📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Have you ever wondered how businesses determine the threshold of profitability? The answer lies in break-even analysis, a vital tool that helps managers and business owners gauge how many units must be sold to cover all costs. At Unilever.edu.vn, we delve deep into this concept to illuminate its significance and application across various industries.

What is Break-Even Analysis?

Break-even analysis is a financial assessment that determines the point at which a company’s total revenues equal its total costs. In simpler terms, it identifies how much product needs to be sold to cover both fixed and variable costs, ultimately leading to neither profit nor loss.

Key Highlights:

- Break-even Point: The point where total costs meet total revenue.

- Significance: Essential for business planning, it helps in setting sales targets.

Break-Even Analysis Formula

Understanding the formula behind break-even analysis can seem daunting at first, but it’s quite straightforward. The primary formula is:

[ text{Break-Even Quantity} = frac{text{Fixed Costs}}{(text{Sales Price per Unit} – text{Variable Cost per Unit})} ]Components of the Formula:

- Fixed Costs: Costs that remain constant regardless of production level. This includes salaries, rent, and other operational expenses.

- Sales Price per Unit: The price at which your product is sold.

- Variable Cost per Unit: Costs that fluctuate with production level, such as materials and direct labor.

So, if a business sells a product for $100 with variable costs of $5, the contribution margin becomes $95, a crucial figure for covering those fixed costs.

A Practical Example of Break-Even Analysis

Consider Company A, a manufacturer of premium water bottles. The managerial accountant, Colin, identifies the following:

- Fixed Costs: $100,000 (including property taxes and salaries)

- Variable Cost per Bottle: $2

- Selling Price: $12

To find out how many bottles need to be sold to break even, we can apply the formula:

[ text{Break Even Quantity} = frac{100,000}{(12 – 2)} = 10,000 text{ bottles} ]This means Company A must sell 10,000 bottles to cover all its costs.

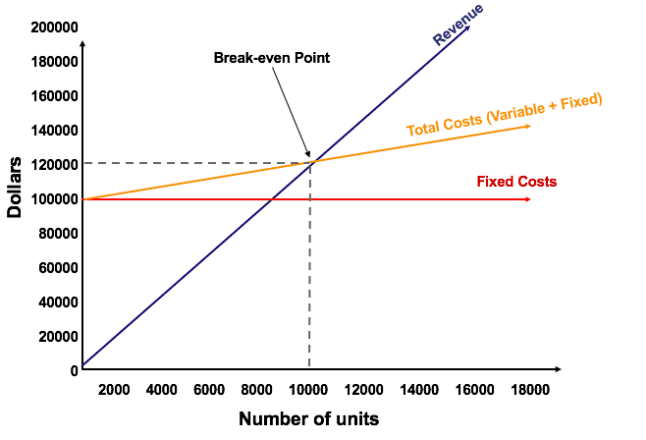

Visual Representation: The Break-Even Chart

The graph above clearly illustrates three critical lines:

- Total Fixed Costs: This horizontal line shows the fixed costs ($100,000).

- Revenue Line: This line rises with each bottle sold, demonstrating revenue growth.

- Total Costs Line: This line gradually rises, reflecting both fixed and variable costs.

The break-even point, located where the revenue and costs intersect, is crucial in assessing business performance. If sales exceed 10,000 bottles, Company A enters the profit zone; below that, it experiences losses.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Interpretation of Break-Even Analysis

When businesses reach the break-even point, they make neither a profit nor a loss. It’s a critical marker, often referred to as a “no-profit” or “no-loss” point. Understanding this enables leaders to strategize effectively:

- Profit Zone: Revenue > Total Costs

- Break-Even Point: Revenue = Total Costs

- Loss Zone: Revenue < Total Costs

Sensitivity Analysis and Its Importance

Break-even analysis frequently merges with sensitivity analysis, enhancing financial modeling. Analysts use tools like Goal Seek in Excel to backtrack the ideal price, cost, and unit sales required to achieve break-even efficiency.

Factors Influencing Break-Even Point

Several factors can alter a company’s break-even point, including:

- Increase in Customer Sales: Rising demand necessitates more production, thus raising costs.

- Variable Cost Surge: Prices for materials or operational expenses can shift the break-even threshold upward.

- Equipment Malfunction: Production halts could increase the fixed costs, subsequently raising the break-even point.

Strategies to Lower the Break-Even Point

Reducing the break-even point is essential for fostering profitability. Here are several approaches:

- Raise Product Prices: Though it carries risks of losing customers, this strategy can significantly boost the contribution margin.

- Outsource Production: Outsourcing can lower manufacturing costs, especially when production quality is maintained.

Understanding these tactics is vital. Businesses must meticulously evaluate their pricing strategies and operational costs to meet profit expectations effectively.

Conclusion

Break-even analysis is an invaluable asset for any business, providing critical insights into sales targets and cost management. By mastering this concept, businesses can not only maintain profitability but also strategize effectively in their respective markets.

If you’re interested in exploring more about financial analysis and management, feel free to check out additional resources on our website. Understanding your break-even point could be the key to unlocking your business’s financial potential.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download