📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

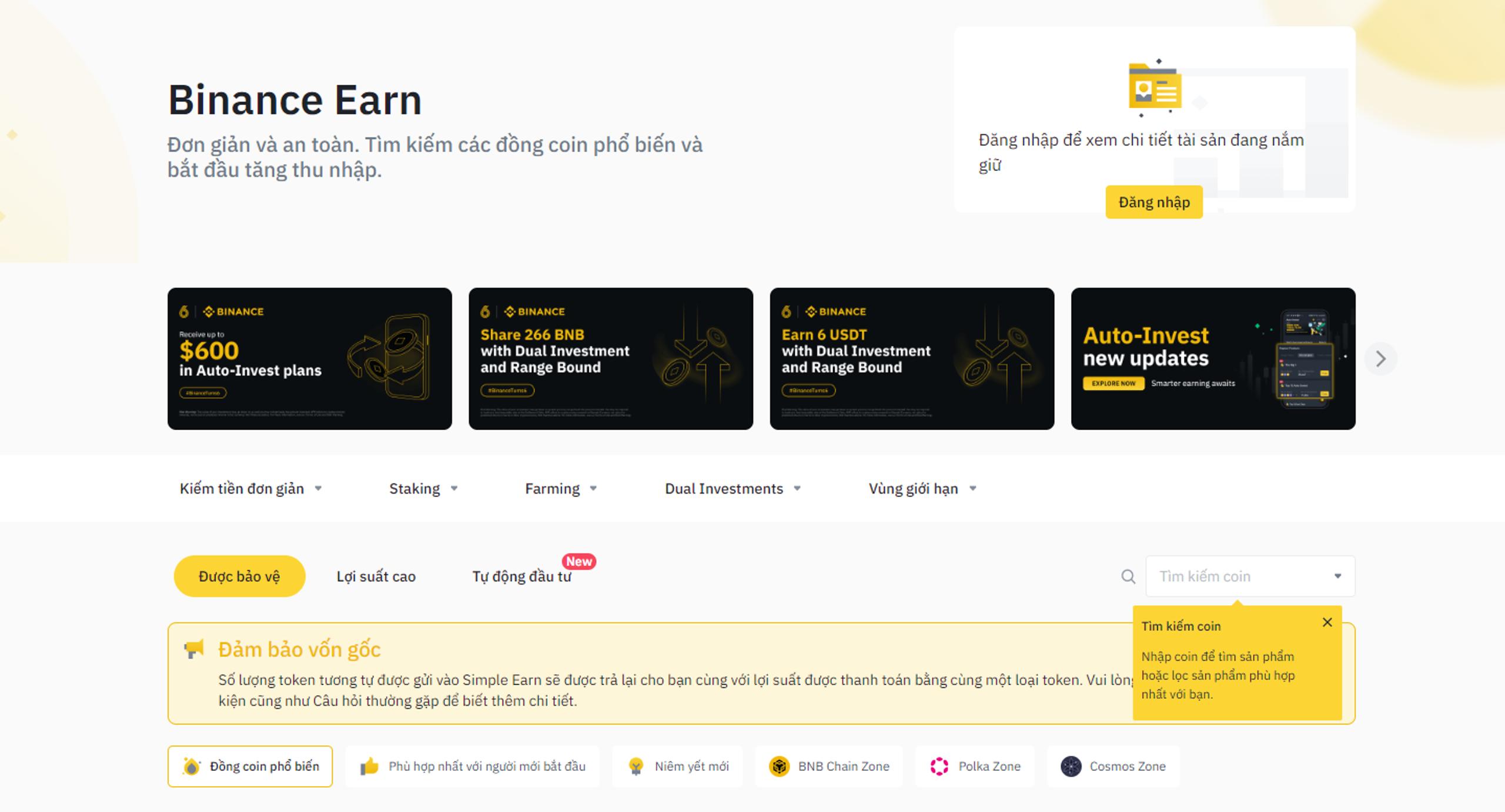

Binance Earn has become a cornerstone for cryptocurrency enthusiasts seeking to maximize their returns. This platform, developed by the world-leading cryptocurrency exchange Binance, offers a diverse suite of products designed to generate passive income on existing digital assets. From flexible savings options to more complex investment strategies, Binance Earn caters to a broad spectrum of investors, each with varying risk tolerances and financial goals. This comprehensive guide will delve into the intricacies of Binance Earn in 2025, exploring its core features, benefits, drawbacks, and the various methods available for earning passive income on your crypto holdings.

nền tảng binance earnBinance Earn Platform Overview

nền tảng binance earnBinance Earn Platform Overview

How Binance Earn Works in 2025

Binance Earn operates much like a traditional savings account, but with the added advantage of utilizing the dynamic world of cryptocurrency. Instead of fiat currency, users deposit their digital assets, which are then used in various investment strategies, including lending, staking, and yield farming. Binance calculates the Annual Percentage Return (APR) based on the chosen product, the asset selected, and the duration of the investment. The user’s primary task is to select their preferred asset, investment type, and investment period. The platform handles the rest, making it a relatively hands-off approach to generating passive income.

