📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

Wing Finance is a decentralized, cross-chain lending platform built on a credit-based system, facilitating seamless interactions between various DeFi products. With its decentralized governance model and robust risk management mechanisms, Wing aims to foster mutually beneficial relationships between borrowers, creditors, and guarantors. A key innovation of Wing is the introduction of a credit evaluation module for DeFi lending called Distributed Identity (DID). Users with a verified OScore can borrow by collateralizing assets worth at least 80% of the loan value. This comprehensive guide will explore the intricacies of Wing Finance, its functionalities, and its potential impact on the DeFi landscape in 2025.

What Sets Wing Finance Apart in 2025?

Wing Finance distinguishes itself through several key features that address the evolving needs of the DeFi space:

Decentralized and Automated Lending

Wing utilizes a decentralized smart contract system coupled with an automated credit evaluation process. This eliminates intermediaries and streamlines the lending process, making it more efficient and transparent. The automation reduces the potential for human error and bias, ensuring a fair and objective lending experience for all users.

Diverse Collateral Options

Traditional DeFi lending platforms primarily accept cryptocurrencies as collateral. Wing Finance aims to broaden this scope by incorporating diverse asset types with comparable or higher liquidity and value relative to the target loan amount. This expansion provides users with more flexibility and opens up new possibilities for leveraging a wider range of assets.

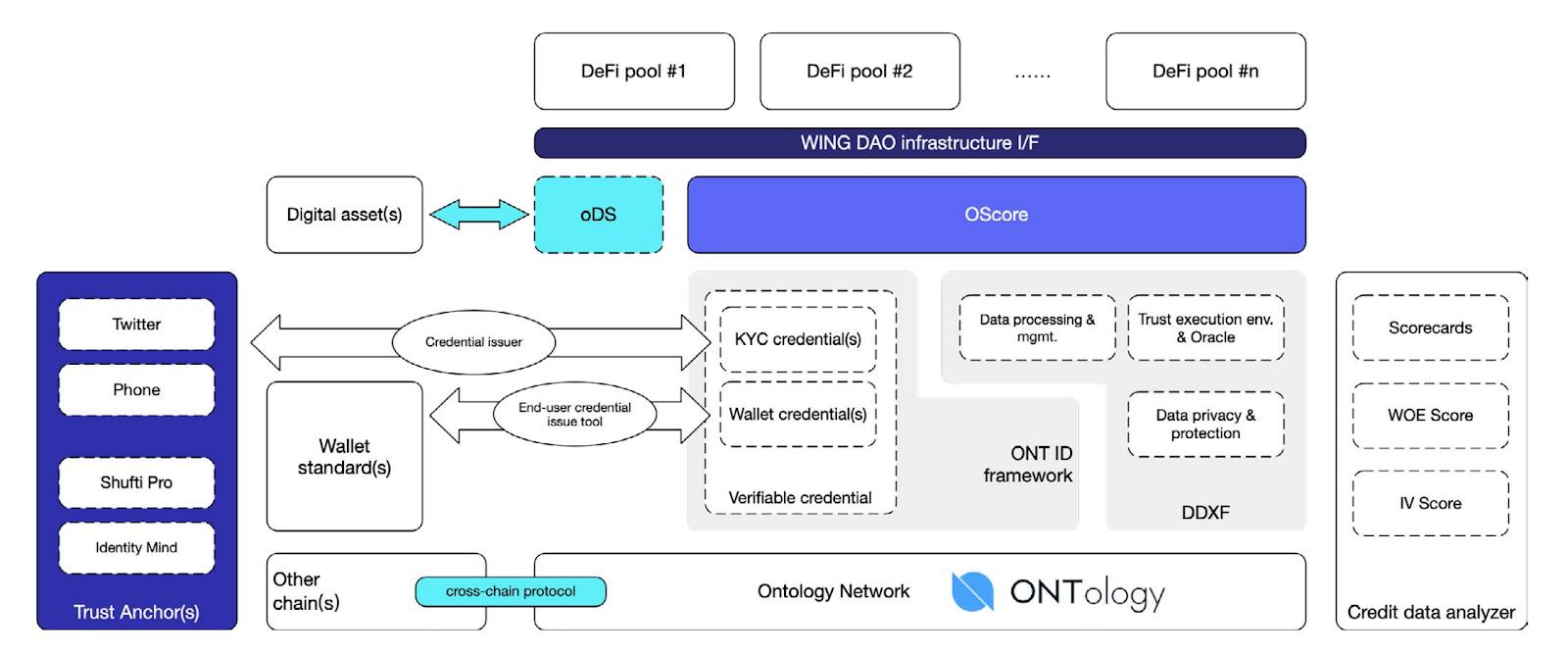

Ontology Blockchain Integration

Wing’s foundation on the Ontology blockchain is strategic. Ontology’s robust infrastructure supports Wing’s functionalities, including the DID credit scoring system and cross-chain interoperability. This integration enables Wing to leverage Ontology’s strengths in identity management and decentralized data solutions.

Architecture of Wing Finance on Ontology Blockchain

Architecture of Wing Finance on Ontology Blockchain

Figure 1: Illustrates the architectural integration of Wing Finance within the Ontology blockchain ecosystem, highlighting the interplay between various components.

