📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

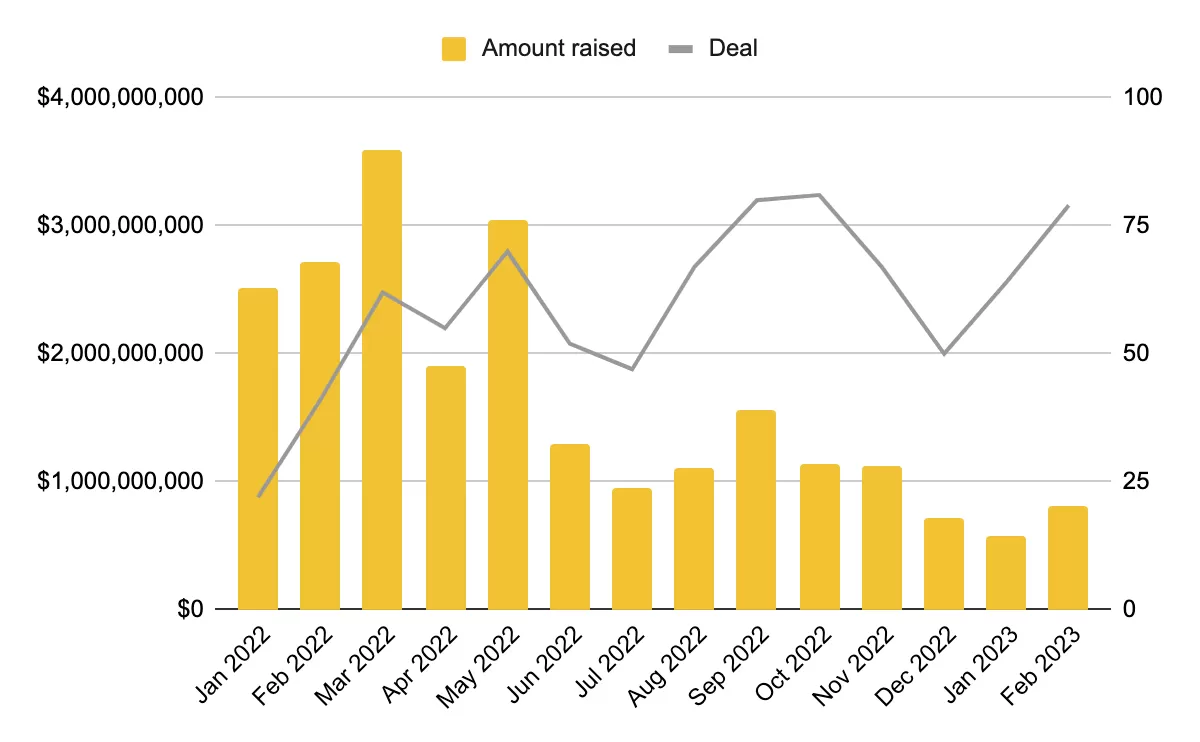

As we dive into the dynamics of the fundraising landscape in early 2023, it’s clear that the market has experienced some fluctuations. According to DefiLlama, the investment capital raised in the first two months of 2023 has seen a decline compared to the same period in 2022. While there was a ~42% increase in funds raised in February compared to January, this uptick does not necessarily indicate a sustainable return of investment activity. On a broader scale, the average amount raised in 2023 is still a staggering 69.1% lower than the average raised in 2022— a time when projects frequently secured substantial funding with numerous crowdfund events.

This decline has been attributed to a significant downward trend that began mid-2022, ignited by the tumultuous events surrounding Terra. There was a time when projects could effortlessly secure millions in funding; today, this is not the case.

A Mixed Outlook: Interest Continues but Capital Flow Slows

Despite the reduction in capital inflow, the number of projects has begun to see a resurgence. This indicates a continued interest in the cryptocurrency space from investors, supported by a more rational pricing model— investment valuations have stabilized, shedding the excessive speculative fervor observed in early 2022.

Interestingly, while the number of projects chasing funding is on the rise, we observe that the enthusiasm among investors may be gradually rekindling. In the previous peak period, hundreds of millions were the norm, but as we look closer, the current climate suggests a more cautious, yet hopeful, engagement.

Sector Trends: What’s Capturing Investor Interest?

