📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Uniswap, a cornerstone of the decentralized finance (DeFi) landscape, is constantly evolving to enhance the user experience. One of its most ambitious projects, Unichain, a Layer-2 scaling solution built on the OP Stack, promises to revolutionize how users interact with Uniswap, paving the way for faster, cheaper, and more versatile transactions, potentially impacting the DeFi landscape significantly by 2025. This innovative solution aims to tackle some of the most pressing challenges in DeFi, including high gas fees and network congestion, while opening doors to exciting new possibilities like cross-chain trading.

Unichain Interface. Image source: Amberblocks

Unichain Interface. Image source: Amberblocks

Key Features of Unichain: Redefining Transaction Speed and Security

While Unichain shares structural similarities with other Layer-2 solutions built upon the OP Stack, it incorporates a unique technological advancement known as Rollup-Boost. This innovative mechanism sets Unichain apart and positions it as a potential game-changer in the DeFi space. Rollup-Boost significantly accelerates transaction processing and ordering, minimizing the risk of Miner Extractable Value (MEV) attacks on Uniswap users. This crucial feature enhances the overall security and efficiency of the platform.

Further reading: Understanding the Mechanics of Optimistic Rollup

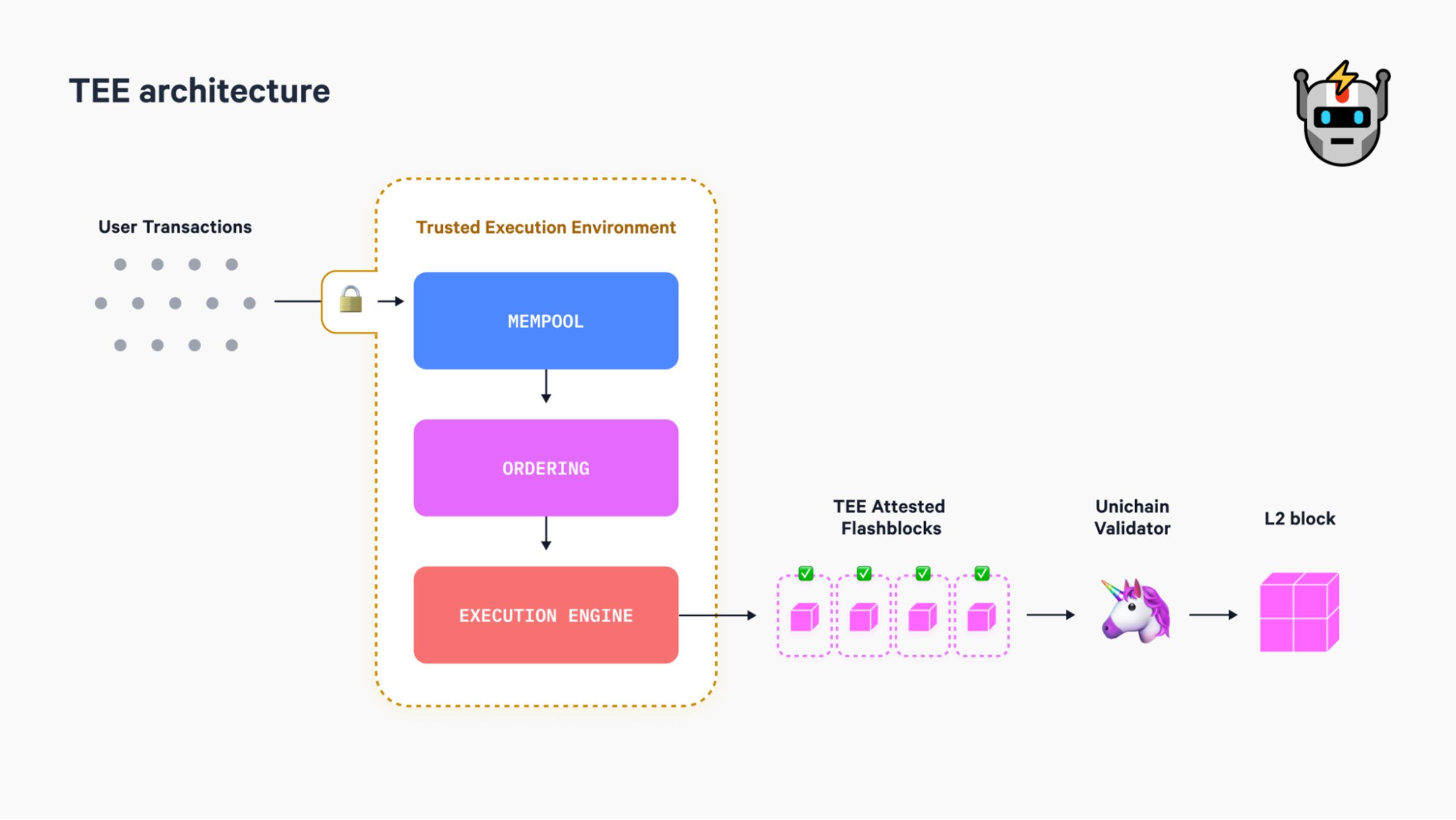

Unichain’s Rollup-Boost comprises two core components:

- TEE (Trusted Execution Environment): This secure environment ensures fair and tamper-proof transaction validation and ordering, mitigating external manipulation. While utilizing TEE requires a trade-off in network performance and higher hardware setup costs, the enhanced security and fairness it provides outweigh these considerations.

