The modern business landscape demands transparency, accountability, and sustainability. Corporate governance is no longer a “nice-to-have” but a critical factor for success, influencing investor decisions, stakeholder relationships, and long-term value creation. This article explores the essential role of corporate governance in today’s business world, examining its impact on strategic management, board effectiveness, stakeholder engagement, and responsible business practices.

What is Corporate Governance and Why is it Crucial?

Corporate governance encompasses the rules, procedures, and processes that steer and control a company. It’s the framework that shapes the behavior of key players and stakeholders, influencing everything from corporate culture and ethical conduct to risk management and long-term value creation.

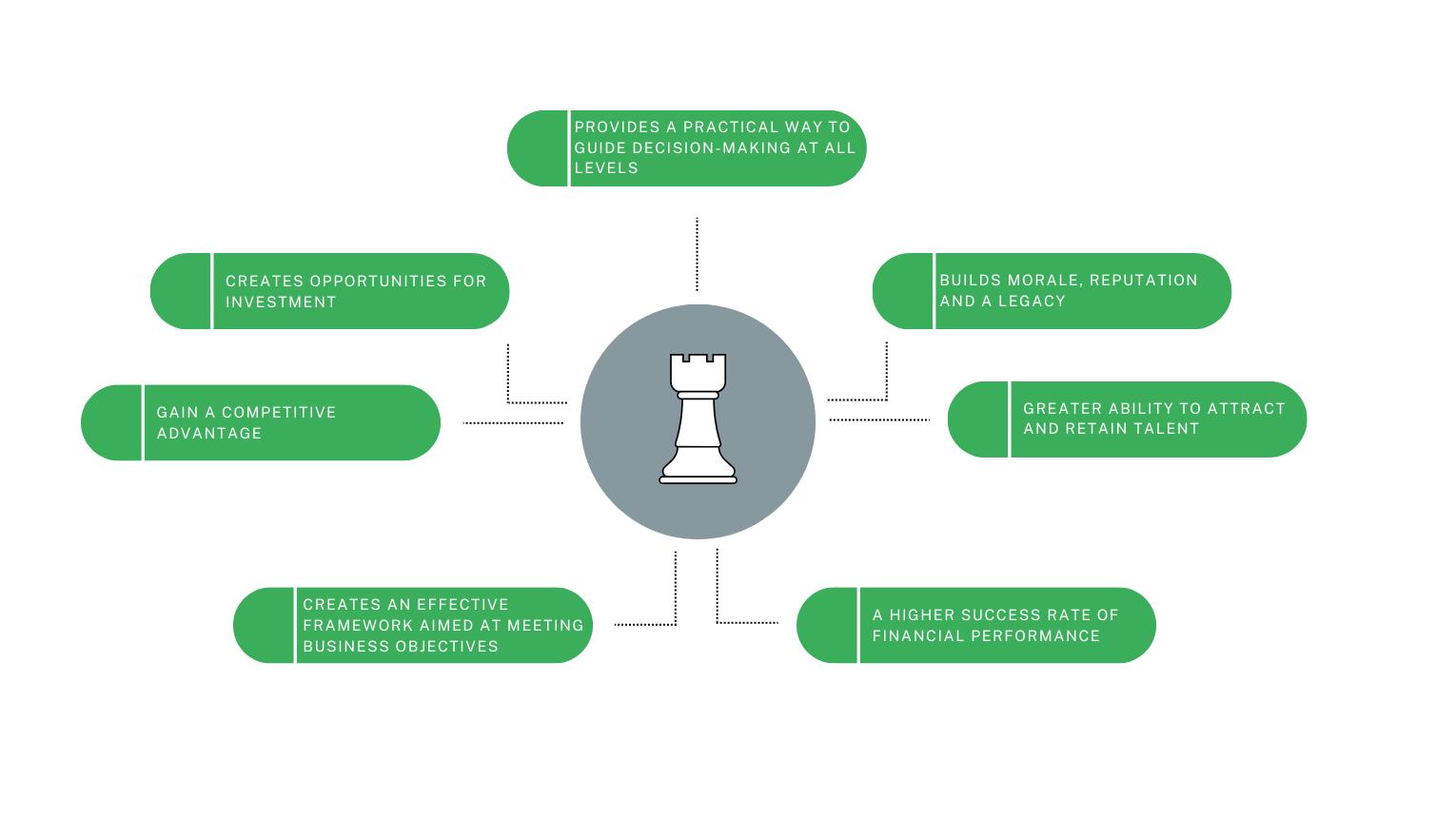

A robust corporate governance framework is essential for several reasons:

- Building Trust and Credibility: Effective governance fosters a culture of integrity, enhancing a company’s reputation and attracting investors.

- Driving Performance and Sustainability: Studies show a direct correlation between good corporate governance and positive financial performance, contributing to long-term sustainability.

- Mitigating Risk: Strong governance mechanisms help identify and manage risks proactively, protecting shareholder interests and ensuring business continuity.

- Improving Decision-Making: Clear roles and responsibilities streamline decision-making processes, leading to greater efficiency and effectiveness.

- Enhancing Stakeholder Relationships: Transparent and accountable governance builds trust with stakeholders, fostering positive relationships with employees, customers, and the wider community.

After this introduction to the essentials of corporate governance, let’s dive deeper into specific aspects. For further insights into responsible business practices, explore our articles on Understanding Corporate Social Responsibility (CSR): What It Means for Business Success and What is the Role of Corporate Social Responsibility (CSR) in Modern Business Management?.