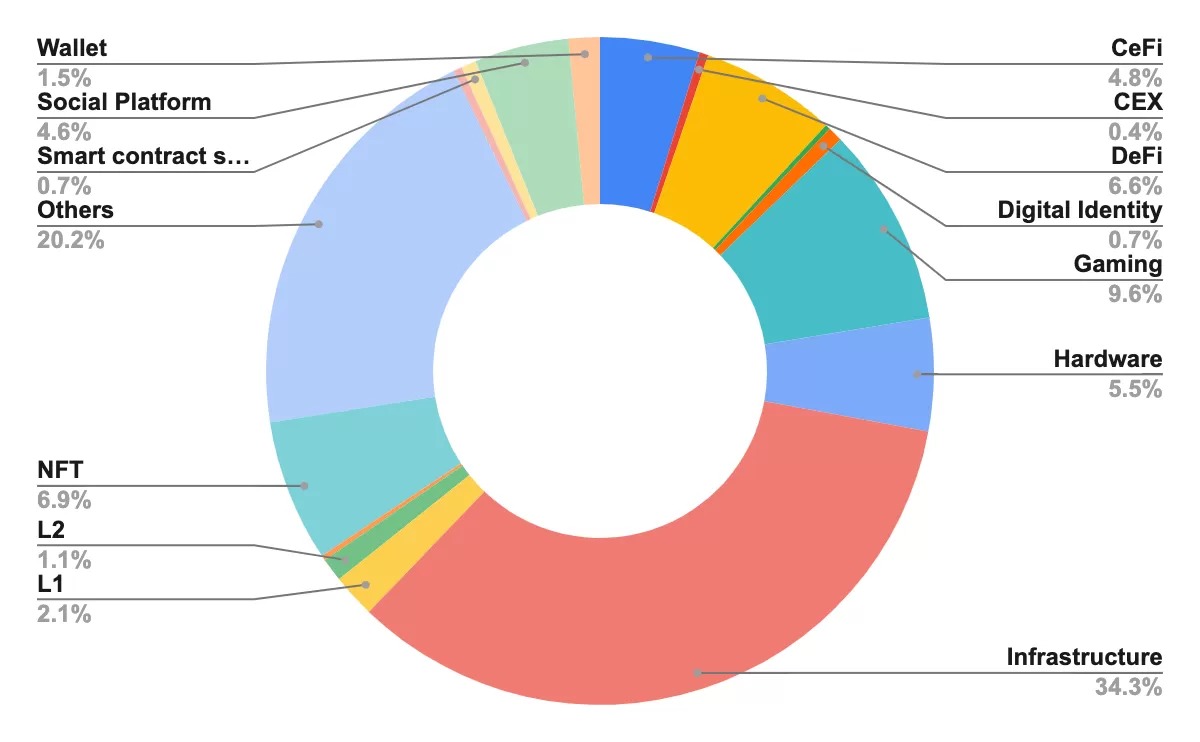

When examining the breakdown of investment across various sectors in the cryptocurrency space, it becomes palpable that the infrastructure sector dominates the landscape. Infrastructure projects, which include Layer 1 and Layer 2 protocols, accounted for an impressive 37.5% of total capital raised in the first two months of 2023. Notably, QuickNode led the pack by securing $800 million—making it the project with the highest valuation during this early stage of 2023.

In this current downturn, infrastructures are drawing investor interest, pointing to a shift in capital flows that favor foundational developments over speculative investments. However, history tells us that tokens in these layers have not always yielded high returns.

Meanwhile, decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming collectively represented approximately 23.1% of the total fundraising amounts. Yet, these sectors, while present, have not been the most prominent performers in terms of capital raised, showing contributions of 6.6%, 6.9% and 9.6% respectively. Despite their lower funding averages, when analyzing the total number of projects, these segments account for about 40% of the active projects within the ecosystem.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

