📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Market manipulation is the deliberate act of influencing asset prices to create an unfair advantage, often resulting in losses for other investors. In the cryptocurrency market, this practice is particularly prevalent due to its decentralized nature and relative lack of robust oversight. Manipulation can take many forms and can have serious consequences for market transparency and fairness. It’s considered illegal and is prohibited by securities and financial market regulations worldwide.

Common Forms of Market Manipulation

Cryptocurrency markets, with their inherent volatility and relative anonymity, are particularly susceptible to manipulation. Let’s explore some common tactics employed by manipulators:

Pump and Dump Schemes

This classic scheme involves artificially inflating an asset’s price through misleading or false information, often spread via social media or online forums. This hype attracts unsuspecting investors, driving up demand and price. Once the price reaches a peak, the manipulators sell their holdings at a profit, leaving other investors with significant losses as the price plummets.

Spoofing

Spoofing is the practice of placing large buy or sell orders with no intention of executing them. These “phantom orders” create a false impression of supply or demand, influencing other traders’ decisions. Once the market reacts, the manipulator cancels their orders and trades in the opposite direction, profiting from the artificial price movement they created.

Wash Trading

Wash trading involves simultaneously buying and selling the same asset to create the illusion of high trading volume. This tactic gives the impression of increased interest and liquidity, attracting more investors. However, the actual trading volume is artificially inflated, misleading investors about the asset’s true market activity.

