Credit plays a vital role in modern finance, allowing individuals and businesses to purchase goods and services using borrowed funds. Understanding the different types of credit is crucial for making informed financial decisions. This article will explore the three primary categories: revolving credit, installment loans, and open credit.

Alt: A person holding a credit card, representing the concept of revolving credit.

Revolving Credit: Flexibility and Ongoing Access

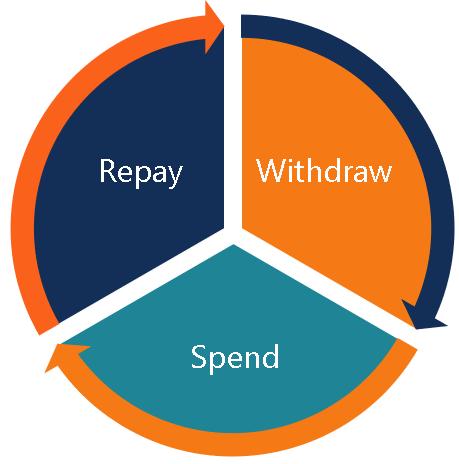

Revolving credit offers a pre-approved credit limit that can be used repeatedly. Borrowers can draw upon the available funds as needed and repay them over time, with minimum payments required regularly. A key characteristic of revolving credit is that the credit line replenishes as the borrowed amount is repaid.

A prime example of revolving credit is a credit card. Cardholders are granted a specific credit limit and can make purchases up to that amount. As they repay the balance, their available credit increases. Another example is a Home Equity Line of Credit (HELOC), which allows homeowners to borrow against the equity in their home.

Types of Credit – Revolving CreditAlt: A diagram illustrating the revolving nature of credit, showing borrowing and repayment cycles.

Types of Credit – Revolving CreditAlt: A diagram illustrating the revolving nature of credit, showing borrowing and repayment cycles.

Installment Loans: Structured Repayment for Larger Purchases

Installment loans involve borrowing a fixed sum of money and repaying it in regular installments over a predetermined period. These loans typically come with a fixed interest rate and a set repayment schedule.

Common examples of installment loans include car loans, mortgages, and student loans. Each loan agreement specifies the total amount borrowed, the interest rate, and the repayment term, allowing borrowers to plan their finances accordingly.

Alt: A car with a loan agreement, symbolizing the concept of an installment loan.

Open Credit: Full Payment Required Each Period

Open credit, also known as charge accounts, requires borrowers to pay the full balance due each billing cycle. Similar to revolving credit, open credit often has a credit limit, but unlike revolving credit, carrying a balance forward is not an option.

Utility bills and cellphone service contracts exemplify open credit arrangements. Consumers utilize these services throughout the billing period and then receive a bill for the total amount due. Full payment is expected by the due date.

Alt: A phone bill representing open credit, where full payment is due each billing cycle.

Applying Credit Knowledge: A Quick Quiz

Let’s test your understanding of the different types of credit:

Q1: You have a monthly payment of $300 until the loan is fully repaid. What type of credit is this?

Q2: You can borrow up to $2,000 monthly but must repay the full amount each month. What type of credit is this?

Q3: You have a $1,500 monthly credit limit and are only required to make a minimum payment. What type of credit is this?

Answers:

A1: Installment Loan

A2: Open Credit

A3: Revolving Credit

Conclusion: Choosing the Right Credit Type

Navigating the world of credit requires a clear understanding of the different options available. Revolving credit offers flexibility, installment loans provide structured repayment for larger purchases, and open credit demands full payment each billing period. By recognizing the distinctions between these credit types, individuals and businesses can make sound financial choices that align with their needs and goals.