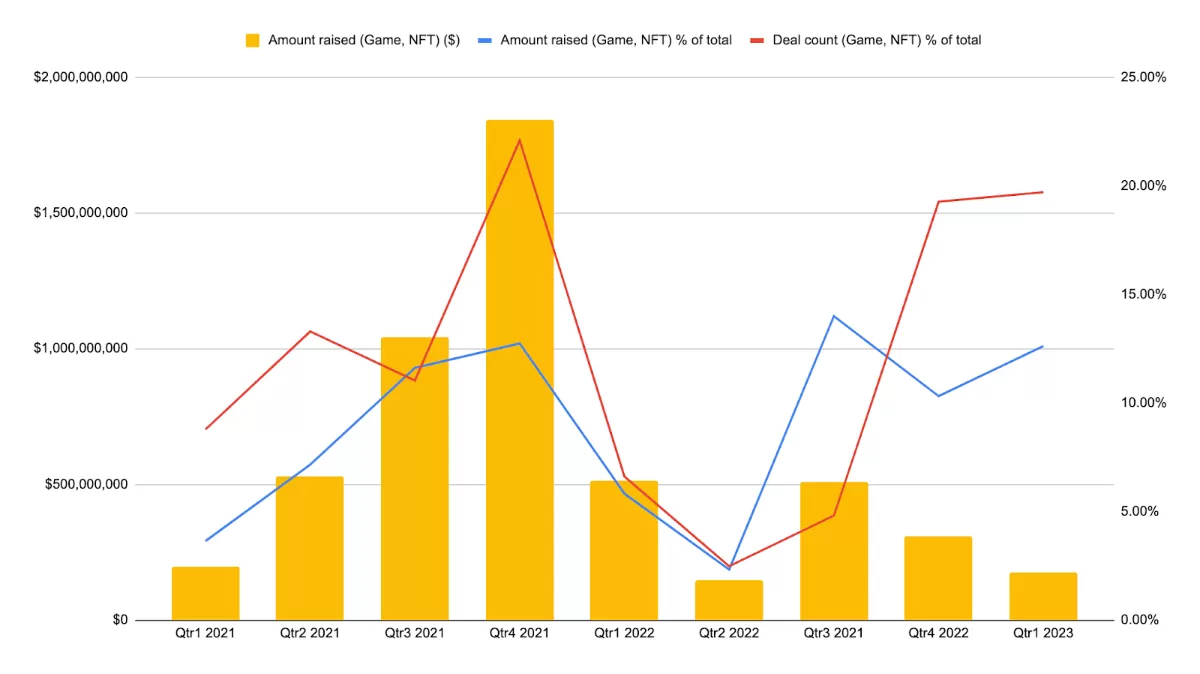

Insights on Gaming and NFTs: Stability Amid Volatility

Despite the plunge in funding for gaming and NFT projects—dropping sharply from a peak of $1.8 billion in Q4 2021 to a mere $200 million in Q1 2023— the interest in these sectors appears resilient. It is important to note that while project funding numbers have shrunk, the sector’s funding proportion is maintaining stability. There lies a significant opportunity in identifying promising projects that can endure and thrive in this challenging environment.

Key Players in the Investment Arena

Several distinguished investment funds have continued their commitments in this tumultuous period. Entities like Binance Labs, a16z, Paradigm, and Multicoin Capital have been active in funding projects during the early months of 2023.

On February 21, CoinDesk reported that Binance Labs disbursed funds to Polyhedra Network, a project focusing on zero-knowledge proof technology, raising $10M. This development highlights a growing trend in infrastructure projects that are receiving attention from established investment firms.

Furthermore, Paradigm, known for participating in promising projects with significant airdrop potential, has also focused its efforts on projects in the zk-rollup space, such as Ulvetanna, which recently raised $15 million. However, given its hardware focus, the likelihood of an airdrop remains uncertain.

Additionally, a16z and Multicoin Capital each backed a standout project, PLAI Labs, raising a noteworthy $32 million, spotlighting this gaming sector company as one to watch in the future.

Conclusion: Navigating the Investment Landscape

As we assess the current climate for fundraising in the cryptocurrency sector, it is imperative to remain vigilant and aware of emerging trends. The market shows signs of resilience, even amid challenges, indicating a shift toward rational investment and strategic engagement.

Arming oneself with sufficient knowledge about ongoing projects—particularly in key sectors like infrastructure and gaming—will ensure that investors are prepared to make informed decisions. In this evolving environment, the narrative of crypto is still being written, and those who can decipher the subtle rhythms of investment will find their insights proving invaluable.

The overarching takeaway is one of cautious optimism; as more projects emerge and traditional valuations return to a more stable pace, the potential for renewed enthusiasm and investments in the cryptocurrency sector is ripe on the horizon. Continuing to track developments and analyzing emerging patterns will be crucial in understanding where the lucrative opportunities lie.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download