Ethena is a liquid staking derivative (LSD) protocol built on the Ethereum network, designed to enhance user returns through the issuance of a synthetic dollar stablecoin called USDe. Users can mint USDe by collateralizing liquid staking tokens (LSTs) such as tETH and rETH. This allows them to earn fixed returns through Internet Bonds or participate in various DeFi activities. Ethena’s USDe employs a delta-hedging strategy, differentiating it from other synthetic assets that rely on collateralized debt positions (CDPs). This approach aims to mitigate liquidation risks for holders during periods of high market volatility.

Ethena Homepage

Ethena Homepage

Ethena’s Core Product: USDe and its 2025 Potential

The cornerstone of Ethena’s ecosystem is USDe, an ERC-20 synthetic dollar stablecoin collateralized by LSTs on Ethereum. Its delta-hedging mechanism ensures stability and generates income for holders.

Stability Mechanisms

Delta-Hedging: USDe maintains its peg through a non-leveraged short position utilizing delta-hedging, in contrast to over-collateralization methods. When users mint USDe, the deposited LSTs are immediately shorted on exchanges, striving for a neutral price position. This aims to maintain a stable value for USDe regardless of market fluctuations.

Controlled Mint/Redeem Process: Ethena Labs controls the minting and redeeming of USDe, requiring users to complete KYC verification. This process aims to manage the USDe supply effectively, contributing to price stability and potentially playing a crucial role in its projected performance in 2025.

Yield Generation Opportunities

Internet Bonds: Ethena offers Internet Bonds as a unique savings mechanism for USDe holders. By combining LST staking rewards and funding rates from derivatives markets, these bonds aim to provide a fixed-income opportunity with a target yield of around 10%. This fixed-income approach provides a predictable return stream, offering stability in the often volatile DeFi landscape. Its potential impact on the 2025 DeFi market is a topic of much discussion.

sUSDe Staking: Users can stake their minted USDe to earn sUSDe, unlocking even higher yield potential, currently advertised at up to 24%. This staking mechanism incentivizes holding USDe and further contributes to the overall stability of the ecosystem. The potential for high yields could attract significant investment in 2025 and beyond.

Estimated Returns from holding USDe through Internet Bonds

Estimated Returns from holding USDe through Internet Bonds

Ethena’s Current Performance and Future in 2025

Since its mainnet launch on February 19, 2024, Ethena has seen rapid growth. The market capitalization of USDe has reportedly surpassed $400 million, with yields exceeding 20% and over 26,000 users participating. This rapid growth raises questions about its long-term sustainability and the potential challenges it might face in the evolving landscape of 2025.

While the delta-hedging mechanism offers a degree of safety, Ethena acknowledges potential risks to USDe’s peg, including funding risks, exchange-related risks, liquidation risks, and collateral risks. These risks are detailed in reports available on their platform, emphasizing the importance of due diligence for potential investors. The project’s transparency in addressing these risks is crucial, especially as the market anticipates its trajectory in 2025.

Ethena Airdrop Strategy: A Path to Community Engagement

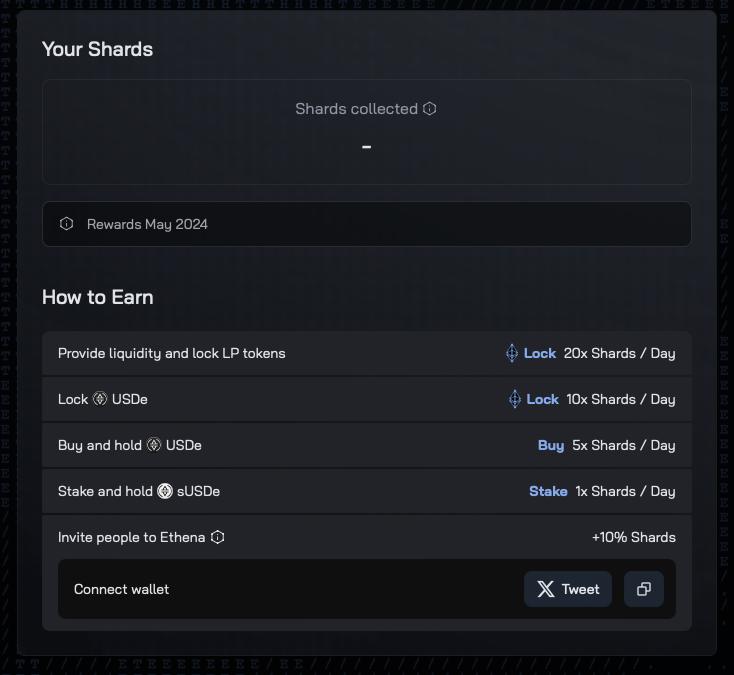

Currently, only whitelisted market makers can mint USDe by depositing LSTs. However, retail investors can still earn Shards, which may contribute to a future airdrop. Shards are earned by purchasing USDe with supported stablecoins (USDT, USDC, DAI, FRAX, crvUSD, mkUSD), staking USDe for sUSDe, providing liquidity to supported pools, and referring new users. Users can earn a 10% bonus on Shards earned by their referrals. This strategy aims to build a strong community and incentivize early adoption, crucial factors for any project looking to make a significant impact in 2025.