Advantages and Disadvantages of Binance Earn

While Binance Earn offers a compelling proposition for crypto investors, it’s crucial to understand both the upsides and downsides before committing your assets.

Advantages of Utilizing Binance Earn

- Diverse Asset Selection: Binance supports over 500 cryptocurrencies, providing an extensive range of options for users to diversify their portfolios and participate in various earning opportunities within Binance Earn. This broad selection allows investors to tailor their strategy to their specific risk appetite and market outlook.

- Varied Product Offerings: From beginner-friendly options like Simple Earn to more sophisticated strategies like Dual Investments, Binance Earn caters to a wide range of experience levels. This allows both novice and seasoned investors to find suitable products to meet their individual financial goals.

- Passive Income Generation: For those with limited time or experience in actively managing their crypto investments, Binance Earn provides a convenient way to generate passive income. The platform automates the investment process, allowing users to earn rewards without constantly monitoring market fluctuations or complex trading strategies.

- User-Friendly Interface: Binance has designed its Earn platform to be intuitive and easy to navigate, even for newcomers to the crypto space. This simplifies the process of selecting and managing investments, making it accessible to a broader audience.

Disadvantages of Utilizing Binance Earn

- Potential for Lower Returns: Compared to higher-risk investment strategies like leveraged trading or yield farming on decentralized platforms, the returns offered by some Binance Earn products may be comparatively lower. This is a trade-off for the lower risk associated with these products.

- Platform Risk: While Binance is a reputable exchange, there’s always an inherent risk associated with centralized platforms. Factors such as security breaches or regulatory changes could potentially impact user funds.

Earning Methods on Binance Earn: A Deep Dive

Binance Earn offers two primary methods for generating income: lower-risk, lower-return options and higher-risk, higher-return strategies.

Lower-Risk Earning Methods

These methods provide a relatively stable and predictable return, ideal for conservative investors.

Simple Earn: Similar to a traditional savings account, Simple Earn allows users to deposit their crypto and earn interest. Flexible and fixed-term options are available, catering to different liquidity needs and risk preferences.

Simple Earn on Binance Earn

Simple Earn on Binance EarnBNB Vault: This product aggregates returns from various BNB-related activities, such as Simple Earn, Launchpool, and DeFi Staking. It’s a convenient way for BNB holders to maximize their earnings potential.

BNB Vault on Binance Earn

BNB Vault on Binance EarnLaunchpool: This platform allows users to stake assets and earn new tokens from projects launching on Binance. It offers early access to promising projects and the potential for significant returns.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Auto-Invest: This automated investment tool employs a Dollar-Cost Averaging (DCA) strategy, allowing users to regularly invest fixed amounts into chosen cryptocurrencies, minimizing the impact of market volatility.

Auto-Invest on Binance Earn

Auto-Invest on Binance Earn

Higher-Risk Earning Methods

These options offer the potential for higher returns but also carry increased risk.

Dual Investments: This product combines staking with price speculation, allowing users to earn yield while betting on the future price of an asset. However, it also carries the risk of buying high or selling low if the market moves against the user’s prediction.

Dual Investments on Binance Earn

Dual Investments on Binance EarnETH 2.0 Staking: Users can stake their ETH to support the Ethereum network and earn rewards. However, staked ETH is locked until withdrawals are enabled on the Ethereum mainnet.

Staking 2.0 on Binance Earn

Staking 2.0 on Binance EarnDeFi Staking: This feature allows users to participate in DeFi staking pools through Binance, simplifying the process and eliminating gas fees. However, it’s essential to remember that Binance acts as an intermediary, and users are still exposed to the risks associated with the underlying DeFi protocols.

Conclusion: Navigating Binance Earn in 2025

Binance Earn provides a valuable gateway for individuals seeking to generate passive income within the cryptocurrency ecosystem. With a diverse range of products catering to varying risk appetites and investment horizons, the platform offers something for everyone. However, it’s crucial to carefully consider the risks and rewards associated with each product before making any investment decisions. By understanding the intricacies of Binance Earn and choosing strategies aligned with your individual financial goals, you can effectively leverage your crypto holdings and navigate the exciting world of decentralized finance.

FAQs about Binance Earn

- What are the risks associated with using Binance Earn? While generally considered safe, risks include platform risk, market volatility impacting returns, and potential smart contract vulnerabilities with DeFi Staking.

- How do I choose the right Binance Earn product for me? Consider your risk tolerance, investment goals, the desired level of involvement, and the potential returns offered by each product.

- What are the fees associated with Binance Earn? Binance typically doesn’t charge fees for using Earn products, but always check the specific terms and conditions for each offering.

We encourage you to share this guide and leave your questions below. Let’s explore the world of passive income with Binance Earn together.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Simple Earn on Binance Earn

Simple Earn on Binance Earn BNB Vault on Binance Earn

BNB Vault on Binance Earn Auto-Invest on Binance Earn

Auto-Invest on Binance Earn Dual Investments on Binance Earn

Dual Investments on Binance Earn Staking 2.0 on Binance Earn

Staking 2.0 on Binance Earn