Wing DAO Governance

The Wing DAO (Decentralized Autonomous Organization) empowers the community to participate in the platform’s governance. Through the DAO, users can propose and vote on crucial decisions, such as the establishment of new asset pools and adjustments to platform parameters. This decentralized governance model ensures that the platform evolves in a direction aligned with the community’s interests.

Figure 2: Depicts the operational model of the Wing DAO, showcasing the process of community proposals and voting for new asset pools.

Each asset pool consists of three components: a lending pool, a borrowed pool, and an optional risk control reserve pool. 5% of the interest earned from each loan is allocated to the reserve pool. If no reserve pool exists, the funds are directed to the Wing DAO community fund. This mechanism incentivizes responsible lending and borrowing practices while ensuring the platform’s financial stability.

A Deep Dive into the WING Token (2025)

The WING token is integral to the Wing Finance ecosystem, serving both as a governance token and a utility token. Understanding its functionalities is crucial for anyone engaging with the platform.

WING Token Metrics (2025 Projections)

While the original supply was limited, community governance has likely influenced changes by 2025. It’s important to consult official Wing Finance documentation for the most up-to-date information.

- Token Name: WING Token

- Ticker: WING

- Blockchain: Binance Smart Chain and potentially others due to cross-chain expansion

- Token Standard: BEP20 and potentially other standards

- Contract: Check official Wing Finance documentation

- Token Type: Utility, Governance

- Total Supply & Circulating Supply: Consult official Wing Finance resources

WING Token Utility and Use Cases

- Governance: WING holders have voting rights within the Wing DAO, influencing the platform’s development trajectory, parameter adjustments, and community fund allocation.

- Interest Rate Discounts: WING can be used to obtain discounts on interest payments within the platform, incentivizing token holding and usage.

- Insurance Purchases: WING allows users to purchase insurance contracts to mitigate financial risks associated with lending and borrowing activities.

- Potential New Utilities: As the DeFi landscape evolves, the WING token may acquire additional functionalities, potentially including staking rewards, access to premium features, or participation in other DeFi protocols.

Acquiring and Storing WING Tokens in 2025

The methods for acquiring and storing WING may have expanded by 2025. Always verify information with official sources.

Earning WING Tokens

Beyond the initial Binance Launchpool offering, options might include:

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download

- Yield Farming: Participating in liquidity pools and other yield farming initiatives within the Wing ecosystem.

- Staking: Staking WING tokens to earn rewards and participate in network consensus.

- Decentralized Exchanges (DEXs): Trading on DEXs that support WING.

WING Token Wallets

As Wing Finance expands its cross-chain compatibility, compatible wallets likely extend beyond those initially supporting BEP20 tokens:

- Multi-Chain Wallets: Wallets like Coin98 Wallet likely continue to support WING, alongside a wider array of blockchain networks.

- Hardware Wallets: Hardware wallets might offer secure storage for WING.

- Other Compatible Wallets: Always refer to the official Wing Finance documentation for the most up-to-date list of supported wallets.

WING Token Exchanges

WING’s availability likely extends beyond the initial exchanges:

- Centralized Exchanges (CEXs): More CEXs might list WING.

- DEXs: DEXs could become primary trading venues for WING.

Always confirm listing information on official exchange platforms.

Wing Finance Team, Investors, and Similar Projects

The core team and investor landscape may have evolved by 2025. Consult official Wing Finance sources for current information. Similarly, the competitive landscape will have changed, with new projects emerging and existing projects adapting. Researching comparable platforms offers valuable context for understanding Wing’s position in the market.

Conclusion: Wing Finance’s Future in the DeFi Landscape

Wing Finance’s innovative approach to decentralized lending, combined with its focus on community governance and risk management, positions it as a significant player in the DeFi space. As the DeFi landscape continues to evolve, Wing’s cross-chain capabilities and commitment to incorporating diverse asset classes could become increasingly valuable. The project’s potential to adapt and expand its functionalities through the Wing DAO further strengthens its long-term prospects. Continuous monitoring of official updates and community discussions is recommended to stay informed about Wing Finance’s progress.

Frequently Asked Questions (FAQs)

Q: What is the current circulating supply of WING tokens?

A: Please refer to official Wing Finance resources for the most up-to-date information on circulating supply, as it is subject to change.

Q: Which blockchain networks does Wing Finance currently support?

A: Wing Finance began on the Binance Smart Chain and Ontology but aims for cross-chain compatibility. Check official documentation for current supported networks.

Q: How can I participate in Wing DAO governance?

A: Holding WING tokens typically grants voting rights in the Wing DAO. Details on governance processes can be found in official Wing Finance documentation.

Q: What are the risks associated with using Wing Finance?

A: As with any DeFi platform, risks include smart contract vulnerabilities, market volatility, and potential governance issues. Thorough research and due diligence are essential before participating.

We encourage you to share your questions and contribute to the conversation. The DeFi space is constantly evolving, and community engagement is crucial for its continued growth and development.

📚 Unlock the World of AI and Humanity with These Two Free Books! 🚀

Dive into the thrilling realms of artificial intelligence and humanity with "The ECHO Conundrum" and "Awakening: Machines Dream of Being Human". These thought-provoking novels are FREE this week! Don't miss the chance to explore stories that challenge the boundaries of technology and what it means to be human.

Read More & Download