Market Manipulation – Wash Trading

Market Manipulation – Wash Trading

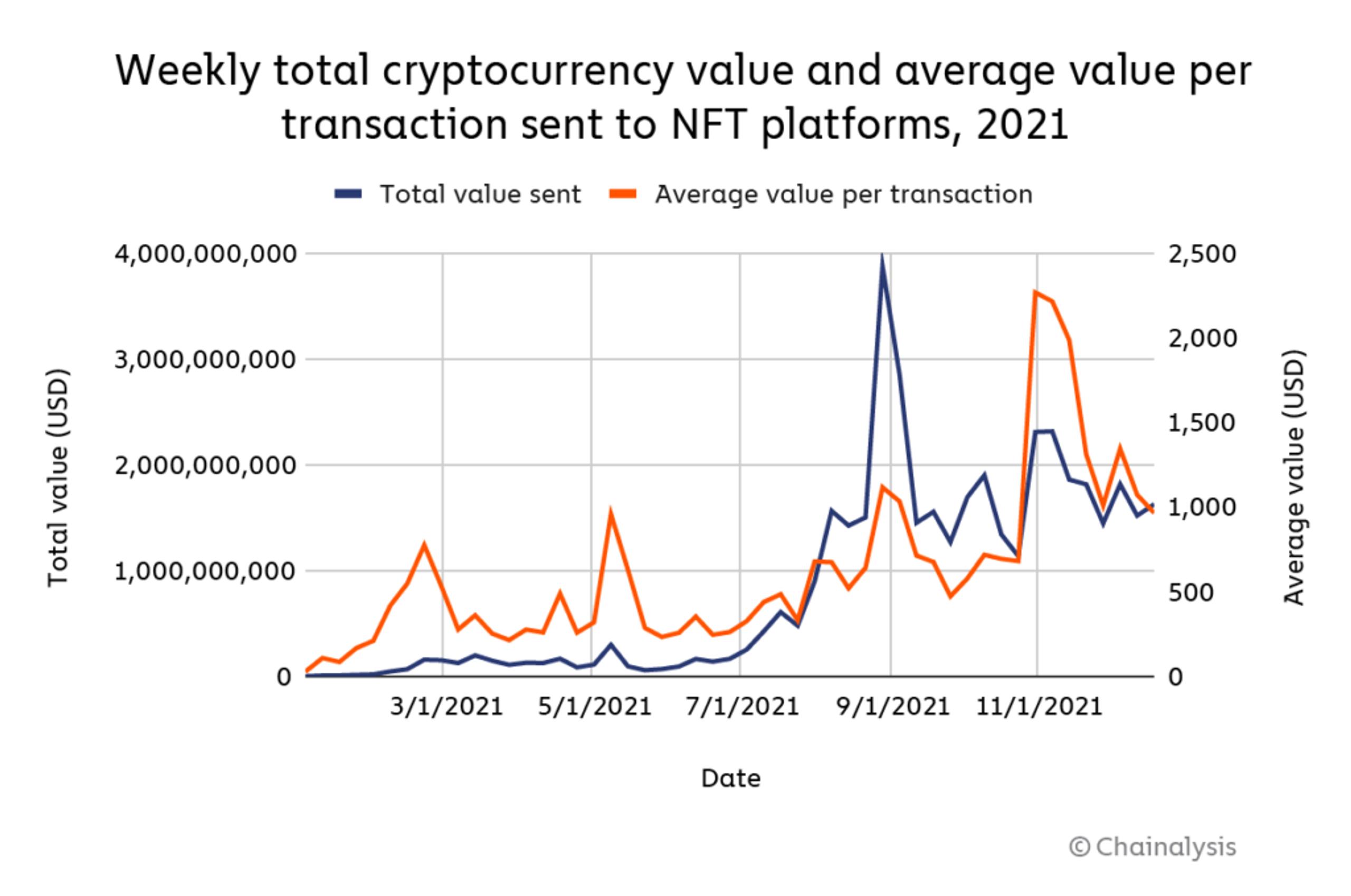

According to Chainalysis, the NFT market, despite its large trading volume, is particularly susceptible to wash trading, making it an ideal environment for manipulation.

Front Running

Front running occurs when a trader with advance knowledge of a large impending order executes their own trade before that order, profiting from the anticipated price change. This unethical practice gives the front-runner an unfair advantage over other market participants. In decentralized exchanges (DEXs), automated bots are often used for front running, exploiting the transparent nature of blockchain transactions.

The Devastating Consequences of Market Manipulation

The impact of market manipulation extends far beyond individual losses. It erodes trust in the entire market, creating a ripple effect of negative consequences:

Loss of Investor Confidence

Manipulation undermines the foundation of a fair and transparent market. As investors lose faith in the integrity of the market, they may withdraw their investments, leading to decreased liquidity and hindering market growth.

Artificial Price Volatility

Manipulation can trigger dramatic and unpredictable price swings, distorting the natural price discovery process. This volatility makes it difficult for investors to make informed decisions and increases the risk of significant losses.

Financial Harm to Investors

Unsuspecting investors who fall victim to manipulative schemes can suffer substantial financial losses. These losses can have devastating consequences, particularly for those who have invested a significant portion of their savings.

Notable Cases of Crypto Market Manipulation

The cryptocurrency market has witnessed several high-profile manipulation incidents that have shaken investor confidence and highlighted the need for greater regulatory oversight.

Bitfinex and Tether Manipulation (2017)

In 2017, Bitcoin’s price soared from under $1,000 to nearly $20,000. Part of this surge was attributed to alleged market manipulation involving the Bitfinex exchange and the stablecoin Tether (USDT). The U.S. Department of Justice (DOJ) investigated whether Bitfinex used Tether to purchase Bitcoin during price dips, artificially inflating the price. This incident underscored the potential for stablecoins to be used for manipulative purposes.

Wash Trading on OKEx and Huobi (2018)

In 2018, the Blockchain Transparency Institute reported evidence of widespread wash trading on major exchanges like OKEx and Huobi. The report claimed that a significant portion of the reported trading volume on these platforms was fabricated, misleading investors about the true level of market activity. This incident highlighted the challenges of accurately measuring trading volume in cryptocurrency markets.

