Sony, a name synonymous with innovation in the consumer electronics industry, experienced a period of significant organizational change in the late 20th and early 21st centuries. This case study analyzes Sony’s strategic decisions, particularly its foray into the entertainment industry with the acquisitions of Columbia Pictures and CBS Records, and the subsequent challenges it faced. Examining these events through the lens of change management frameworks provides valuable insights into the complexities of organizational transformation and the importance of a well-defined, long-term vision.

The Rise of an Electronics Giant

Sony’s initial success was built on a foundation of groundbreaking products like the Walkman and Trinitron television. These innovations cemented Sony’s position as a global leader in consumer electronics, captivating audiences worldwide and driving remarkable profitability. The company’s ability to anticipate and meet consumer demand for portable and high-quality electronics was a key driver of its growth. This period exemplified Sony’s strength in technological innovation and its understanding of the consumer market. The Walkman, in particular, revolutionized personal music consumption, becoming a cultural icon of the era. Sony’s Trinitron technology similarly set new standards for television picture quality, further enhancing the company’s reputation for cutting-edge technology. This focus on innovation and market understanding was central to Sony’s early triumphs.

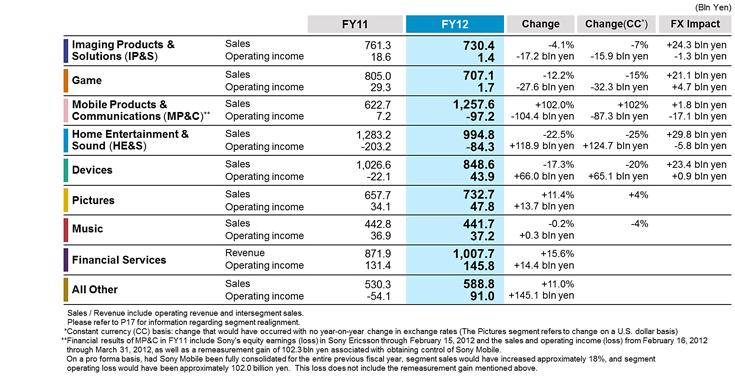

Financial Year 2012 Results by Segment

Financial Year 2012 Results by Segment

Fig.1. Financial Year 2012 Results by Segment (Sony Group, 2013).

The Pursuit of Vertical Integration and the Entertainment Industry

Seeking further growth, Sony’s leadership embarked on a strategy of vertical integration, aiming to control the entire entertainment ecosystem from content creation to hardware. This led to the acquisition of Columbia Pictures and CBS Records, marking a significant departure from Sony’s core electronics business. The rationale was to synergistically link hardware and content, anticipating that owning both production and distribution would create a competitive advantage. However, this move proved to be more challenging than anticipated. The entertainment industry operated under different dynamics than the consumer electronics market, requiring distinct expertise and business models. The cultural differences between the Japanese electronics giant and the American entertainment companies also presented integration challenges.

Challenges and Setbacks: A Shift in Focus

The acquisitions of Columbia Pictures and CBS Records brought significant financial challenges for Sony. Both entities struggled to generate consistent profits, and the anticipated synergies failed to materialize. The film Last Action Hero, for example, despite its substantial budget, became a box office flop, highlighting the unpredictable nature of the entertainment industry. Furthermore, Sony’s focus on its entertainment ventures arguably diverted resources and attention from its core electronics business. This coincided with the rise of new technologies like LCD screens, in which Sony had not invested heavily. As a result, Sony found itself losing ground to competitors like Samsung who were quicker to adopt and develop these emerging technologies. The shift in focus towards entertainment, coupled with missed opportunities in the rapidly evolving electronics market, contributed to Sony’s declining performance.

Sony Corporation’s Transformation: Adapting to Change

Sony’s response to these challenges involved significant internal restructuring, including the unprecedented appointment of an American CEO. This marked a radical shift in corporate culture for the traditionally Japanese company, demonstrating the extent to which Sony was willing to adapt. While this move signaled a commitment to change, it did not immediately resolve the underlying issues stemming from the entertainment acquisitions. The company continued to grapple with the financial burdens of these ventures and the need to regain its footing in the evolving electronics landscape. The appointment of an outsider CEO, while symbolic of change, highlighted the depth of the challenges Sony faced and the need for a more fundamental reassessment of its strategy.