Corporate Governance and Strategic Management

Corporate governance plays a crucial role in shaping a company’s strategic direction. It ensures that management’s strategies align with stakeholder interests and long-term value creation. Key intersections between corporate governance and strategic management include:

- Independent Directors: Independent directors provide objective insights and challenge management thinking, leading to more robust and well-rounded strategies.

- Transparency in Financial Reporting: Transparent financial reporting provides stakeholders with a clear view of the company’s performance and financial viability, enabling informed decision-making.

- Ethical Conduct: A strong ethical framework guides strategic decisions, ensuring that the company operates with integrity and responsibility.

Companies with robust corporate governance are more likely to be sustainable, as they prioritize accurate financial reporting and maintain trust with stakeholders. Conversely, weak governance can undermine a company’s potential and jeopardize its long-term viability.

The Board of Directors: A Cornerstone of Corporate Governance

The board of directors is central to effective corporate governance. It oversees the company’s operations, ensures compliance, and safeguards stakeholder interests. A high-performing board is characterized by:

- Clear Responsibilities: Well-defined roles and responsibilities ensure accountability and effective oversight.

- Strategic Focus: The board actively participates in strategic planning, setting the company’s direction and ensuring alignment with its mission and values.

- Financial Oversight: The board reviews financial statements, ensures robust internal controls, and works closely with the audit committee to ensure accurate external audits.

- Executive Management: The board oversees executive compensation, ensuring alignment with company performance and stakeholder interests.

- Diversity and Inclusion: A diverse board brings a wider range of perspectives and experiences, leading to better decision-making and enhanced corporate governance.

Why is corporate governance important?

Why is corporate governance important?

Board diversity is increasingly recognized as a critical factor in corporate success. Studies show that companies with diverse boards tend to perform better financially and are more resilient in the face of challenges.

Board Committees: Enhancing Governance Effectiveness

Board committees play a vital role in streamlining decision-making and enhancing transparency. Key committees include:

- Audit Committee: Oversees financial reporting, internal controls, and external audits.

- Compensation Committee: Determines executive compensation and ensures alignment with company performance.

- Nominating Committee: Identifies and recommends potential board members, ensuring a diverse and competent board composition.

These committees provide specialized expertise and oversight, strengthening the board’s ability to govern effectively.

Stakeholders and Corporate Governance

Corporate governance impacts a wide range of stakeholders, including:

- Shareholders: Good governance protects shareholder investments and ensures that their interests are prioritized.

- Employees: Ethical and responsible governance creates a positive work environment and fosters employee engagement.

- Customers: Customers increasingly prefer companies that operate ethically and responsibly.

- Community: Strong corporate governance contributes to community well-being through sustainable practices and responsible corporate citizenship.

Stakeholder theory emphasizes the importance of considering the interests of all stakeholders when making business decisions. This approach promotes a more holistic and sustainable approach to corporate governance.

The Evolving Landscape of Corporate Governance

Several factors are shaping the future of corporate governance:

- AI Oversight: The increasing use of AI in business requires new governance frameworks to ensure responsible development and deployment.

- ESG (Environmental, Social, and Governance) Integration: ESG factors are becoming increasingly important to investors and stakeholders, driving companies to integrate sustainability into their core business strategies.

- Technology and Cybersecurity: Digital transformation has heightened the importance of cybersecurity and data privacy, requiring robust governance mechanisms to protect sensitive information.

Transparency and Accountability: Pillars of Good Governance

Transparency and accountability are fundamental principles of effective corporate governance. Transparency fosters trust and open communication, while accountability ensures that individuals and teams are responsible for their actions. Together, these principles create a culture of integrity and ethical conduct.

The Role of Shareholders

Shareholders play a crucial role in corporate governance. They have the power to elect board members, vote on key decisions, and hold management accountable. Active shareholder engagement is essential for ensuring that companies operate in the best interests of all stakeholders.

Corporate Social Responsibility and Modern Business

Corporate social responsibility (CSR) is closely linked to corporate governance. Responsible companies prioritize ethical conduct, environmental sustainability, and social impact, recognizing that these factors contribute to long-term value creation. Key aspects of CSR include:

- Responsible Investment Decisions: Companies are increasingly incorporating CSR and sustainability into their investment decisions.

- Board Diversity: Diverse boards are more likely to champion CSR initiatives and promote ethical conduct.

- Ethical Business Practices: Ethical behavior is at the heart of CSR, guiding companies to operate with integrity and responsibility.

Conclusion

Corporate governance is essential for building trust, driving performance, and ensuring long-term sustainability. By embracing the principles of transparency, accountability, ethical conduct, and stakeholder engagement, companies can create a culture of integrity that benefits all stakeholders. In the evolving business landscape, effective corporate governance is not just a best practice, but a necessity for success.

FAQ

Q: What are the main benefits of strong corporate governance?

A: Strong corporate governance leads to increased investor confidence, improved risk management, enhanced reputation, more effective decision-making, and greater long-term sustainability.

Q: How does board diversity contribute to good governance?

A: Diverse boards bring a wider range of perspectives and experiences, leading to better decision-making, enhanced oversight, and a stronger focus on ethical conduct.

Q: What is the relationship between corporate social responsibility (CSR) and corporate governance?

A: CSR is closely linked to corporate governance. Responsible companies prioritize ethical conduct, environmental sustainability, and social impact, which are all integral components of good governance.

We encourage you to share your questions and insights on corporate governance in the comments below. Your participation is valuable in fostering a deeper understanding of this crucial topic.