- Fastblocks: These sub-blocks play a vital role in confirming user transactions with an impressive block creation time of just 250 milliseconds. Fastblocks are designed to deliver a near-instantaneous trading experience, a significant improvement over traditional Layer-2 solutions.

Typically, transactions on Layer-2 solutions are executed instantly, but proving their validity requires a considerable waiting period (ranging from 3 to 60 minutes) due to the reliance on confirmation blocks from the Layer-2. Fastblocks expedite this process by acting as confirmation blocks, drastically reducing the time required for validation and execution.

How Unichain Processes Transactions: A Step-by-Step Guide

By integrating TEE and Fastblocks, Unichain creates a highly efficient transaction processing mechanism:

- Transaction Execution and Data Transmission: A transaction is executed on Uniswap, and the data is sent to the TEE.

- Mempool Entry and Ordering: The transaction enters the mempool and is ordered within the TEE.

- Fastblock Confirmation: The ordered transaction is then passed to a Fastblock for final validation.

- Node Download and Execution: Nodes on Unichain can now download and execute the transaction without waiting for a new block on the Layer-2 to verify its validity, as this has already been accomplished by the Fastblock.

cấu trúc của unichainUnichain Architecture. Image source: Flashbots

cấu trúc của unichainUnichain Architecture. Image source: Flashbots

Unichain’s Role in the Uniswap Ecosystem: Empowering Users and Driving Innovation

While Unichain is currently in its testnet phase, its potential impact on the Uniswap ecosystem is significant. Based on available documentation and recent developments from Uniswap Labs, several key roles for Unichain are emerging:

- Enhanced Utility for UNI Token Holders: Unichain introduces staking opportunities for UNI token holders, allowing them to participate as validators on the network. This increased utility could drive demand for UNI and strengthen its position within the DeFi ecosystem. Notably, UNI experienced an 11.8% surge within a day of Unichain’s launch, hinting at the potential positive impact.

- Enabling Cross-Chain Trading on Uniswap: Leveraging the OP Stack, Unichain allows Uniswap users to seamlessly trade and provide liquidity across multiple networks within the Superchain with a single click. This feature addresses the issue of liquidity fragmentation and reduces slippage for users, enhancing the overall trading experience.

- Expanding the Application of ERC-7683: For cross-chain transactions on networks outside the Superchain, Unichain utilizes ERC-7683, a standard designed to provide a unified framework for cross-chain interoperability. While this implementation currently focuses on cross-chain trading and not liquidity provision, it sets the stage for future advancements in cross-chain functionality.

Beyond these core functions, some speculate that Unichain could be the foundation for the upcoming Uniswap V4. The “hooks” feature of Uniswap V4 allows developers to implement liquidity pools with customizable features, potentially creating a diverse ecosystem on Unichain where “dApps” are essentially customized liquidity pools from Uniswap V4.

This innovative concept has sparked considerable enthusiasm within the community, with calls for other major DeFi projects like Aave and Swell to adopt similar approaches. Such developments could significantly drive innovation within the DeFi space.

Further reading: Unichain Analysis – Enhancing UNI Token Utility and Redesigning the MEV Mechanism

Exploring Similar Projects: The Expanding Landscape of Layer-2 Solutions

Unichain is not alone in its pursuit of Layer-2 scaling solutions. Other notable projects are also exploring innovative approaches:

- Morph: This Layer-2 blockchain utilizes both Optimistic Rollup and Zk Rollup solutions, offering a hybrid approach to scaling.

- Fraxchain: Developed by Frax Finance, Fraxchain also combines Optimistic Rollup and Zk Rollup, aiming to achieve a balance between security and efficiency.

Conclusion: Unichain’s Potential to Reshape DeFi in 2025 and Beyond

Unichain represents a significant step forward in the evolution of DeFi. By addressing key challenges like high gas fees and network congestion, it aims to make DeFi more accessible and efficient for a broader audience. The potential for cross-chain trading, enhanced UNI token utility, and the integration with Uniswap V4 could position Unichain as a key driver of innovation in the DeFi landscape by 2025. While still in its testnet phase, Unichain’s innovative approach holds immense promise for the future of decentralized finance. As the project progresses, its development and impact on the DeFi space will be closely watched.

FAQ: Addressing Common Questions About Unichain

- Q: When is Unichain expected to launch on mainnet?

- A: There is no official mainnet launch date announced yet for Unichain. Stay tuned for updates from Uniswap Labs.

- Q: How does Unichain differ from other Layer-2 solutions?

- A: Unichain’s key differentiator is its Rollup-Boost technology, which combines TEE and Fastblocks to significantly accelerate transaction processing and enhance security.

- Q: What are the benefits of staking UNI on Unichain?

- A: Staking UNI allows users to participate as validators on the Unichain network, contributing to its security and earning rewards in the process.

- Q: How will Unichain impact the future of Uniswap?

- A: Unichain is expected to enhance Uniswap’s functionality by enabling faster, cheaper transactions, cross-chain trading, and potentially serving as the foundation for Uniswap V4.

We encourage you to share your questions and thoughts about Unichain in the comments below. Your engagement helps us build a stronger community and fosters a deeper understanding of this exciting new technology.