📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

The PDURATION function is a powerful tool in financial modeling, enabling users to calculate the time required for an investment to reach a specific target value. This article provides a comprehensive guide to the PDURATION function, covering its formula, practical applications, and potential pitfalls.

Example of PDURATION function input in Excel

Example of PDURATION function input in Excel

What is the PDURATION Function?

The PDURATION function, introduced in Excel 2013, is a financial function that determines the number of periods needed for an investment to grow to a future value (FV) given a present value (PV) and a constant interest rate. Essentially, it answers the question: “How long will it take for my investment to reach a specific amount?”

Formula and Arguments

The PDURATION function uses the following syntax:

=PDURATION(rate, pv, fv)Where:

rate: The interest rate per period (required). This represents the periodic interest rate, not the annual rate unless the periods are years.pv: The present value of the investment (required). This is the initial investment amount.fv: The future value of the investment (required). This is the target value you want the investment to reach.

Practical Examples

Let’s illustrate the PDURATION function with some practical examples:

Example 1: Calculating Investment Duration in Years

Suppose you invest $1,000,000 at an annual interest rate of 4%. How long will it take for your investment to grow to $1,500,000?

=PDURATION(0.04, -1000000, 1500000)This formula returns approximately 10.34 years. Note the negative sign for the present value (pv) indicating an outflow of cash.

Example 1 output in Excel

Example 1 output in Excel

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

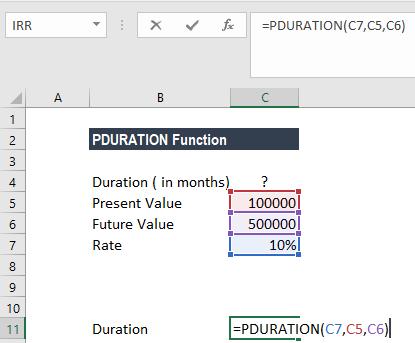

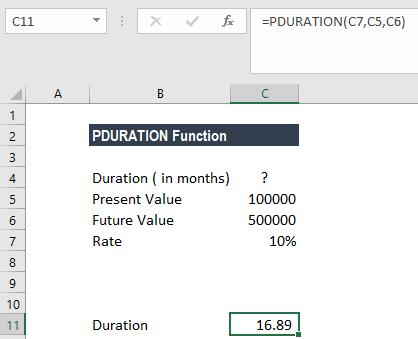

Example 2: Combining PDURATION with RRI

Consider an investment of $100,000 with a future value of $500,000 and a periodic interest rate of 10%. You can use PDURATION to calculate the duration and then RRI to determine the compound annual growth rate (CAGR).

=PDURATION(0.10, -100000, 500000)This yields approximately 17 years. You can then use RRI to confirm the 10% growth rate.

PDURATION Function – Example 2aExample 2: PDURATION Calculation

PDURATION Function – Example 2aExample 2: PDURATION Calculation

PDURATION Function – Example 2bExample 2: RRI Calculation

PDURATION Function – Example 2bExample 2: RRI Calculation

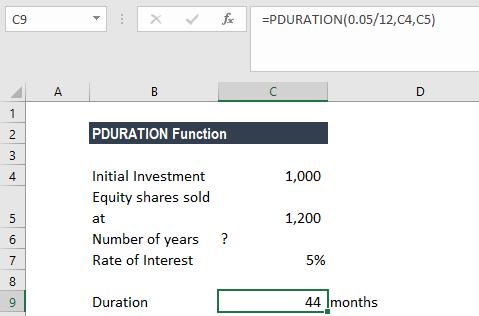

Example 3: Calculating Duration in Months

Let’s say you invest $1,000 at an annual interest rate of 5%. How many months will it take to reach $1,200?

=PDURATION(0.05/12, -1000, 1200)By dividing the annual rate by 12, we get the monthly rate. This formula returns approximately 44 months.

PDURATION Function – Example 3aExample 3: Calculating duration in months

PDURATION Function – Example 3aExample 3: Calculating duration in months

Important Considerations and Error Handling

#NUM!Error: This error occurs if any of the arguments are negative or zero, or if they are in an invalid format.#VALUE!Error: This error occurs if any of the arguments are non-numeric.

Conclusion

The PDURATION function is a valuable tool for financial planning and analysis, enabling users to project investment timelines effectively. By understanding its formula, arguments, and potential errors, you can leverage this function to make informed financial decisions. Remember to adjust the rate argument to match the desired period (e.g., monthly, quarterly, annually).

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download