tieu chí tính điểm shards ethenaEthena provides multiple ways for users to earn Shards

tieu chí tính điểm shards ethenaEthena provides multiple ways for users to earn Shards

Acquiring and Utilizing USDe on the Ethena Platform

Ethena provides a user-friendly interface for interacting with its platform. Here’s a breakdown of the key processes:

Buying USDe

- Connect your wallet (MetaMask, Coin98 Super Wallet, Ledger, etc.) to the Ethena app.

Ethena supports popular and reliable wallets

Ethena supports popular and reliable wallets

- Accept Ethena’s terms and conditions.

Users should review all service information and project policies

Users should review all service information and project policies

Navigate to the “Buy” section.

Select the asset you wish to sell, enter the amount, and confirm the purchase. The final amount of USDe received will reflect slippage (0.1%) and gas fees.

Ethena allows users to purchase USDe through six assets: USDC, DAI, USDT, GHO, crvUSD, and mkUSD

Ethena allows users to purchase USDe through six assets: USDC, DAI, USDT, GHO, crvUSD, and mkUSD

Staking USDe for sUSDe

Go to the “Stake” section.

Enter the amount of USDe you want to stake and confirm. The amount of sUSDe received will be adjusted for gas fees. Note that there is a 7-day unstaking period before you can claim your USDe back.

The yield for holding sUSDe is approximately 24%

The yield for holding sUSDe is approximately 24%

Providing Liquidity

Navigate to the “Liquidity” section.

Select the asset pair you wish to provide liquidity for (e.g., USDe/sDAI, USDe/USDC).

Enter the desired amounts and confirm.

Users choose asset pairs to provide liquidity and earn Shards

Users choose asset pairs to provide liquidity and earn Shards

Referring Friends

Go to the “Shards” section.

Copy your referral link and share it on social media. You’ll earn 10% of the Shards earned by your referrals.

Ethena Token (ENA): Tokenomics and Launch Details

ENA Token Key Metrics

- Token Name: Ethena

- Ticker: ENA

- Blockchain: Ethereum

ENA Token Sale

The ENA token was listed on Binance Launchpool, allowing users to stake BNB and FDUSD to earn ENA. The token launch further broadened Ethena’s reach and provided an early opportunity for community participation.

Ethena Team and Investors

Project Team

Ethena boasts a team with extensive experience in the tech and crypto space, including Arthur Hayes (Founding Advisor), Leptokurtic (Founder & CEO), and Wintermute (Heads of Engineering). This experienced team brings a wealth of knowledge and expertise to the project.

đội ngũ dự án ethenaEthena’s development team includes prominent figures in the market

đội ngũ dự án ethenaEthena’s development team includes prominent figures in the market

Investors

Ethena has secured funding from prominent investors like Dragonfly Capital, Arthur Hayes, Binance Labs, OKX Ventures, Bybit, and Deribit, totaling $20.5 million across several rounds. This substantial backing demonstrates strong investor confidence in the project’s potential.

Ethena’s three funding rounds

Ethena’s three funding rounds

Similar Projects to Ethena

Other projects exploring similar concepts in the LSD space include Lybra and ZeroLiquid, both of which offer unique approaches to utilizing LSTs for yield generation and lending.

FAQs: Addressing Common Questions about Ethena

Q: What is the long-term vision for Ethena in the evolving DeFi landscape?

A: Ethena aims to become a leading LSD protocol, offering innovative solutions for yield generation and stablecoin utilization. The project’s focus on delta-hedging and community engagement positions it for potential growth in the coming years.

Q: How does Ethena plan to address the potential risks associated with its delta-hedging strategy?

A: Ethena acknowledges the inherent risks and provides detailed reports outlining potential scenarios and mitigation strategies. The project’s transparency and proactive approach to risk management are crucial for maintaining user trust.

Q: What are the future plans for Shard holders, and will there be an ENA token airdrop?

A: While Ethena has not confirmed a specific airdrop plan, the Shard system suggests a potential future reward system for early participants. The project’s community-focused approach hints at the possibility of further incentives for Shard holders.

We encourage our readers to submit their questions and share their insights on Ethena and its potential impact on the future of DeFi. The evolving nature of the crypto space requires continuous learning and community engagement, and we value your contributions to this ongoing discussion.