Change Management Frameworks: Analyzing Sony’s Approach

Sony’s organizational changes can be analyzed through the lenses of various change management theories. The dialectical framework highlights the interplay of competing forces within and outside the organization that drive change. Sony’s pursuit of vertical integration was partly a response to perceived competitive pressures and the desire to secure its future in the evolving entertainment landscape. The teleological framework emphasizes the role of purposeful action in achieving desired outcomes. Sony’s acquisitions were driven by the goal of achieving synergy and market dominance, albeit with ultimately unsuccessful results. While Sony demonstrated a proactive approach to change, the execution of its strategy fell short. The company’s experience underscores the importance of not only embracing change but also carefully evaluating the long-term implications of strategic decisions. A thorough analysis of potential risks and benefits is crucial for successful organizational transformation.

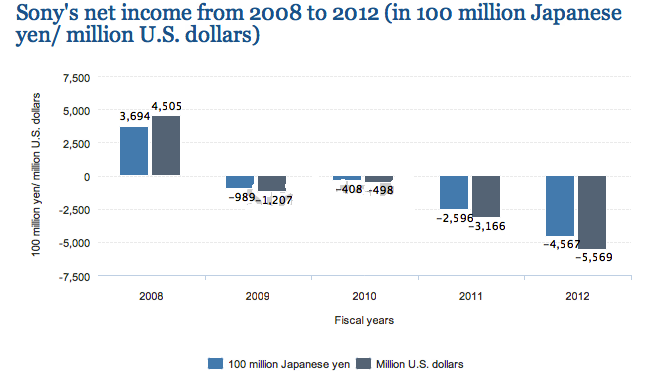

Sony Corporation’s Net Income 2008-2012

Sony Corporation’s Net Income 2008-2012

Fig.2. Sony Corporation’s Net Income 2008-2012 (Statista, 2012).

Lessons Learned and Recommendations

Sony’s experience provides valuable lessons for organizational change management. The company’s initial success stemmed from its focus on innovation and its deep understanding of the consumer electronics market. The pursuit of vertical integration, while strategically ambitious, ultimately diverted resources and attention from Sony’s core strengths. The acquisitions of Columbia Pictures and CBS Records, driven by a desire for synergy and market dominance, proved to be financially burdensome and strategically misaligned. Sony’s experience highlights the importance of a thorough due diligence process before embarking on major organizational changes. A clear understanding of market dynamics, potential risks, and integration challenges is crucial for successful transformation. Furthermore, a company’s core strengths and competencies should be carefully considered when formulating new strategies. While adaptation and innovation are essential for long-term success, they must be aligned with a company’s core values and capabilities.

The Future of Sony: Returning to its Roots

Sony’s journey underscores the importance of adapting to a changing landscape while remaining true to a company’s core strengths. While the entertainment ventures presented significant challenges, Sony’s willingness to adapt and restructure its leadership demonstrates a commitment to evolving with the times. The company’s future success likely lies in rediscovering its roots in innovation and leveraging its technological expertise to create new and compelling products. By focusing on its core competencies and learning from past experiences, Sony can regain its position as a leader in the ever-evolving world of technology and entertainment.

Frequently Asked Questions (FAQ)

Q: Why did Sony acquire Columbia Pictures and CBS Records?

A: Sony aimed to implement a vertical integration strategy, controlling the entire entertainment process from content creation to hardware distribution. They believed this would create synergies and strengthen their market position.

Q: What were the main challenges Sony faced after these acquisitions?

A: The entertainment ventures struggled to generate profits, and the anticipated synergies didn’t materialize. This, combined with a missed opportunity in the burgeoning LCD market, led to financial difficulties and a decline in market share.

Q: How did Sony respond to these challenges?

A: Sony implemented significant internal restructuring, including the appointment of an American CEO, a first for the Japanese company. They also refocused on their core electronics business.

Q: What lessons can be learned from Sony’s experience?

A: Sony’s story emphasizes the importance of thorough due diligence and a clear understanding of market dynamics before undertaking major organizational changes. It also highlights the importance of staying true to a company’s core competencies and adapting to change strategically.

We encourage you to share your thoughts and questions in the comments below. Your insights and perspectives are valuable to our community.

References

Lynch, R 2006, Shaking up Sony: restoring the profits and the innovative fire, Indiana University Press, Indiana.

Nakamoto, M 2005, Caught in its own trap: Sony battle to make headway in the networked world, Financial Times, London.

Nathan, J 1999, Sony: the private life, Houghton Mifflin Company, New York.

Sengupta, N, & Bhattacharya, M 2006, Managing change in organizations, New Jersey, Prentice Hall.

Sony Group, 2013, Financial year 2012 results by segment. Web.

Spar, D 2003, Managing international trade and investment, Imperial College Press, London.

Statista 2012, Sony’s net income from 2008 to 2012 (in 100 million Japanese Yen/million U.S. dollars). Web.

Tabuchi, H 2012, Sony revises expected loss to $6.4 billion. Web.