📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

The Wisconsin Child Tax Credit stands as a significant financial resource for families across the state. This credit, designed to alleviate the costs associated with raising children, offers a welcome benefit for eligible families. As we approach 2025, understanding the nuances of the Wisconsin Child Tax Credit, particularly its payment schedule, becomes crucial for effective financial planning.

Unveiling the Wisconsin Child Tax Credit 2025 Payment Schedule

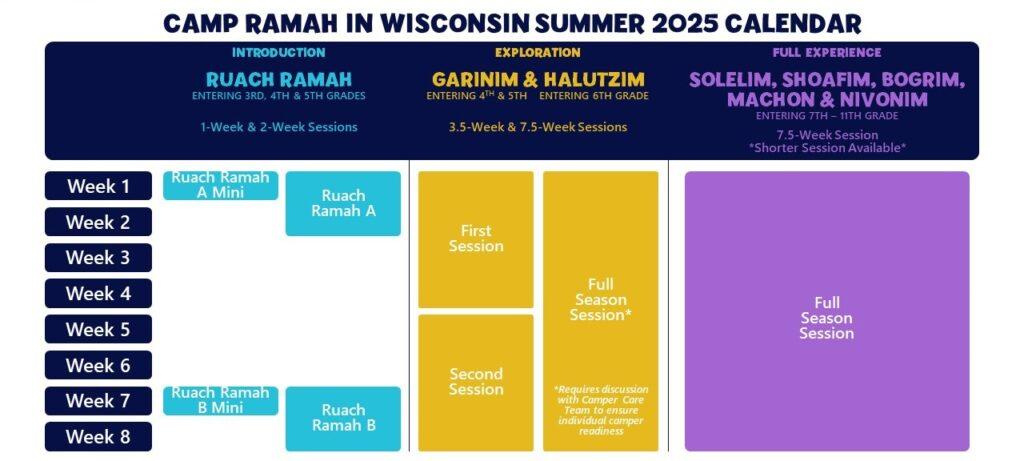

Wisconsin Child Tax Credit 2025 Payment Schedule ImageWisconsin Child Tax Credit 2025 Payment Schedule Image. Credit: ramahwisconsin.com

Wisconsin Child Tax Credit 2025 Payment Schedule ImageWisconsin Child Tax Credit 2025 Payment Schedule Image. Credit: ramahwisconsin.com

The Wisconsin Child Tax Credit 2025 payment schedule outlines the specific dates throughout the year when eligible families can anticipate receiving their payments. This structured timeline promotes proactive financial management by providing a clear picture of when and how much to expect.

Delving into Eligibility for the Wisconsin Child Tax Credit

Before delving into the payment schedule itself, it’s paramount to understand the qualifying factors for the Wisconsin Child Tax Credit.

Income Requirements

Eligibility hinges on meeting specific income thresholds. These thresholds are subject to change annually, reflecting current economic conditions. Staying updated on the latest income requirements for 2025 is vital to determine eligibility accurately.

Dependent Children

The age and number of dependent children within a household directly impact the amount of tax credit received. Generally, children under 18 years of age qualify, but specific criteria may apply.

Residency Stipulations

To qualify for the Wisconsin Child Tax Credit, individuals must be bona fide residents of Wisconsin. Proof of residency might be required during the application process.

Key Dates and Deadlines: Marking Your Calendar for 2025

Navigating the Wisconsin Child Tax Credit effectively involves staying informed about important dates and deadlines.

Payment Disbursement Dates

The Wisconsin Child Tax Credit, in line with its aim to provide consistent support, generally operates on a monthly payment schedule. This means eligible families can expect payments on a designated day each month, commencing in January 2025.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Application Deadline

Timely submission of a complete and accurate application is crucial for a smooth experience. While the specific deadline for the 2025 tax year is yet to be announced, it’s prudent to prepare in advance.

Maximizing Your Wisconsin Child Tax Credit: Strategic Planning

Understanding the intricacies of the Wisconsin Child Tax Credit goes beyond eligibility and payment dates. It’s about leveraging this financial tool to its full potential.

Prudent Expense Management

Align significant expenditures with the anticipated arrival of tax credit payments. This approach fosters better financial control and ensures the credit serves its intended purpose.

Exploring Investment Avenues

Consider allocating a portion of the tax credit towards investments. While it’s crucial to consult with a financial advisor for personalized guidance, exploring investment options can potentially yield long-term financial benefits.

Frequently Asked Questions: Addressing Common Queries

What is the payment frequency for the Wisconsin Child Tax Credit in 2025?

Payments are typically disbursed on a monthly basis, starting in January 2025.

Where can I find the most up-to-date information on the Wisconsin Child Tax Credit 2025 payment schedule?

The official Wisconsin Department of Revenue website remains the most reliable source for accurate and updated information.

What constitutes a ‘qualifying child’ for the Wisconsin Child Tax Credit?

Specific criteria, including age, residency, and relationship to the taxpayer, determine whether a child qualifies for the credit. Refer to official guidelines for a comprehensive understanding.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download