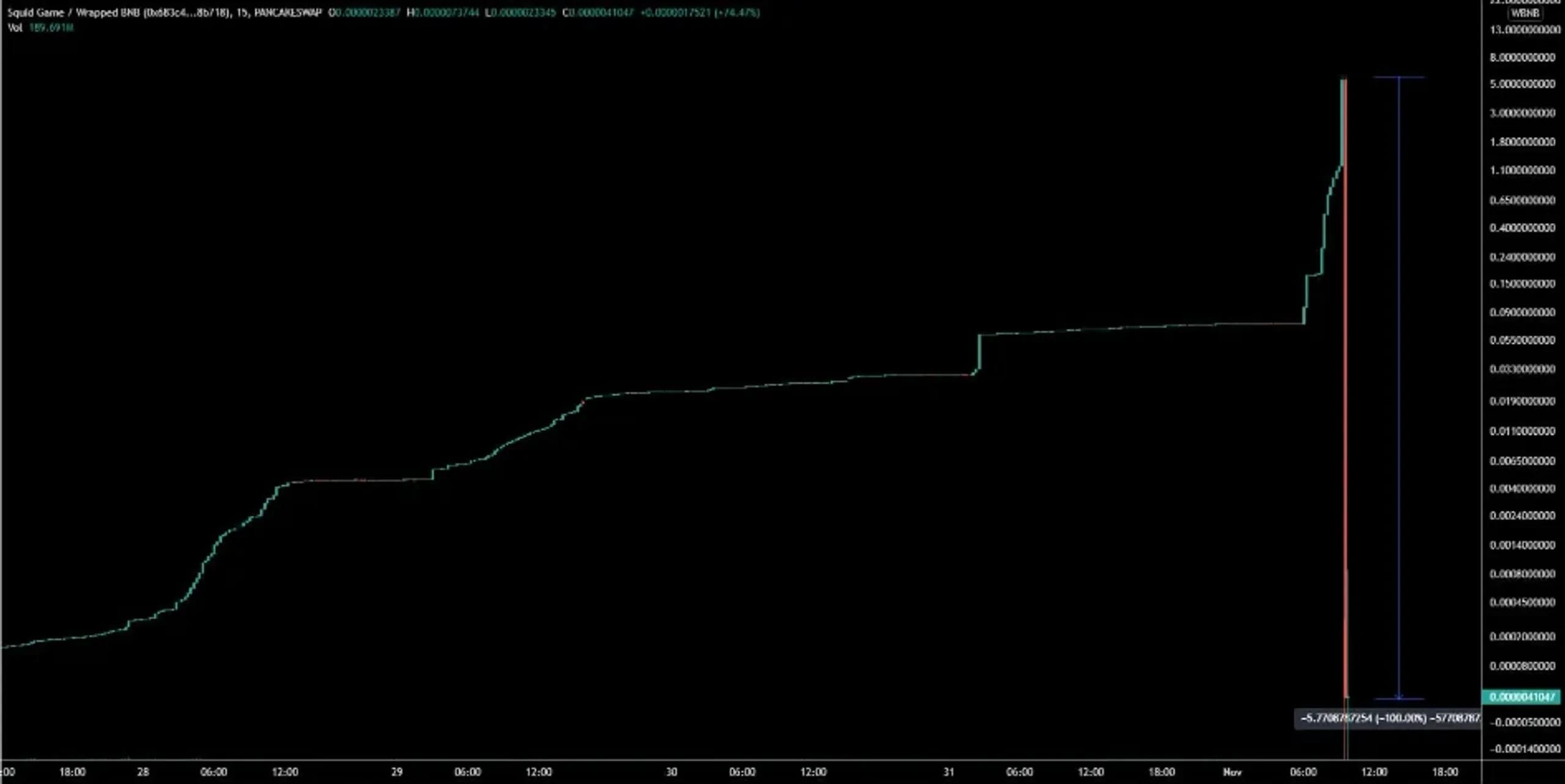

The “Squid Game” Coin Pump and Dump (2021)

The “Squid Game” token, riding the popularity of the Netflix series, experienced a meteoric rise and subsequent crash, epitomizing a pump-and-dump scheme. The token’s price surged from a few cents to nearly $3,000 before plummeting to near zero within minutes. This incident served as a stark reminder of the risks associated with investing in meme coins and the potential for rapid price manipulation.

Squid Game token's dramatic price drop

Squid Game token's dramatic price drop

Front Running on Decentralized Exchanges (DeFi)

Automated bots have been identified exploiting the transparent nature of decentralized exchanges (DEXs) to engage in front running. Research from Cornell University and the University of Michigan has quantified the significant financial gains these bots have achieved at the expense of other users. These findings highlight the ongoing challenge of mitigating front running in the DeFi space.

Conclusion: Navigating the Risks and Protecting Yourself

Market manipulation poses a serious threat to the integrity and stability of the cryptocurrency market. While regulatory efforts are underway, investors must remain vigilant and take proactive steps to protect themselves.

Thorough research, a healthy dose of skepticism, and a deep understanding of market dynamics are crucial for navigating the complexities of the crypto world. By staying informed and exercising caution, investors can mitigate the risks associated with manipulation and contribute to a healthier, more transparent market.

FAQs: Common Questions About Market Manipulation

Q: How can I identify a pump-and-dump scheme?

- A: Be wary of sudden, dramatic price increases accompanied by exaggerated claims and hype, particularly for less-established cryptocurrencies.

Q: Are all forms of market manipulation illegal?

- A: Yes, various forms of market manipulation are prohibited by securities and financial market regulations globally.

Q: What can I do if I suspect market manipulation?

- A: Report your concerns to the relevant regulatory authorities and the cryptocurrency exchange involved.

We encourage our readers to share their own experiences and questions regarding market manipulation in the comments below. Your insights and contributions can help build a stronger and more informed community.