s a crucial metric for understanding a company’s worth in the public market and plays a vital role in various financial analyses, from investment decisions to mergers and acquisitions. This guide provides a comprehensive overview of equity value, its calculation, and its significance in the financial world.

Calculating Equity Value

The most straightforward way to calculate equity value is by multiplying a company’s current share price by the number of its outstanding shares. This reflects the market’s collective assessment of the company’s future earnings potential.

Alternatively, equity value can be derived from enterprise value (EV). Enterprise value represents the total value of a company, encompassing claims from all stakeholders, including debt holders, preferred shareholders, and equity investors. To arrive at equity value from EV, deduct debt and debt equivalents, non-controlling interest, and preferred stock, then add cash and cash equivalents. This adjustment isolates the portion of value attributable solely to equity holders.

Equity Value vs. Book Value

It’s important to distinguish between equity value and book value. While equity value reflects market perception, book value represents the net asset value of a company as reported on its balance sheet. It’s calculated by subtracting total liabilities from total assets. For thriving companies, equity value typically surpasses book value, as market valuations incorporate growth expectations and intangible assets not fully captured on the balance sheet.

Basic vs. Diluted Equity Value

Basic equity value uses the current number of outstanding shares in its calculation. However, diluted equity value considers the potential impact of dilutive securities, such as stock options, warrants, and convertible debt, which could increase the number of shares outstanding in the future. Diluted equity value provides a more conservative estimate of a company’s value, particularly in the context of acquisitions.

Equity Value vs. Enterprise Value

Understanding the distinction between equity value and enterprise value is crucial for financial analysis. While equity value focuses solely on the value available to equity investors, enterprise value considers the company’s total value, encompassing all forms of financing. The relationship between the two is defined by the company’s capital structure.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Using Equity Value in Valuation

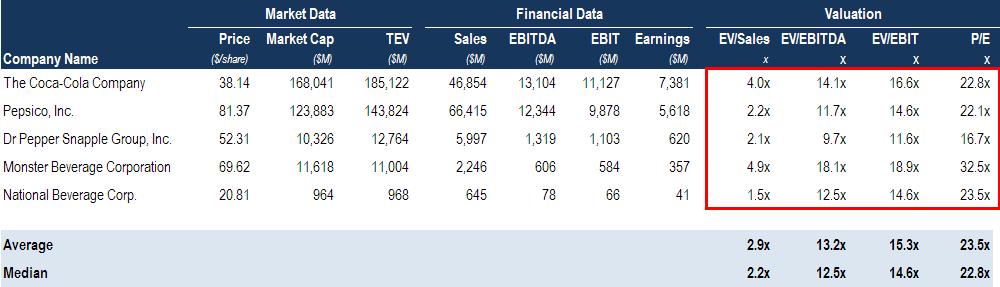

Both equity value and enterprise value are used in company valuations. The choice depends on the specific valuation metric being applied. For instance, price-to-earnings (P/E) ratio uses equity value, while EV/EBITDA uses enterprise value.

Equity Value vs Enterprise Value Table

Equity Value vs Enterprise Value Table

Discount Rates and Equity Value

In discounted cash flow (DCF) analysis, the discount rate applied depends on whether we’re valuing equity or the enterprise. For equity valuation, levered free cash flow (FCF) – the cash flow available to equity holders – is discounted using the cost of equity. For enterprise valuation, unlevered FCF – the cash flow available to all stakeholders – is discounted using the weighted average cost of capital (WACC).

Equity Value in Specific Industries

While enterprise value is widely used, certain industries, particularly financial institutions like banks and insurance companies, rely more heavily on equity value and related metrics like P/E and price-to-book (P/B) ratios. This is because the nature of their operations and capital structure makes separating operating and financing activities more complex. Valuation in these sectors often involves dividend discount models or future share price projections based on comparable company analysis.

Conclusion

Equity value is a fundamental metric for understanding a company’s worth and performance. By grasping its nuances, including its relationship to enterprise value, book value, and its role in various valuation methodologies, investors and analysts can make more informed decisions in the financial markets.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download